Are you a freelancer or independent contractor looking for a way to report your income for tax purposes? Look no further than the 1099 form. The 1099 form is used by businesses to report payments made to non-employees, such as freelancers, independent contractors, and vendors. This form is essential for anyone who receives income from sources other than an employer.

As tax season approaches, it’s important to have all the necessary forms in order to accurately report your income. The 1099 form is crucial for freelancers and independent contractors as it outlines the income they have received throughout the year. It is important to ensure that you have this form filled out correctly to avoid any discrepancies with the IRS.

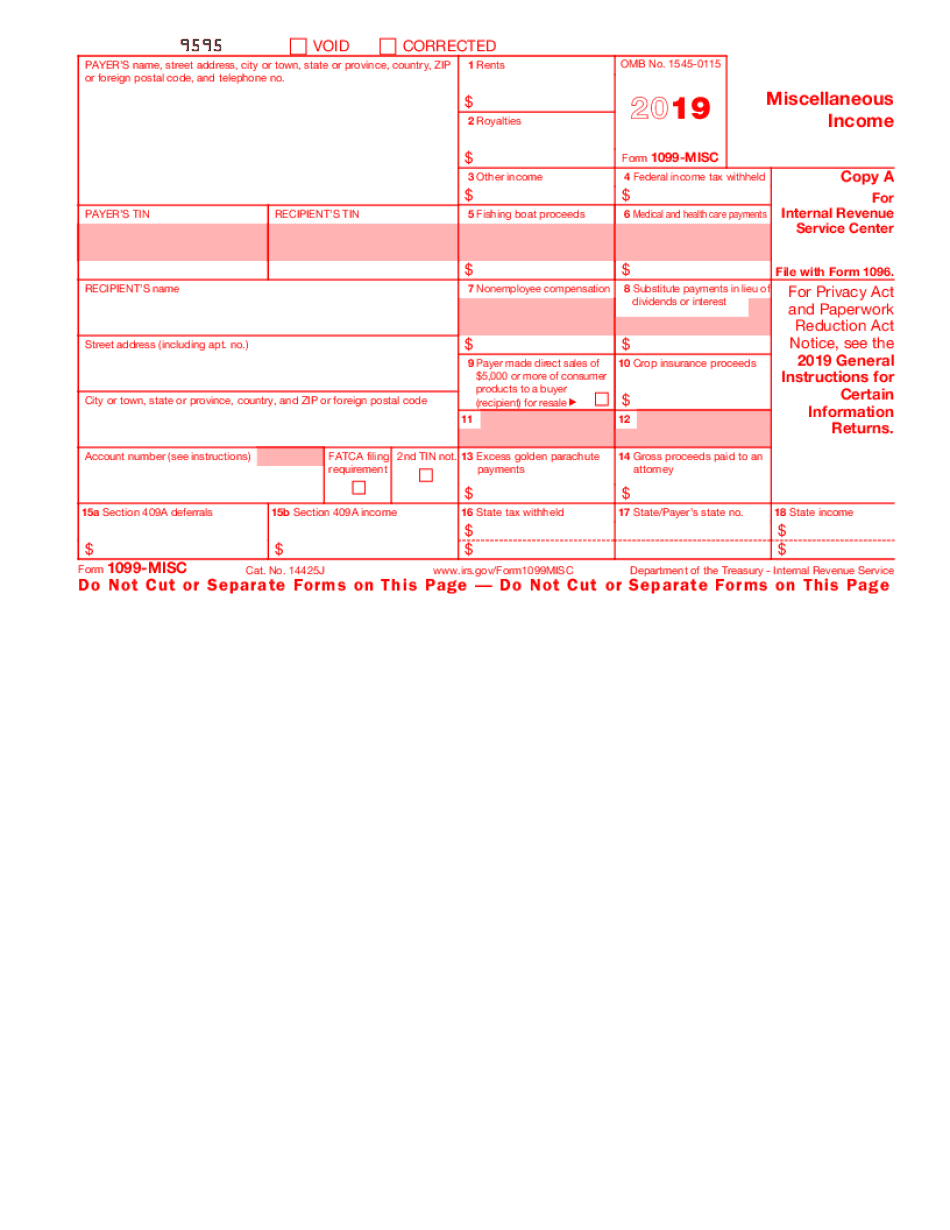

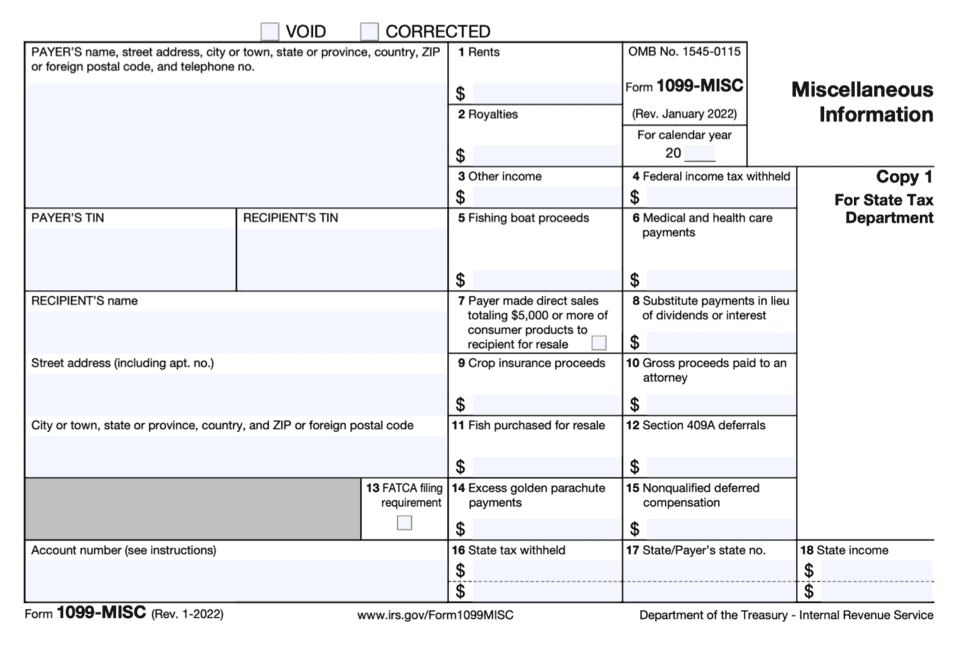

1099 Form Printable

One of the easiest ways to obtain a 1099 form is by downloading a printable version online. Many websites offer free, downloadable 1099 forms that you can easily fill out and submit. This saves you time and hassle from having to pick up a physical form from an office supply store.

When filling out the 1099 form, be sure to include all relevant information such as your name, address, taxpayer identification number, and the amount of income you received. It’s important to double-check all information to ensure accuracy before submitting the form to the IRS.

Once you have completed the 1099 form, you can either mail it to the IRS or submit it electronically through their website. Be sure to keep a copy of the form for your records in case you need to reference it in the future.

In conclusion, the 1099 form is an essential document for freelancers and independent contractors to report their income accurately to the IRS. By utilizing a printable version of the form, you can easily fill it out and submit it without any hassle. Be sure to double-check all information before submitting the form to avoid any potential issues with the IRS.