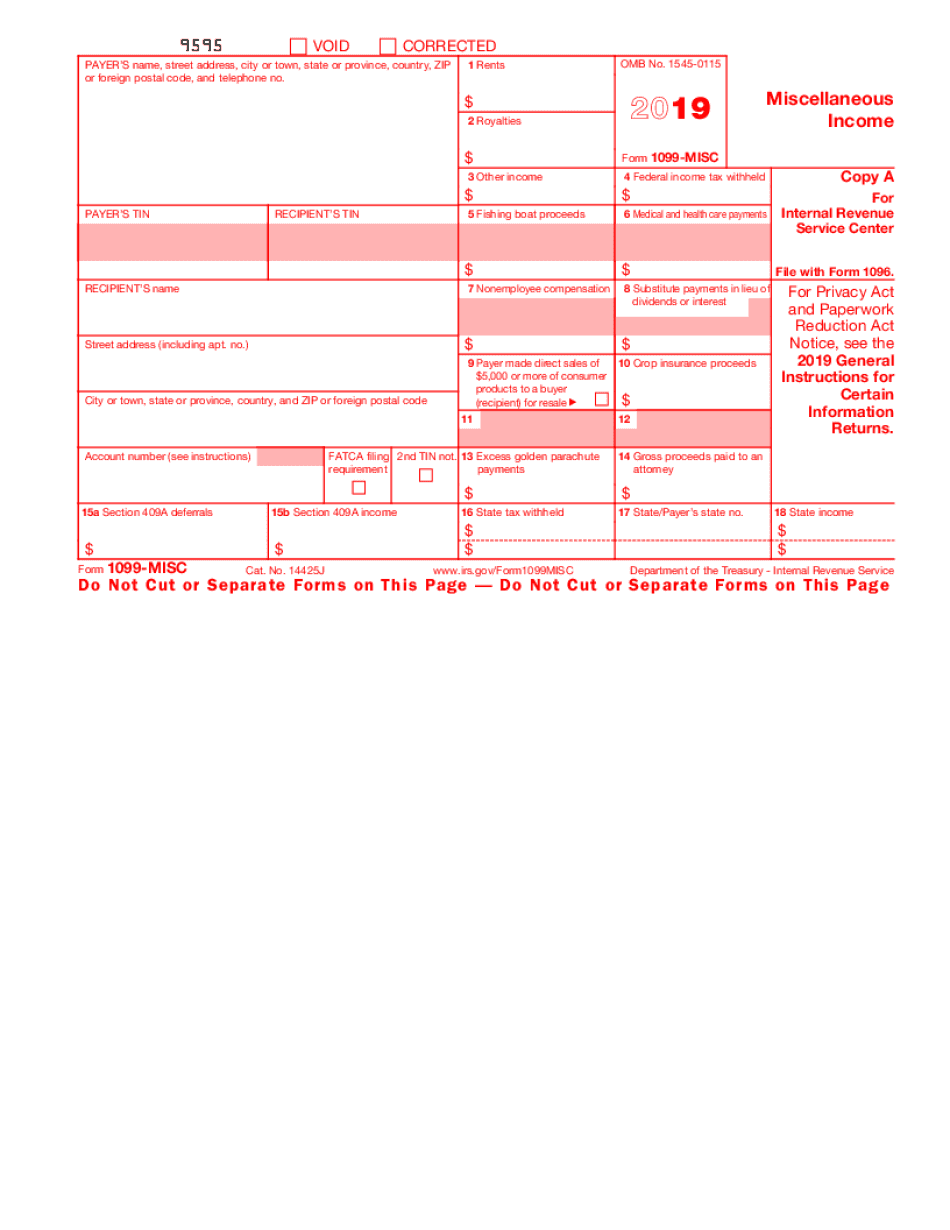

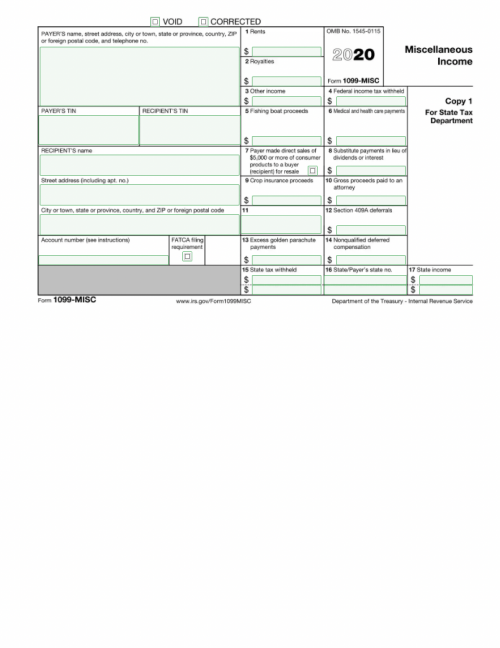

Form 1099 is a series of IRS tax forms used to report various types of income other than wages, salaries, and tips. These forms are essential for both businesses and individuals who receive certain types of income during the tax year. Form 1099 Printable allows taxpayers to easily fill out and submit the necessary information to the IRS.

Form 1099 Printable simplifies the process of reporting income such as dividends, interest, self-employment earnings, and more. It provides a convenient way for taxpayers to accurately report their income and ensure compliance with tax laws. By using Form 1099 Printable, individuals and businesses can avoid errors and potential penalties for incorrect reporting.

When using Form 1099 Printable, taxpayers should ensure that they have all the necessary information and documentation related to their income. This includes details such as the payer’s name and address, the amount of income received, and any applicable taxes withheld. By accurately filling out Form 1099 Printable, taxpayers can avoid delays in processing and potential audits by the IRS.

It is important to note that there are different types of Form 1099, each corresponding to specific types of income. For example, Form 1099-DIV is used to report dividends and distributions, while Form 1099-MISC is used for miscellaneous income such as rent payments or royalties. Form 1099 Printable provides easy access to these various forms, making it simple for taxpayers to report their income accurately.

Overall, Form 1099 Printable is a valuable tool for individuals and businesses to report non-wage income to the IRS. By utilizing this printable form, taxpayers can ensure compliance with tax laws and avoid potential penalties for incorrect reporting. Whether you are a freelancer, investor, or small business owner, Form 1099 Printable can help streamline the process of reporting income and meeting your tax obligations.

In conclusion, Form 1099 Printable is an essential tool for accurately reporting various types of income to the IRS. By utilizing this printable form, taxpayers can simplify the process of reporting income and ensure compliance with tax laws. Whether you are an individual or a business, Form 1099 Printable offers a convenient way to fulfill your tax obligations and avoid potential penalties.