When it comes to filing your taxes, the 1040 tax form is one of the most commonly used forms by individuals. This form is used to report your annual income to the IRS and determine how much tax you owe or how much of a refund you are entitled to. Understanding how to fill out the 1040 tax form correctly is essential to ensure that you are in compliance with the tax laws and maximize any potential refunds.

One of the advantages of the 1040 tax form is that it is available in a printable format, making it easy for individuals to access and complete. This printable form can be found on the IRS website or through various tax preparation software. Having the ability to print out the form allows you to work on it at your own pace and have a physical copy for your records.

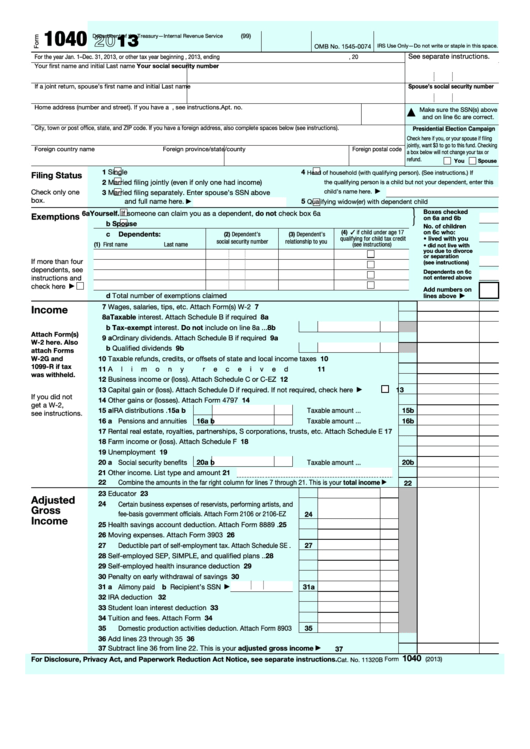

1040 Tax Form Printable

When filling out the 1040 tax form, it is important to gather all necessary documents such as W-2s, 1099s, and any other relevant income statements. You will also need to report any deductions or credits that you are eligible for, such as student loan interest, mortgage interest, or charitable contributions. The form includes various sections for you to input this information accurately.

It is crucial to double-check all the information you input on the 1040 tax form before submitting it to the IRS. Errors or omissions can lead to delays in processing your return or even trigger an audit. Utilizing the printable version of the form allows you to review your entries carefully and make any necessary corrections before finalizing your submission.

Once you have completed the 1040 tax form, you can either mail it to the IRS or file electronically using an e-filing service. The IRS encourages taxpayers to e-file as it is a faster and more secure way to submit your return. If you are expecting a refund, e-filing can also expedite the process and help you receive your money sooner.

In conclusion, the 1040 tax form printable is a valuable tool for individuals to report their income and taxes accurately. By understanding how to fill out the form correctly and utilizing the printable version, you can ensure that your taxes are filed correctly and maximize any potential refunds owed to you.