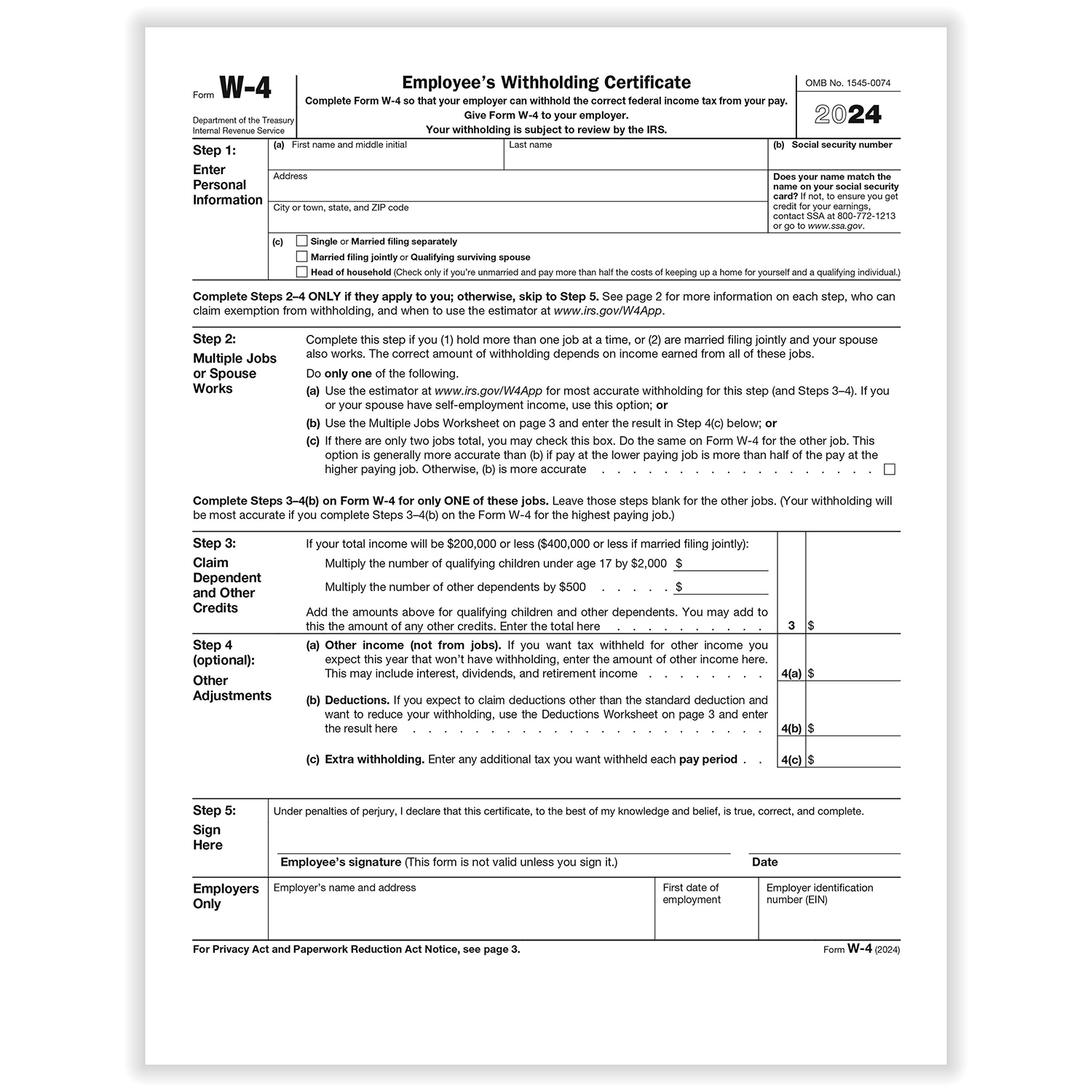

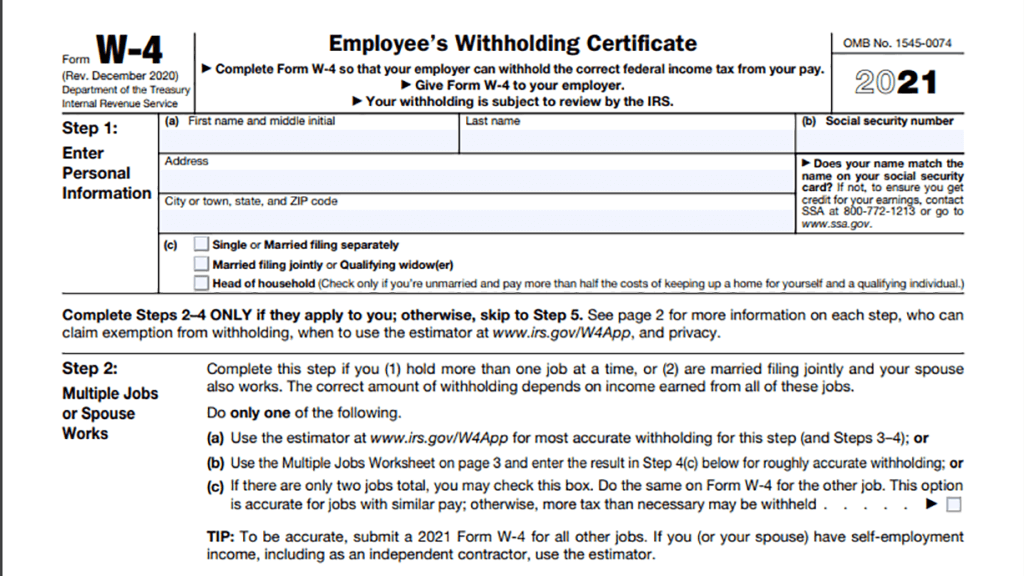

As tax regulations continue to evolve, it’s important for individuals to stay informed about the latest updates. The 2025 W-4 Form is a crucial document that employees must fill out accurately to ensure the correct amount of taxes are withheld from their paychecks. This form plays a significant role in determining how much money is taken out of each paycheck for federal income taxes.

Understanding the 2025 W-4 Form is essential for employees to avoid under or over-withholding taxes. This form requires individuals to provide information such as their filing status, number of dependents, and any additional income they may have. By accurately completing this form, employees can ensure they are not hit with unexpected tax bills or refunds come tax season.

The 2025 W-4 Form Printable is easily accessible online, making it convenient for individuals to download and fill out. This form simplifies the process of updating tax withholding information and ensures that employees are compliant with current tax laws. By utilizing the printable form, individuals can make any necessary adjustments to their withholding allowances quickly and efficiently.

When filling out the 2025 W-4 Form, individuals should carefully review the instructions provided to ensure accuracy. Making mistakes on this form can lead to incorrect tax withholding, which may result in owing taxes or receiving a smaller refund. It’s important to take the time to accurately complete this form to avoid any potential issues down the line.

Overall, the 2025 W-4 Form Printable is a valuable resource for employees to update their tax withholding information. By staying informed and proactive in completing this form accurately, individuals can ensure they are on track with their tax obligations and avoid any surprises when tax season rolls around.

Stay ahead of the game by utilizing the 2025 W-4 Form Printable to update your tax withholding information today!