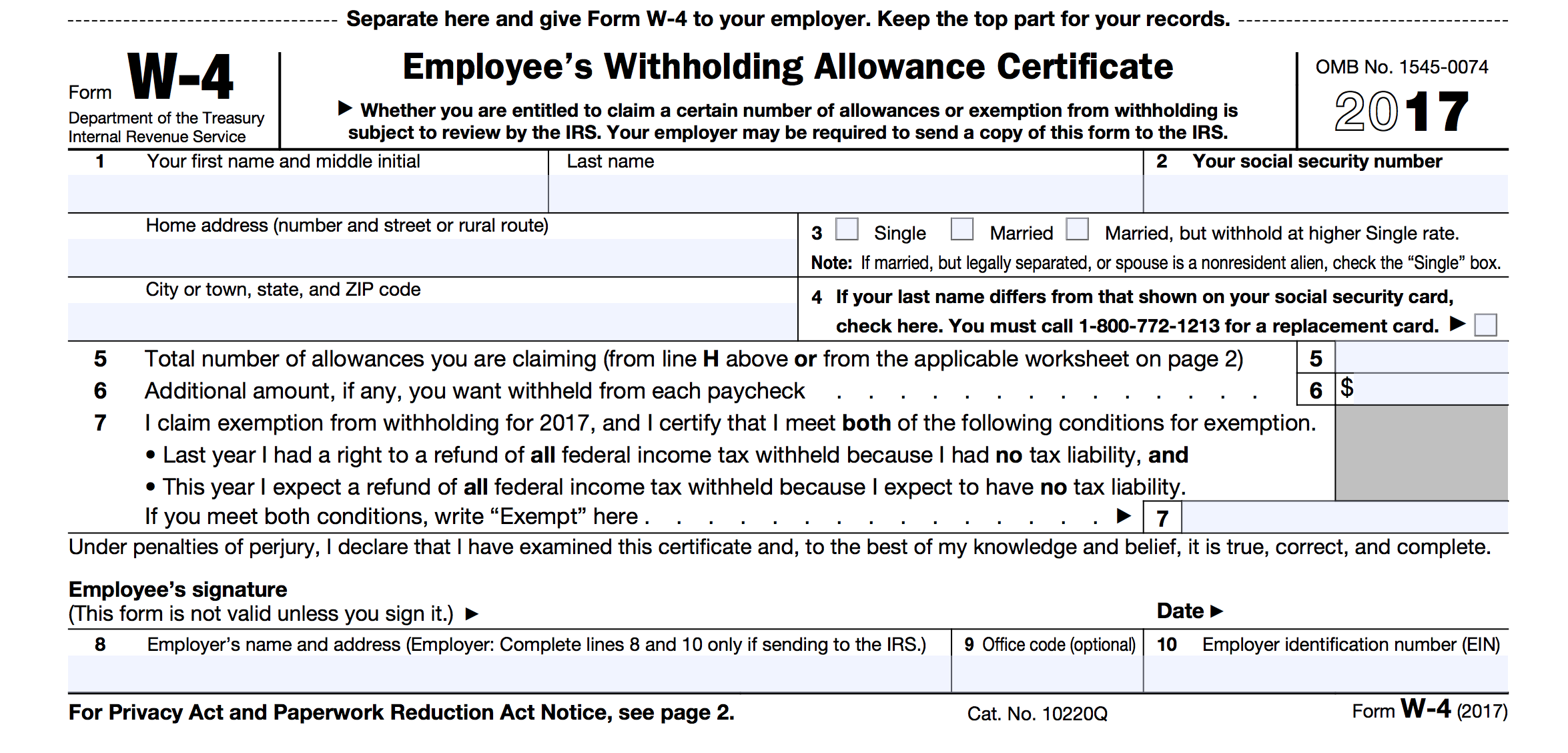

In 2025, the W-4r form has become an essential document for employees to fill out when starting a new job or making changes to their tax withholding. This form helps employers determine how much federal income tax to withhold from an employee’s paycheck based on their filing status and number of allowances.

Printable versions of the W-4r form make it easy for employees to fill out and submit to their employers. This form is crucial for ensuring that the correct amount of tax is withheld from each paycheck, helping employees avoid unexpected tax bills or refunds at the end of the year.

When filling out the 2025 W-4r form, employees will need to provide information such as their name, address, filing status, and number of allowances. They may also need to indicate if they have any additional income or deductions that should be taken into account when calculating their tax withholding.

Employers use the information provided on the W-4r form to calculate how much federal income tax to withhold from each paycheck. It’s important for employees to review their withholding periodically and make updates as needed, especially if their financial situation changes.

By utilizing the 2025 W-4r form printable version, employees can easily access and complete this important document. It’s crucial for both employees and employers to ensure that tax withholding is accurate and up to date to avoid any issues with the IRS.

Overall, the 2025 W-4r form printable version simplifies the process of filling out this essential tax document. Employees can easily access and submit this form to their employers, ensuring that their tax withholding is accurate and up to date.