As the tax season approaches, it’s important to stay organized and prepared. One of the key components of filing your taxes is having access to the necessary forms. In 2024, there are a variety of tax forms that individuals and businesses will need to fill out in order to accurately report their income and deductions.

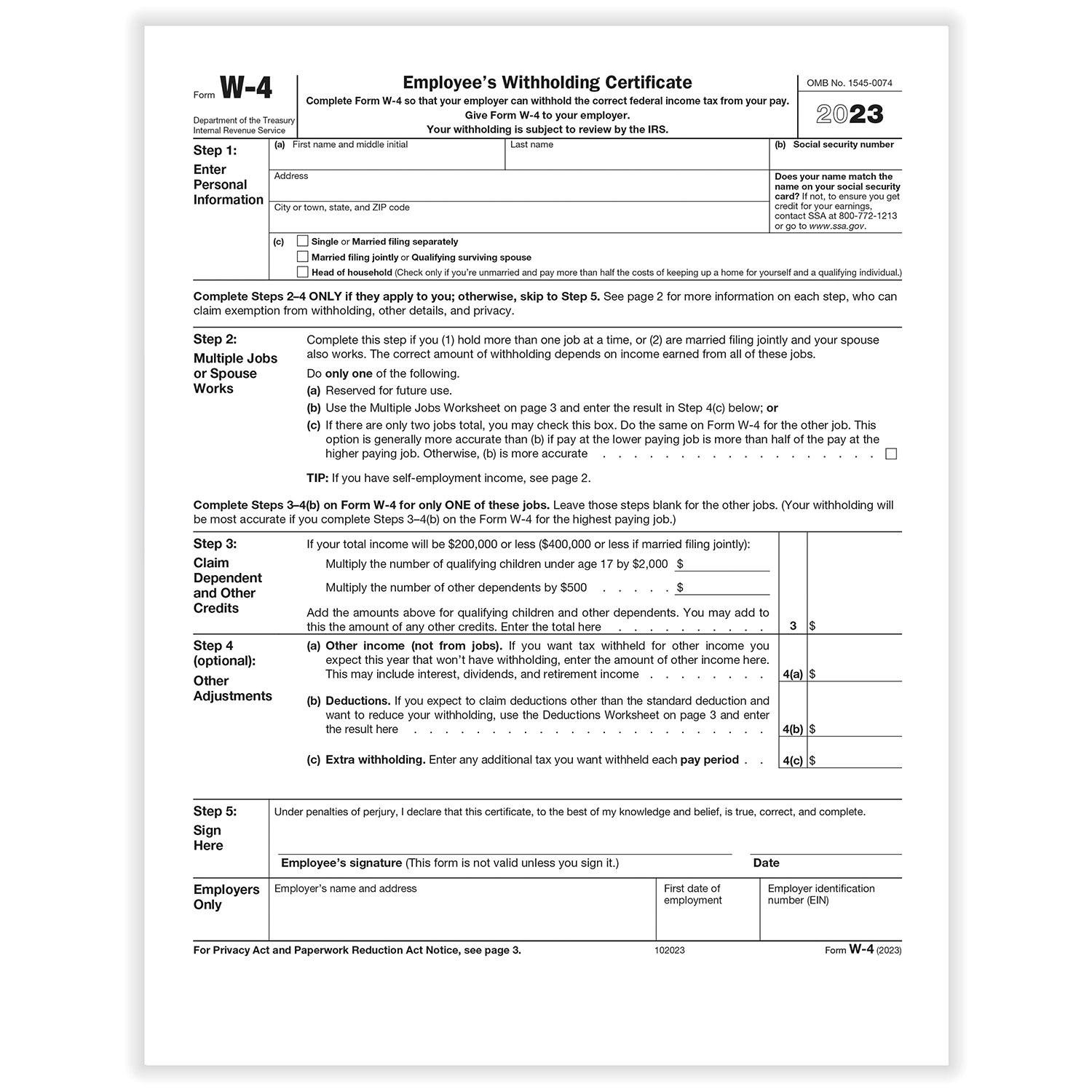

Whether you’re a W-2 employee, a freelancer, a small business owner, or anything in between, understanding the tax forms you need to file is crucial. Having the right forms on hand can make the process much smoother and help you avoid potential errors or delays in receiving your tax refund.

