W2 Printable Form is an essential document that serves as a record of an employee’s earnings and taxes withheld by their employer throughout the year. This form is crucial for filing taxes and ensuring that individuals accurately report their income to the IRS. It provides detailed information about wages, tips, bonuses, and other compensation received by an employee.

Employers are required to provide employees with a W2 Form by January 31st each year, detailing their earnings and tax withholdings for the previous year. This form is crucial for individuals to accurately file their taxes and claim any deductions or credits they may be eligible for. It is important to carefully review the information on the W2 Form to ensure its accuracy before submitting it with your tax return.

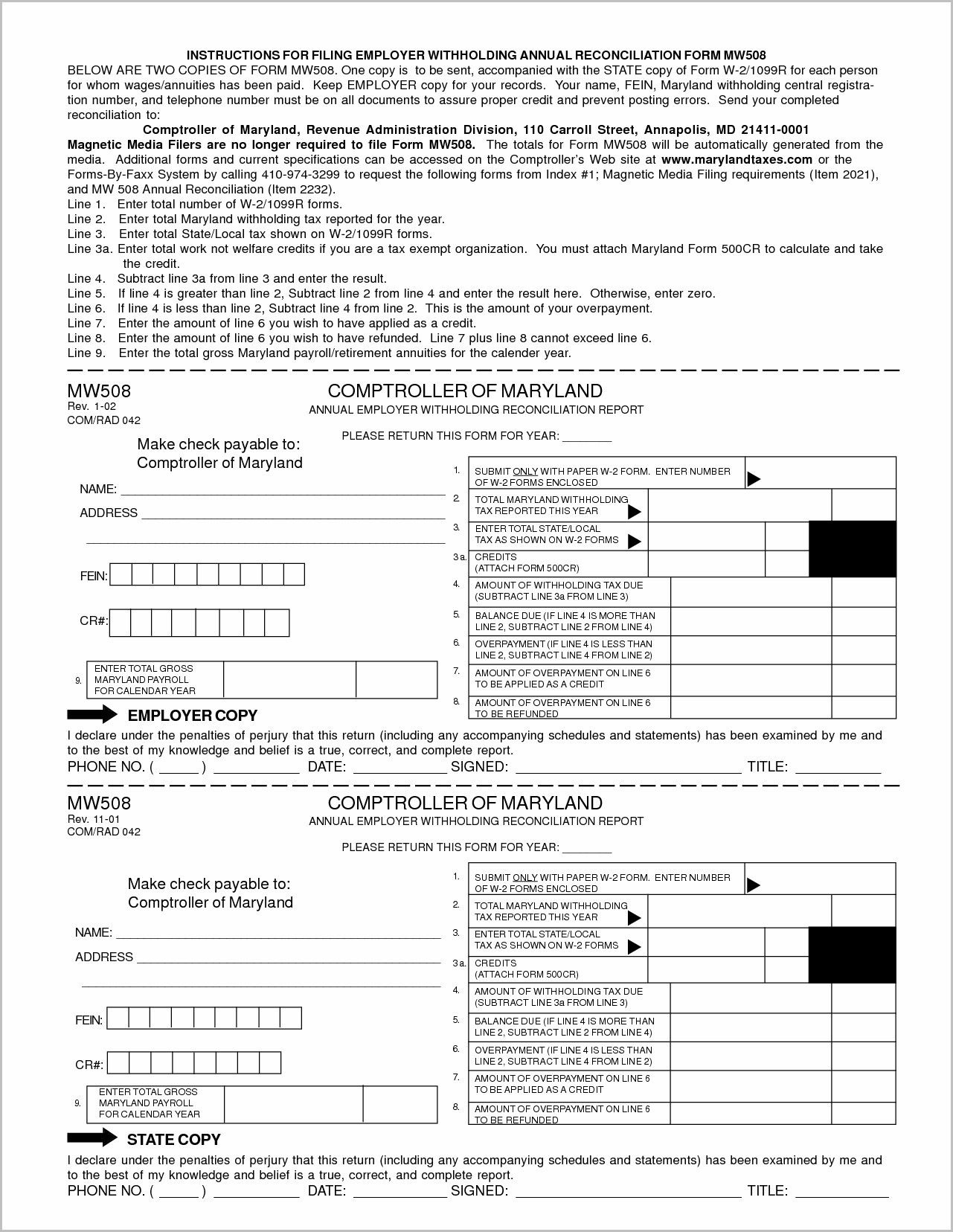

W2 Printable Form

W2 Printable Form can be easily accessed online from the IRS website or through your employer’s payroll system. Many employers also provide employees with a physical copy of their W2 Form for their records. The W2 Form typically includes information such as the employee’s name, address, social security number, and employer identification number. It also lists the total wages earned, federal and state tax withholdings, and any other deductions or credits.

When using a W2 Printable Form, it is important to follow the instructions provided by the IRS to ensure that the form is filled out correctly. This includes accurately reporting all income, deductions, and credits to avoid any potential penalties or audits. It is also important to keep a copy of your W2 Form for your records and to provide it to your tax preparer if you hire one to file your taxes.

Overall, W2 Printable Form is a critical document that helps individuals accurately report their income and taxes to the IRS. By carefully reviewing and completing this form, individuals can ensure that they are compliant with tax laws and avoid any potential issues with the IRS. It is important to take the time to understand how to properly fill out and submit your W2 Form to ensure a smooth tax filing process.

In conclusion, W2 Printable Form is an essential document for individuals to accurately report their income and taxes to the IRS. By following the instructions provided and carefully reviewing the information on the form, individuals can ensure that they are compliant with tax laws and avoid any potential issues with the IRS. It is important to keep a copy of your W2 Form for your records and to submit it with your tax return each year.