As tax season approaches, it’s essential to stay informed about the latest IRS tax forms for the year 2024. The IRS releases updated forms each year to reflect any changes in tax laws and regulations. Having access to printable forms can make filing your taxes easier and more convenient.

Whether you’re an individual taxpayer or a business owner, understanding the different IRS forms is crucial for accurately reporting your income and deductions. By having access to printable forms, you can easily fill them out at your own pace and have a physical copy for your records.

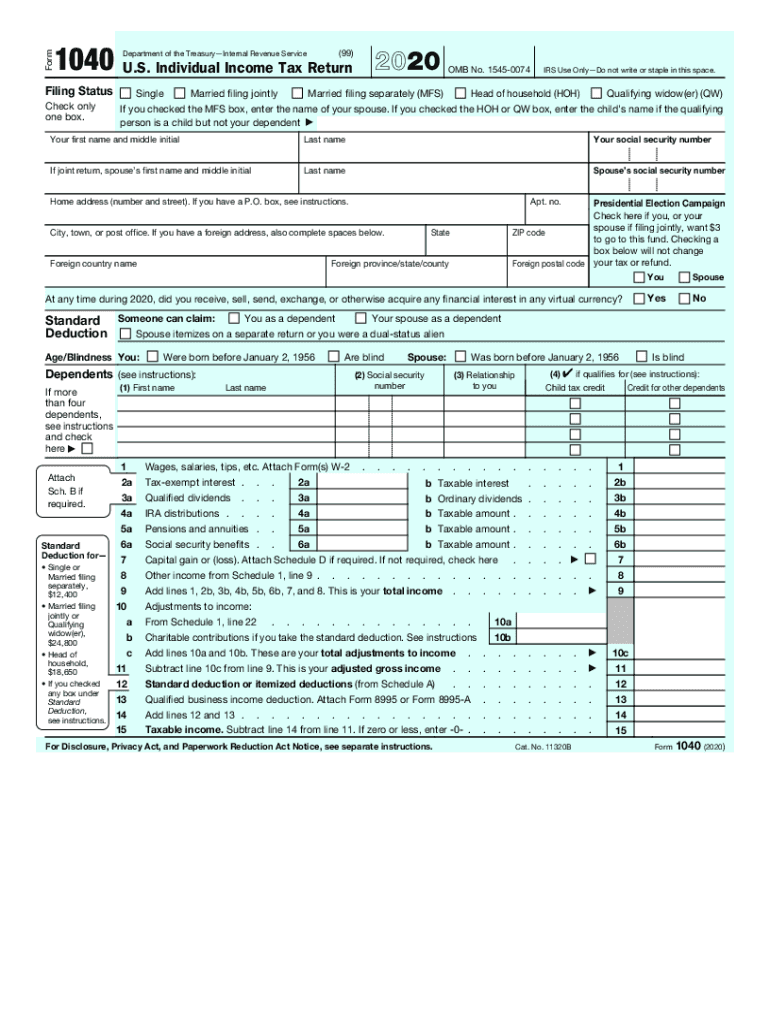

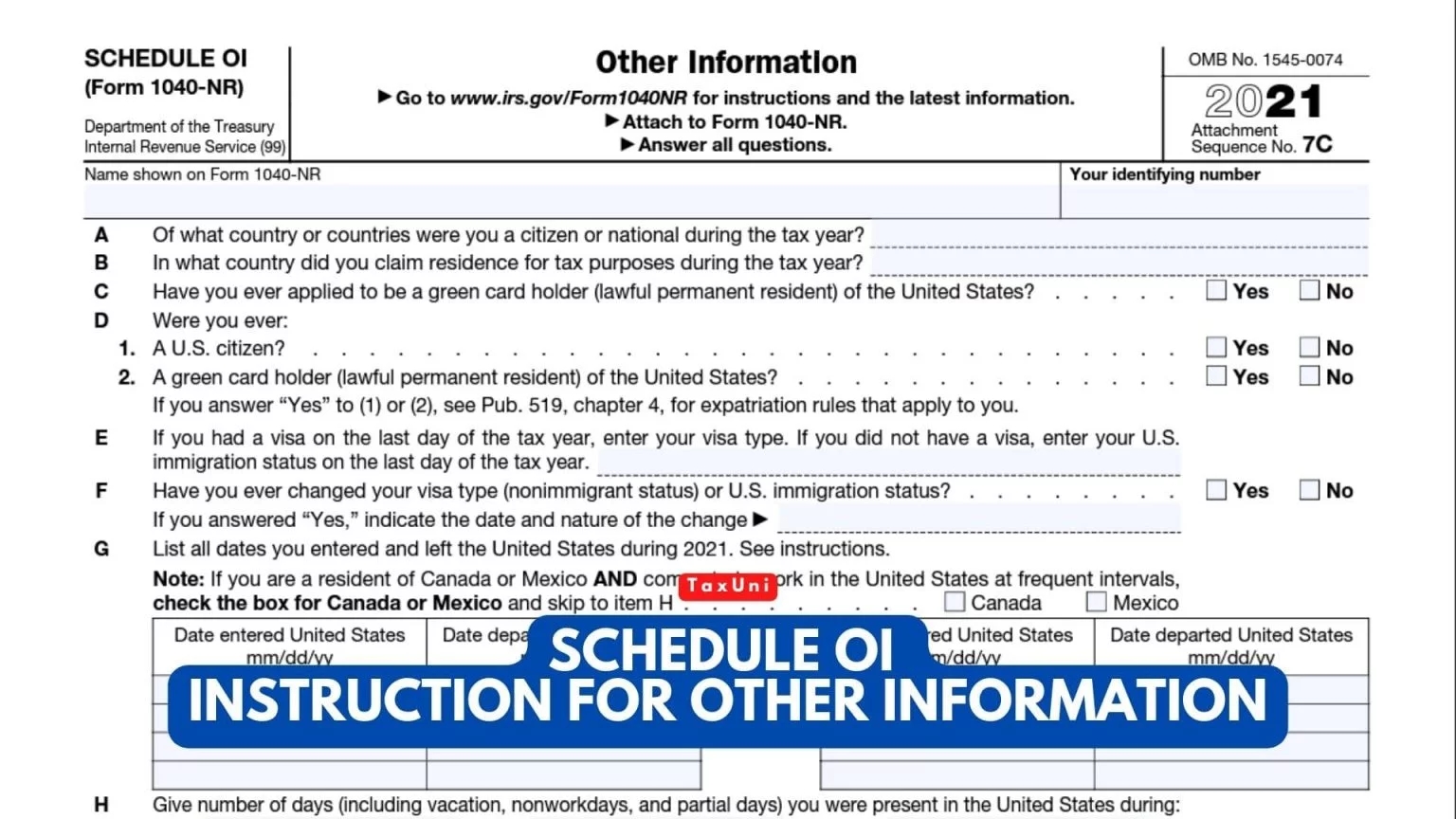

When it comes to IRS tax forms for the year 2024, there are several key forms that you may need to file your taxes. These include Form 1040 for individual income tax returns, Form 1120 for corporate tax returns, and Form 941 for employer’s quarterly federal tax returns. Additionally, there are various schedules and worksheets that may accompany these forms depending on your specific tax situation.

By utilizing printable IRS tax forms, you can ensure that you have all the necessary documentation to accurately report your income and deductions. It’s important to fill out these forms correctly to avoid any potential audits or penalties from the IRS. Having access to printable forms can also save you time and money by allowing you to file your taxes on your own without the need for professional assistance.

Overall, staying informed about IRS tax forms for the year 2024 and utilizing printable forms can make the tax filing process much smoother and more manageable. Be sure to download the necessary forms from the IRS website or obtain physical copies from a local tax office to ensure you have everything you need to file your taxes accurately and on time.

In conclusion, having access to printable IRS tax forms for the year 2024 is essential for individuals and businesses alike. By staying informed about the latest forms and regulations, you can ensure that you are accurately reporting your income and deductions. Utilize printable forms to make the tax filing process easier and more convenient for yourself this tax season.