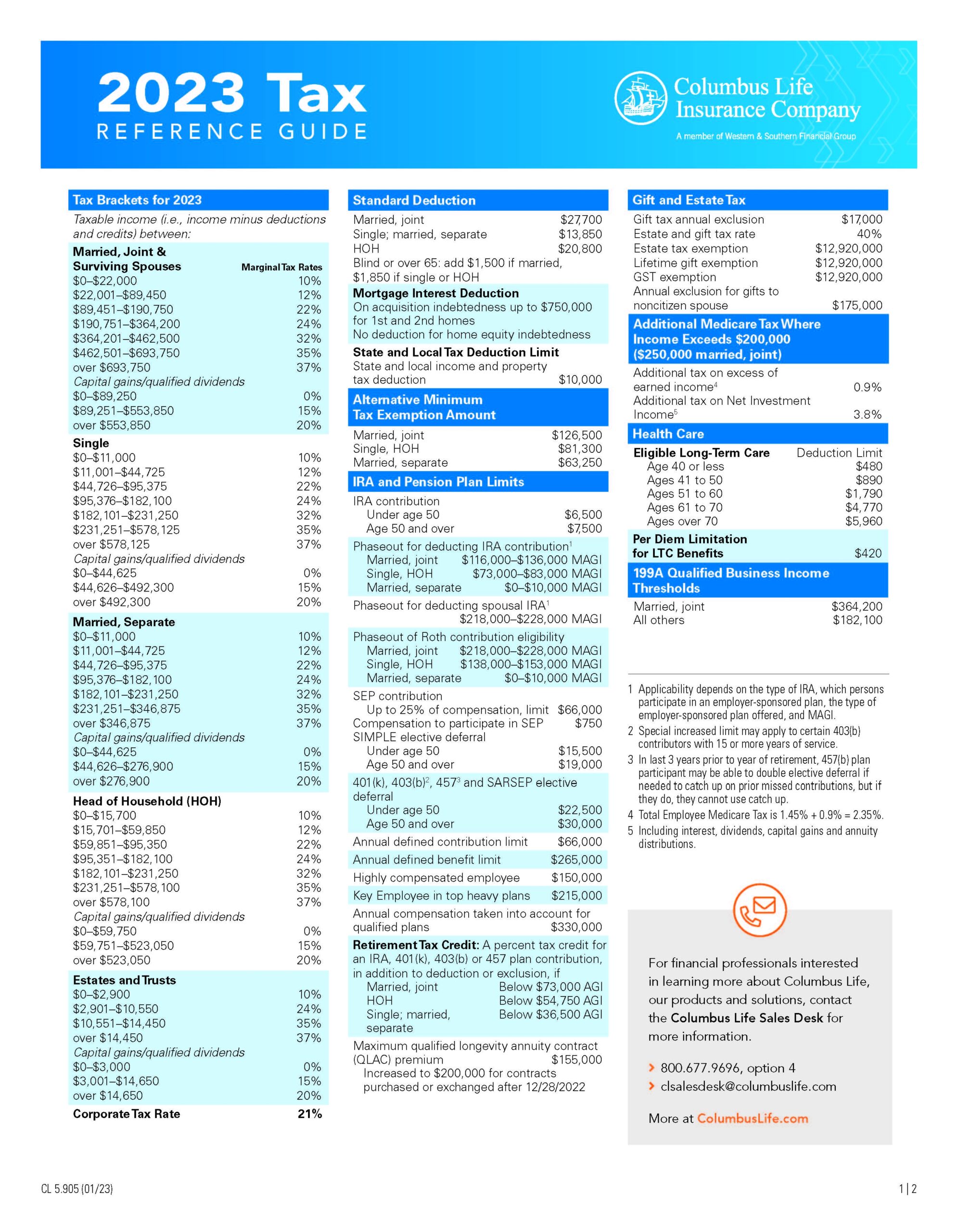

When it comes to printable tax forms for 2024, there are several options available. The most common forms include the 1040, 1040A, and 1040EZ for individual taxpayers. These forms vary in complexity and are used based on your filing status and income level. Additionally, there are specific forms for reporting income from investments, self-employment, rental properties, and more.

For businesses, tax forms such as the 1065 for partnerships, the 1120 for corporations, and the Schedule C for sole proprietors are essential for accurately reporting business income and expenses. It’s important to carefully review the instructions for each form to ensure that you’re providing all the necessary information.

Fortunately, most tax forms for 2024 are available for download and printing on the IRS website. This makes it easy to access the forms you need without having to wait for them to arrive in the mail. Additionally, many tax preparation software programs also offer printable versions of the forms, making it even more convenient to file your taxes accurately and on time.

In conclusion, staying organized and prepared for tax season is essential for a smooth filing process. By understanding the tax forms you need to fill out and having access to printable versions, you can ensure that your taxes are filed accurately and on time. Be sure to gather all the necessary documents and take the time to review your forms before submitting them to the IRS.