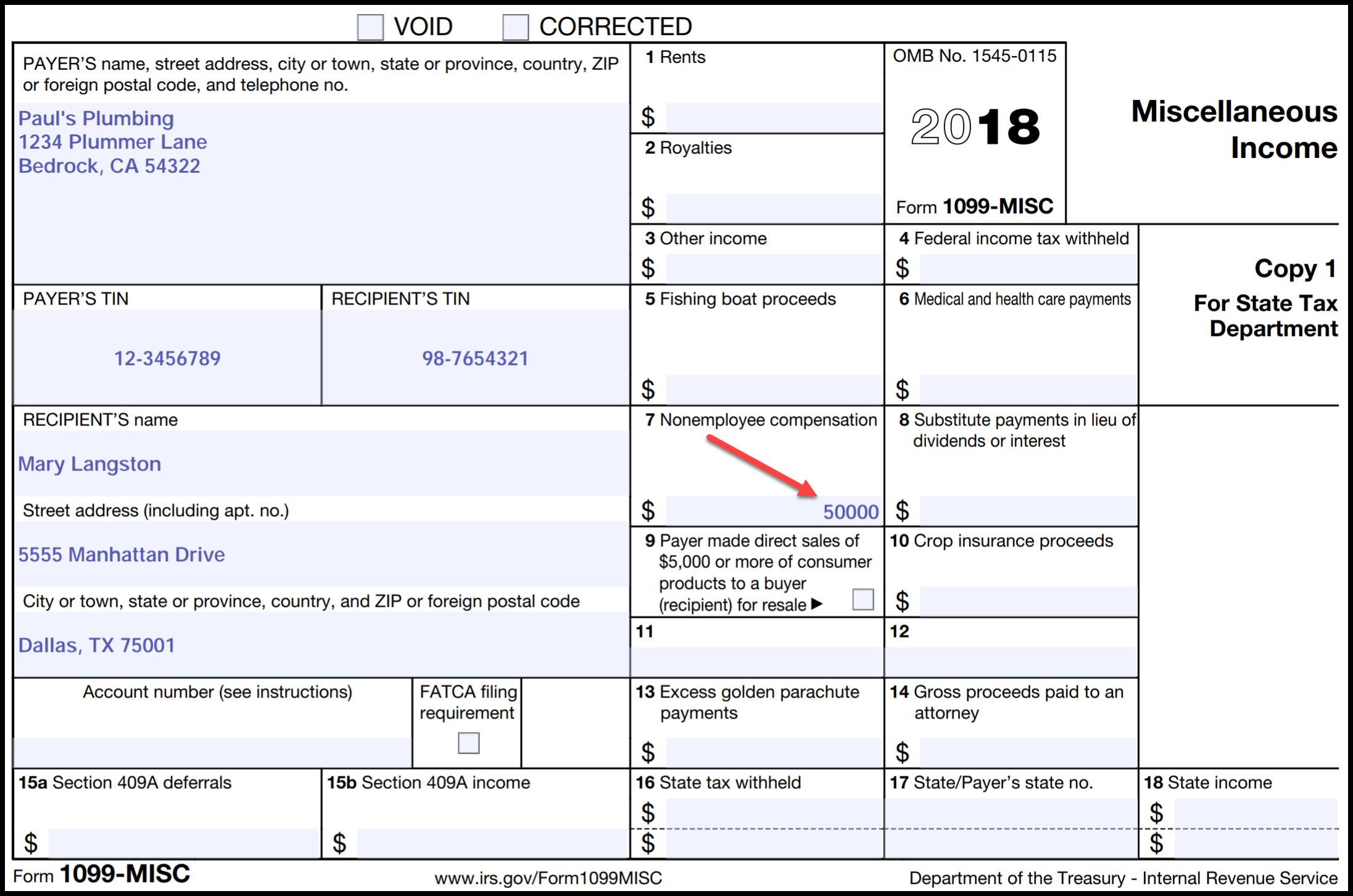

The 1099 NEC Form 2024 is an important document for businesses and independent contractors. It is used to report nonemployee compensation to the IRS. This form is crucial for tax reporting purposes and must be filled out accurately to avoid any penalties or fines.

Businesses are required to issue this form to any individual or entity that they have paid at least $600 in nonemployee compensation during the tax year. This includes payments for services rendered, such as freelance work, consulting fees, or any other type of work performed on a contract basis.

It is essential for businesses to provide the 1099 NEC Form 2024 to recipients by January 31st of the following year. Recipients will then use this form to report their income on their tax returns. The form must also be submitted to the IRS by the end of February if filing by mail, or by the end of March if filing electronically.

For those who need to fill out the 1099 NEC Form 2024, there are printable versions available online. These forms can be easily downloaded and printed for convenience. It is important to ensure that the information provided on the form is accurate and matches the records of both the business and the recipient.

Businesses should keep copies of the 1099 NEC Form 2024 for their records and provide recipients with a copy as well. This form is a crucial part of tax reporting and helps ensure that income is properly reported to the IRS. Failure to file this form correctly or on time can result in penalties and fines, so it is important to take this process seriously.

In conclusion, the 1099 NEC Form 2024 is a vital document for businesses and independent contractors to report nonemployee compensation to the IRS. By ensuring that this form is filled out accurately and submitted on time, businesses can avoid potential penalties and fines. Printable versions of the form are available online for convenience, making the process of tax reporting easier for all parties involved.