When it comes to filing your taxes, the IRS 1040 form is one of the most important documents you’ll need. This form is used by individuals to report their annual income to the Internal Revenue Service (IRS) and calculate how much tax they owe. It is crucial to fill out this form accurately and submit it by the deadline to avoid any penalties or fines.

Whether you are self-employed, a freelancer, or a salaried employee, the IRS 1040 form is a must-have document for all taxpayers. It is used to report various types of income, deductions, and credits that can affect your tax liability. The form is updated annually, so it’s important to use the most recent version when filing your taxes.

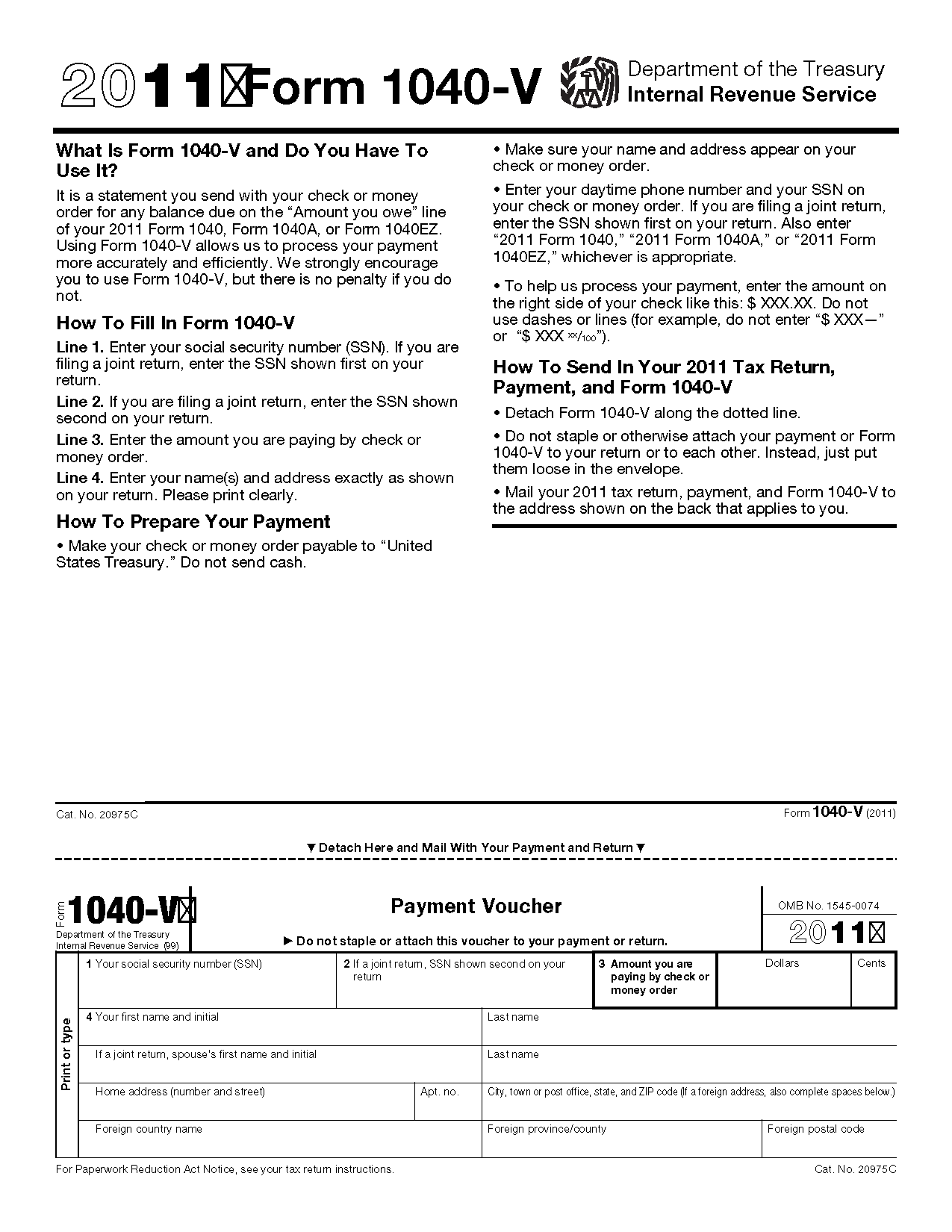

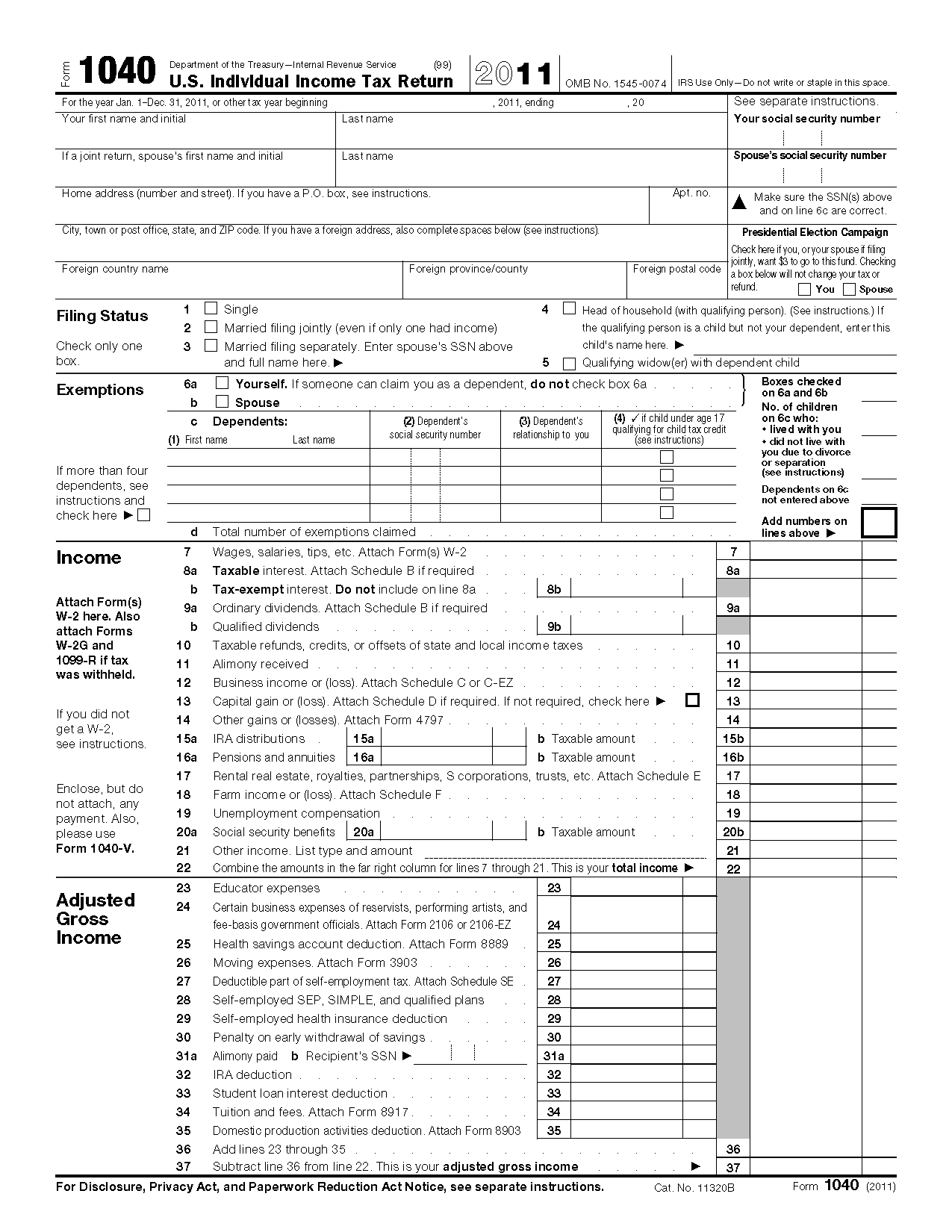

Printable IRS 1040 Form

One of the easiest ways to access the IRS 1040 form is by downloading it online. The IRS website offers a printable version of the form that you can fill out and submit electronically or by mail. This printable form includes all the necessary sections and instructions to help you accurately report your income and deductions.

When filling out the IRS 1040 form, make sure to double-check all the information you provide to avoid any errors. Any mistakes on your tax return can delay the processing of your refund or result in additional taxes owed. If you’re unsure about how to fill out certain sections of the form, it’s best to seek help from a tax professional or accountant.

Once you have completed the IRS 1040 form, you can submit it online using the IRS e-file system or mail it to the address provided on the form. Make sure to keep a copy of your tax return for your records and to reference in case of any future audits or inquiries from the IRS. Filing your taxes accurately and on time will help you avoid any unnecessary stress or financial burdens.

In conclusion, the IRS 1040 form is a crucial document for all taxpayers that must be filled out accurately and submitted by the deadline. By using the printable version of the form available online, you can easily report your income and deductions to the IRS. Remember to review your tax return carefully before submitting it to ensure accuracy and compliance with tax laws. Filing your taxes properly will help you avoid any penalties or fines and ensure a smooth tax-filing process.