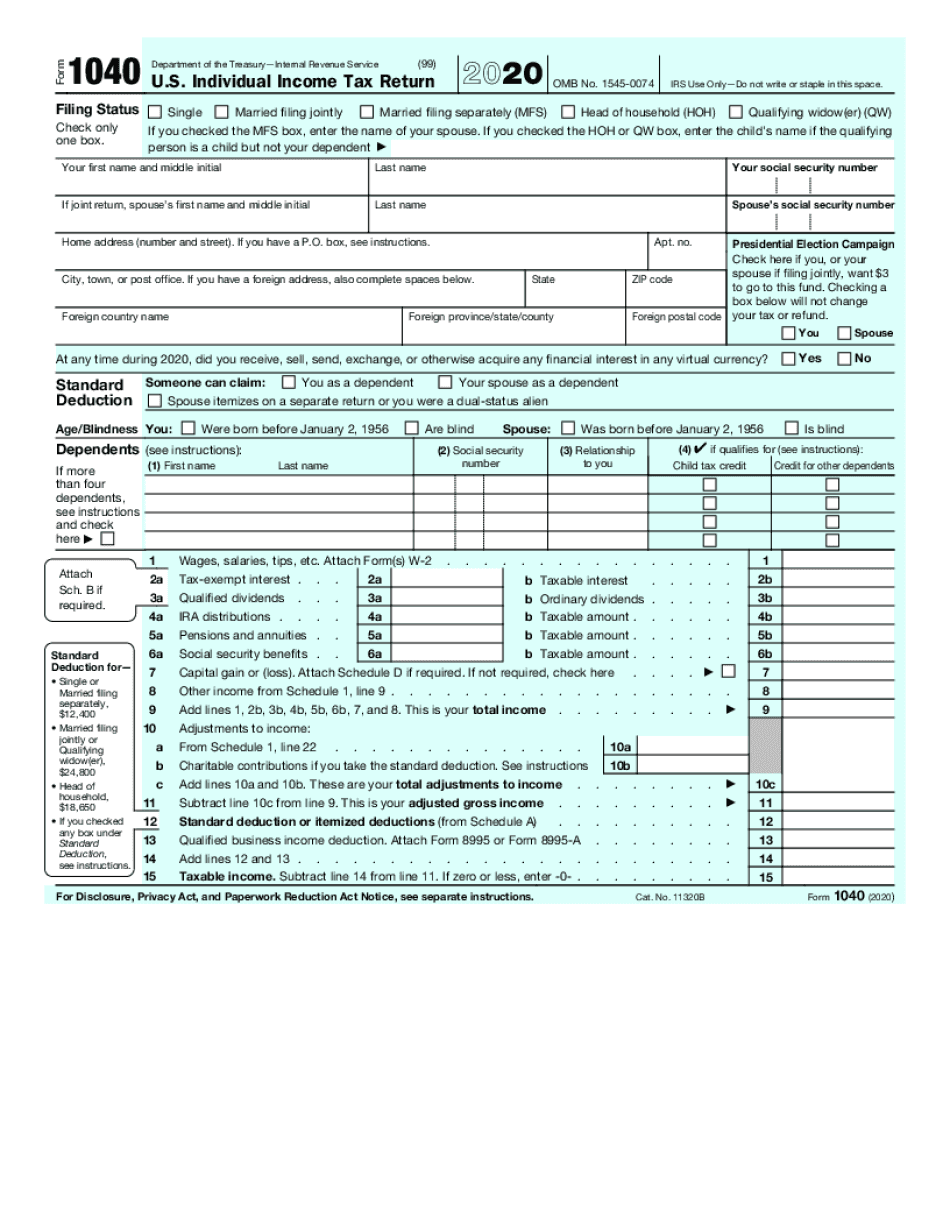

As tax season approaches, many individuals and businesses are gearing up to file their tax returns. One of the most commonly used tax forms in the United States is Form 1040. This form is used by individuals to report their annual income and calculate their tax liability to the Internal Revenue Service (IRS).

For those who prefer to file their taxes manually, Printable Form 1040 is a convenient option. This form can be easily downloaded from the IRS website and filled out by hand. It provides a comprehensive overview of the taxpayer’s financial situation, including income, deductions, credits, and taxes owed.

Printable Form 1040

When filling out Printable Form 1040, taxpayers must provide information about their income sources, such as wages, salaries, tips, and investments. They must also report any deductions they are eligible for, such as mortgage interest, charitable contributions, and medical expenses. Additionally, taxpayers must calculate their tax liability based on their income and deductions, and determine if they owe any taxes or are eligible for a refund.

One of the key advantages of using Printable Form 1040 is that it allows taxpayers to carefully review their financial information and ensure that all necessary details are included. By filling out the form manually, taxpayers can also gain a better understanding of their tax situation and make informed decisions about their finances.

Before submitting Printable Form 1040, taxpayers should double-check their information for accuracy and completeness. Any errors or omissions could result in penalties or delays in processing their tax return. It is also important to keep a copy of the completed form for your records, as well as any supporting documents that may be required.

In conclusion, Printable Form 1040 is a valuable tool for individuals who prefer to file their taxes manually and take a hands-on approach to their finances. By carefully completing this form and reviewing their financial information, taxpayers can ensure that their tax return is accurate and avoid potential issues with the IRS. So, if you prefer to file your taxes the old-fashioned way, consider using Printable Form 1040 for a comprehensive overview of your financial situation.