When it comes to tax season, one of the most important documents you’ll need is the 1040 form. This form is used by individuals to file their annual income tax return with the IRS. It’s essential to have this form filled out correctly to ensure that you’re not missing out on any deductions or credits that you may be eligible for.

Whether you’re filing as a single individual, married couple, or head of household, the 1040 form is the standard document used to report your income, deductions, and credits for the year. It’s important to understand the various sections of the form and how to accurately fill them out to avoid any potential errors.

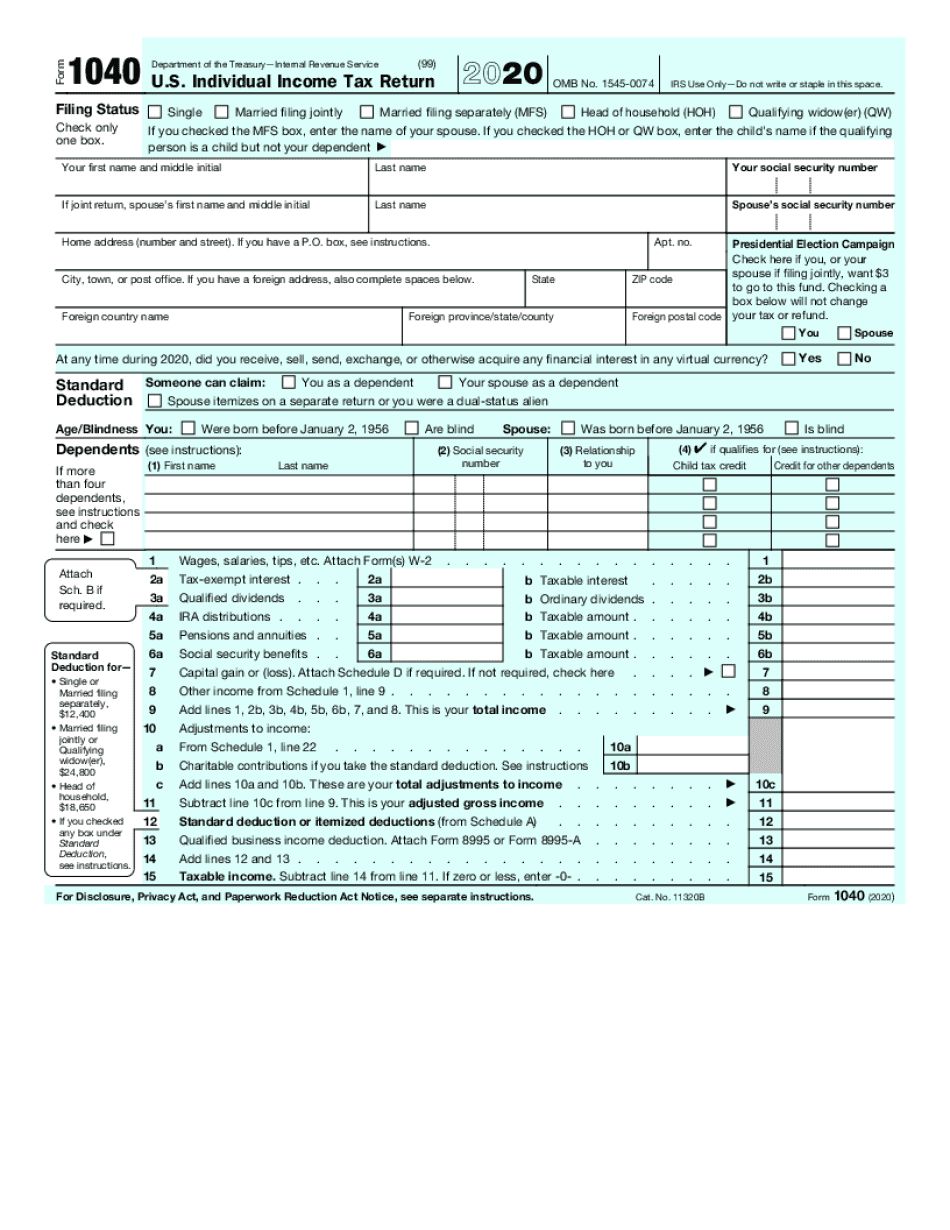

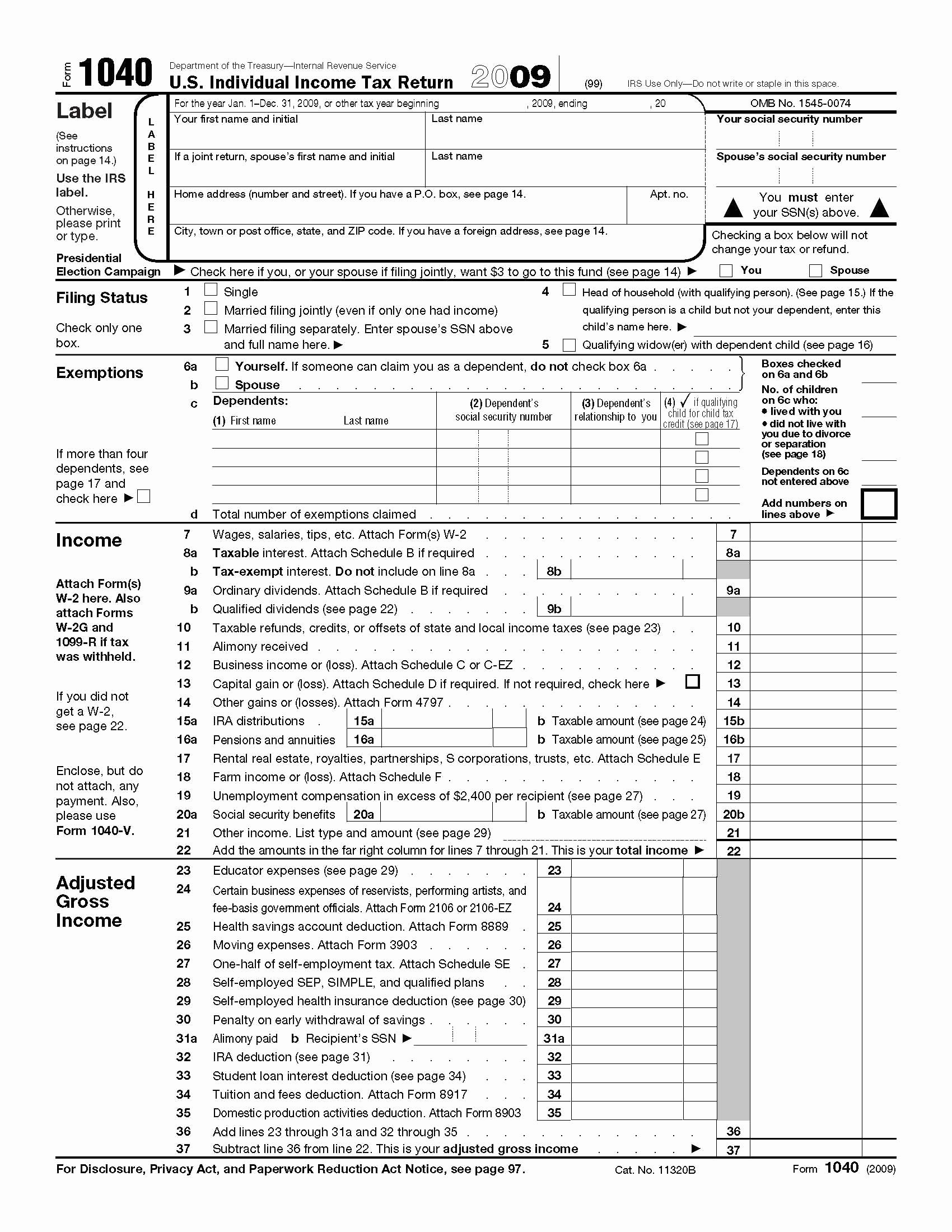

1040 Printable Form

One of the easiest ways to access and fill out the 1040 form is by using the printable version available online. This allows you to conveniently download the form, fill it out electronically or by hand, and then print it for submission. The printable form includes all the necessary sections and instructions to guide you through the process.

When filling out the 1040 form, be sure to gather all your income documents, such as W-2s, 1099s, and any other relevant forms. You’ll also need to have information on any deductions or credits you may be eligible for, such as mortgage interest, student loan interest, or child tax credits. Take your time to review the form and double-check all calculations to ensure accuracy.

Once you’ve completed the 1040 form, you can either file it electronically using IRS e-file, or mail it to the IRS along with any required documentation. Be sure to keep a copy of your completed form for your records, as well as any supporting documents in case of an audit. Remember, accuracy is key when it comes to filing your taxes, so take the time to review your form before submission.

In conclusion, the 1040 printable form is a valuable tool for individuals to file their annual income tax return. By understanding the form and filling it out accurately, you can ensure that you’re taking advantage of all available deductions and credits. So, don’t wait until the last minute – download the 1040 form today and start preparing your taxes with confidence!