W2 printable forms are essential documents that provide employees with a summary of their earnings and tax withholdings for the year. These forms are crucial for individuals when filing their taxes and ensuring that they are in compliance with the Internal Revenue Service (IRS) regulations. By accurately filling out and submitting W2 forms, employees can avoid potential penalties and ensure that they receive the appropriate tax refunds.

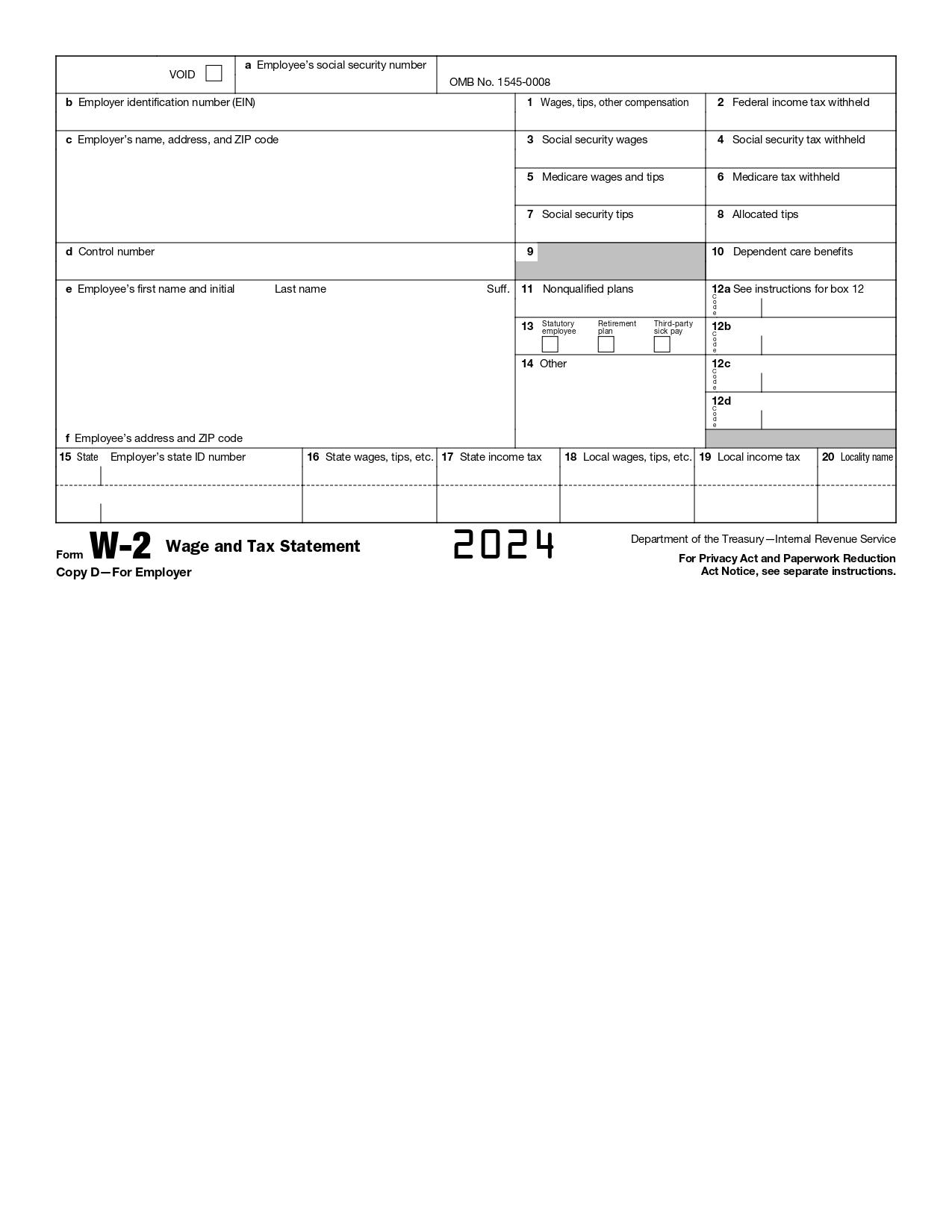

W2 printable forms typically include important information such as the employee’s gross earnings, deductions for taxes and benefits, and the amount of taxes withheld by the employer. It is important for employees to review this information carefully to ensure its accuracy before submitting it to the IRS. Employers are required by law to provide employees with their W2 forms by January 31st of each year, allowing individuals ample time to prepare and file their taxes before the April deadline.

One of the key benefits of using W2 printable forms is that they provide a standardized format that makes it easy for employees to report their income and tax withholdings. This can help eliminate errors and discrepancies that may arise when individuals attempt to calculate their taxes manually. Additionally, W2 forms are recognized by the IRS as official documents, making them a reliable source of information for both employees and tax authorities.

Employers can also benefit from using W2 printable forms as they help streamline the tax reporting process and ensure compliance with federal regulations. By providing employees with accurate and timely W2 forms, employers can avoid potential audits and penalties that may result from incorrect or incomplete tax reporting. Employers can also use W2 forms to track employee earnings and tax withholdings throughout the year, making it easier to generate accurate financial reports and meet tax deadlines.

In conclusion, W2 printable forms play a crucial role in the tax reporting process for both employees and employers. By accurately completing and submitting these forms, individuals can ensure that they are in compliance with IRS regulations and maximize their tax refunds. Employers can also benefit from using W2 forms to streamline their tax reporting process and avoid potential penalties. Overall, W2 printable forms are essential documents that help facilitate accurate and efficient tax reporting for all parties involved.