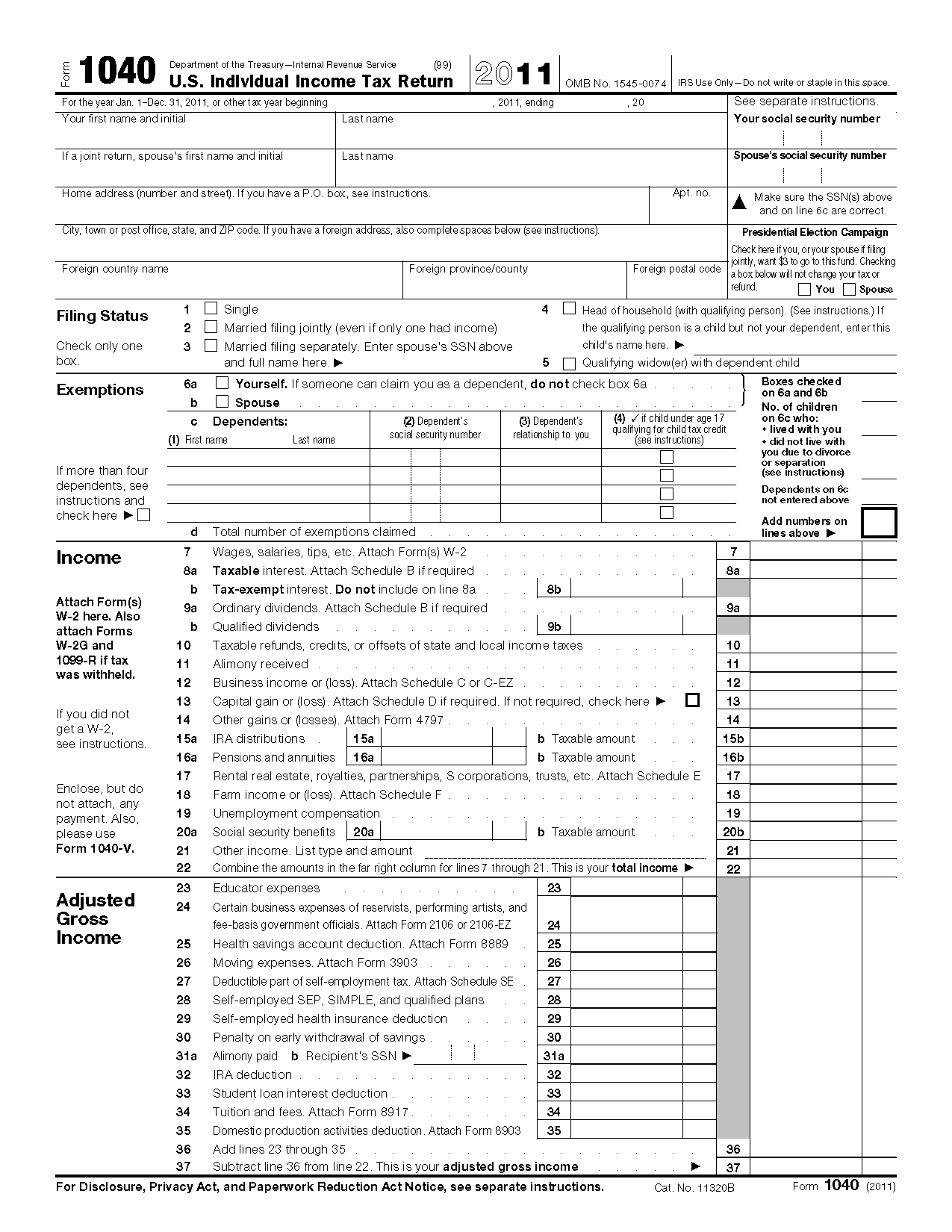

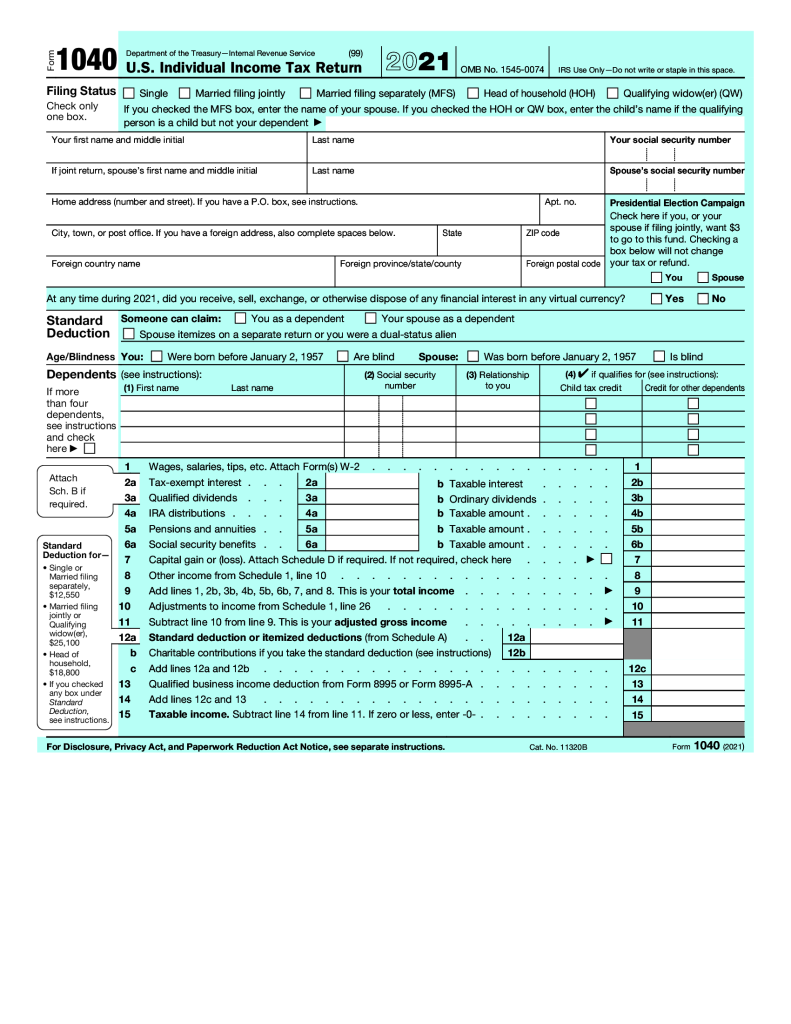

If you are looking for a convenient and easy way to file your taxes, 1040 printable forms are the way to go. These forms are readily available online and can be easily printed from the comfort of your own home. Whether you are a seasoned tax filer or a first-timer, these forms make the process quick and efficient.

1040 printable forms are the most commonly used tax forms for individual taxpayers in the United States. They are used to report income, deductions, and credits to determine the amount of tax owed to the IRS. These forms are available in both PDF and fillable formats, making it easy for taxpayers to fill them out accurately.

One of the main benefits of using 1040 printable forms is the convenience they offer. Instead of having to wait for forms to arrive in the mail or having to pick them up from a local IRS office, taxpayers can simply download and print the forms they need. This saves time and allows individuals to start the filing process sooner.

Another advantage of using 1040 printable forms is the ability to access them at any time. Whether you need to file an extension or amend a previous return, having these forms readily available online makes it easy to do so. Additionally, many tax software programs are compatible with these forms, making it even easier to file electronically.

Overall, 1040 printable forms provide a simple and efficient way to file your taxes. By utilizing these forms, taxpayers can save time and ensure that their returns are filed accurately. So, the next time tax season rolls around, consider using 1040 printable forms to make the process hassle-free.

In conclusion, 1040 printable forms offer a convenient and user-friendly way to file your taxes. With easy access to these forms online, taxpayers can quickly and accurately report their income and deductions to the IRS. Whether you are a seasoned tax filer or a first-timer, 1040 printable forms are a great option for all individuals.