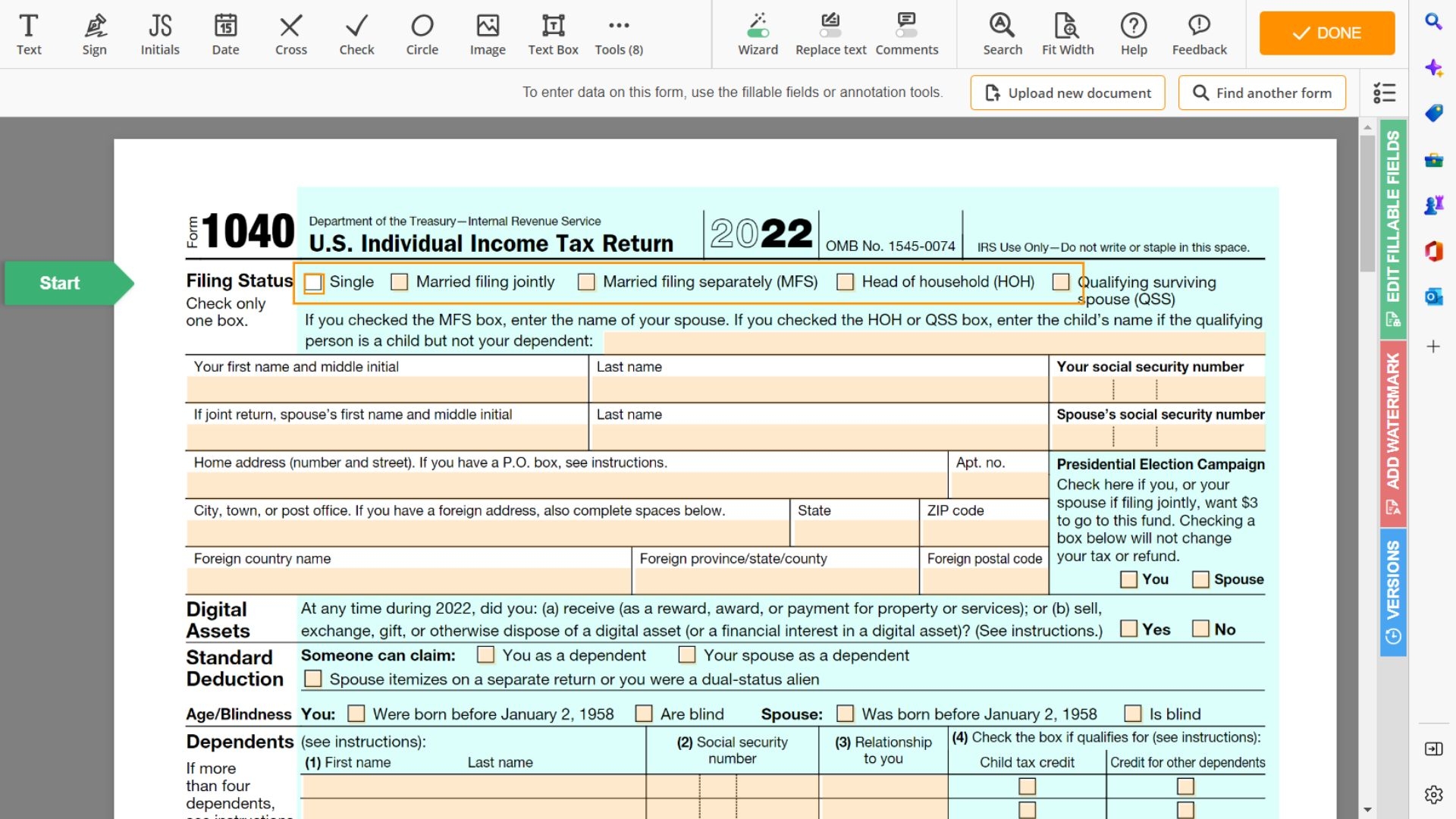

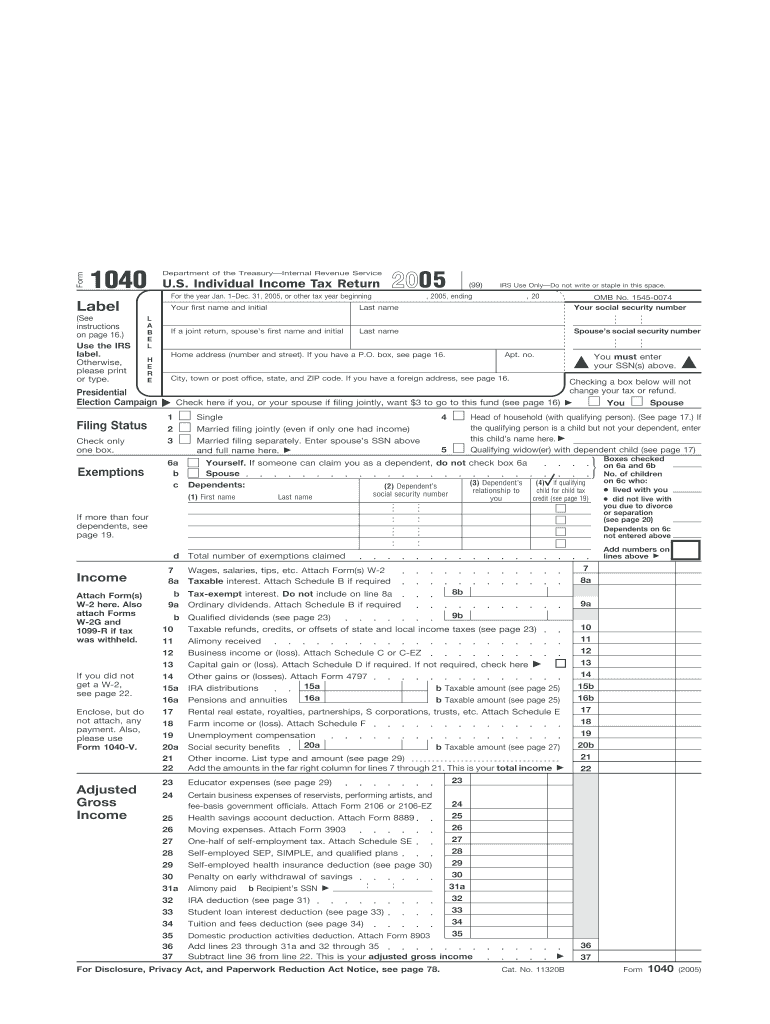

Filing taxes can be a daunting task for many individuals, but having access to printable forms can make the process much easier. The 2023 Form 1040 is an essential document for taxpayers to report their annual income and determine any taxes owed or refunds due. This form provides a comprehensive overview of an individual’s financial situation and is used by the Internal Revenue Service (IRS) to assess tax liability.

With the 2023 Form 1040 Printable, taxpayers can easily fill out the necessary information, including income, deductions, and credits, to accurately report their tax liability. This form is designed to streamline the tax filing process and ensure that individuals comply with federal tax laws.

When filling out the 2023 Form 1040, taxpayers must provide details about their income sources, such as wages, interest, dividends, and capital gains. They must also report any deductions they are eligible for, such as student loan interest, mortgage interest, and charitable contributions. Additionally, taxpayers can claim tax credits to reduce their overall tax liability, such as the Earned Income Tax Credit or Child Tax Credit.

It is important for taxpayers to carefully review the instructions for the 2023 Form 1040 to ensure they are accurately reporting their financial information. Any errors or omissions on the form could result in penalties or delays in processing their tax return. By using the printable form, individuals can easily reference the instructions and double-check their entries before submitting their tax return to the IRS.

Overall, the 2023 Form 1040 Printable is a valuable tool for taxpayers to report their income and expenses accurately and efficiently. By utilizing this form, individuals can ensure they are compliant with federal tax laws and avoid any potential issues with the IRS. Filing taxes may never be a favorite task, but having access to printable forms can certainly make the process smoother and less stressful.

As tax season approaches, be sure to download the 2023 Form 1040 Printable to start preparing your tax return. By taking the time to carefully fill out this form, you can ensure a smooth and hassle-free filing process. Remember to consult with a tax professional if you have any questions or need assistance with completing your tax return.