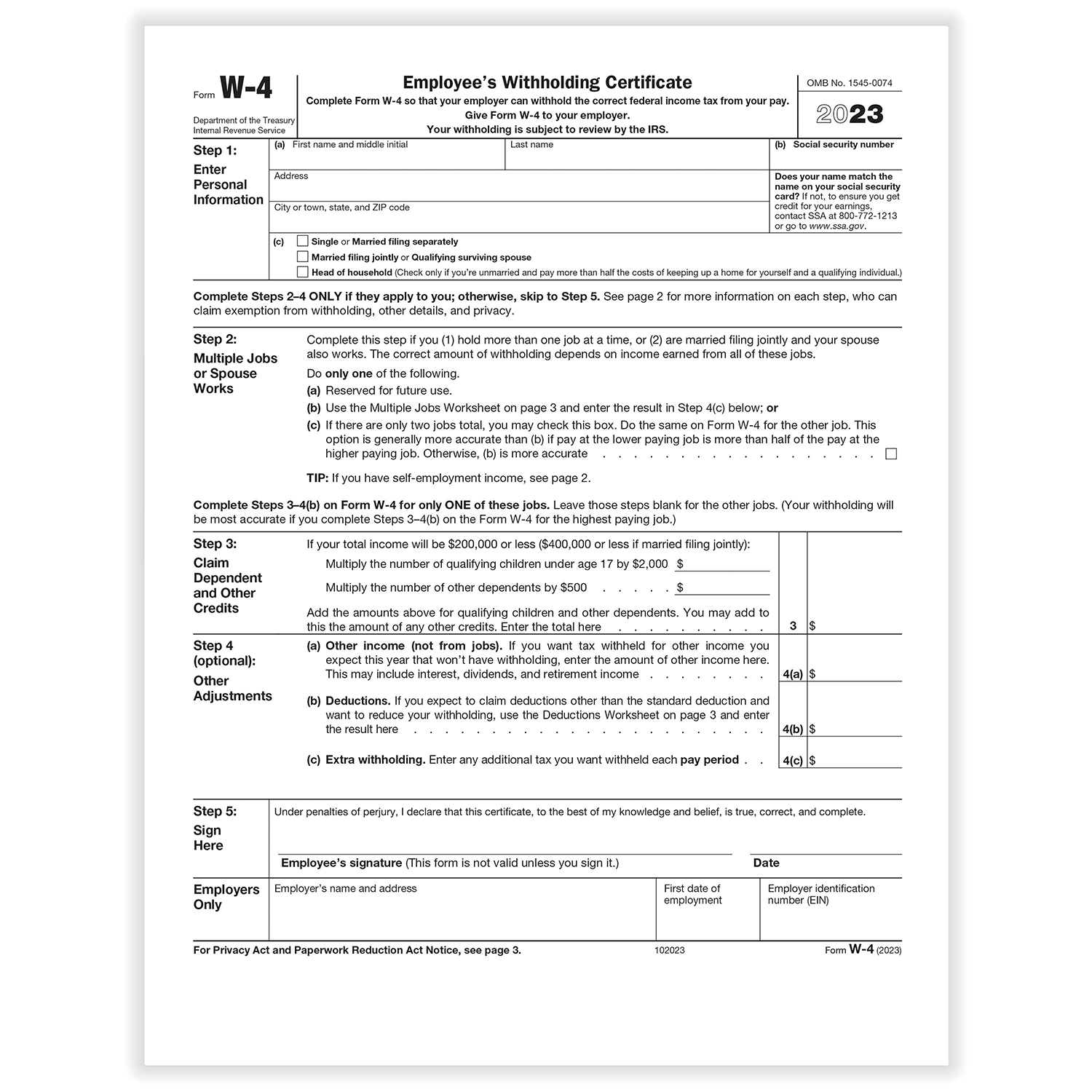

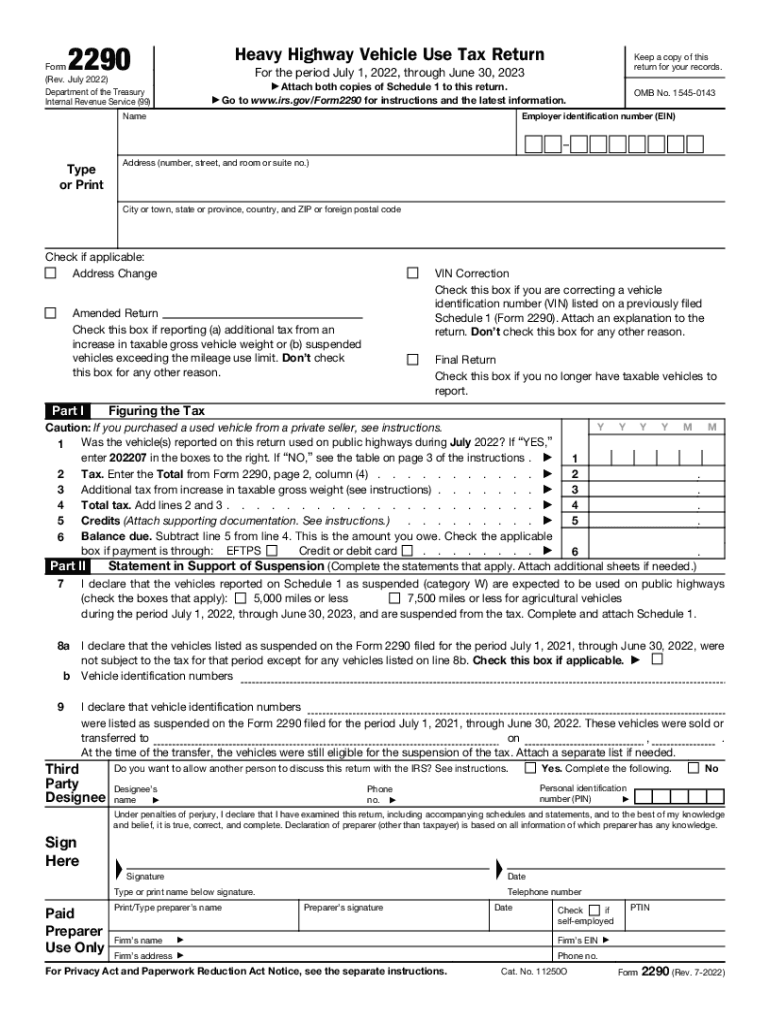

As the tax season approaches, it is important for taxpayers to stay informed about the latest updates and changes to the federal tax forms. In 2024, there are several changes that taxpayers should be aware of, including updates to the tax brackets, deductions, and credits. One of the easiest ways to stay organized and ensure that you are filling out your taxes correctly is to use printable federal tax forms.

Printable tax forms can be easily accessed online and provide a convenient way to fill out your taxes without having to worry about making errors or missing important information. By using printable forms, you can ensure that you are following the correct guidelines and regulations set by the IRS, making the tax filing process much smoother and efficient.

2024 Federal Tax Forms Printable

2024 Federal Tax Forms Printable

When looking for 2024 federal tax forms printable, it is important to make sure that you are using the most up-to-date versions. The IRS updates tax forms regularly to reflect changes in tax laws and regulations, so using outdated forms could result in errors or delays in processing your tax return. By downloading and printing the latest forms from the IRS website, you can ensure that you are using the correct forms for the current tax year.

Some of the most commonly used federal tax forms for individuals include Form 1040, which is used to report income, deductions, and credits, and Form 1040-ES, which is used to estimate and pay quarterly taxes. Additionally, there are various schedules and worksheets that may need to be filed depending on your individual tax situation. By using printable forms, you can easily access and fill out these forms as needed.

Overall, using 2024 federal tax forms printable is a convenient and efficient way to ensure that you are filling out your taxes accurately and on time. By staying organized and using the most up-to-date forms, you can make the tax filing process much smoother and less stressful. Be sure to visit the IRS website to download and print the forms you need for the upcoming tax season.