When tax season rolls around, one of the essential documents you will need is your W-2 form. This form provides information about your earnings and taxes withheld throughout the year. It is crucial for accurately filing your tax return and ensuring you receive any refunds you may be entitled to.

Many employers provide their employees with a physical copy of their W-2 form, but if you need to access it online or print it out for any reason, having a printable version is convenient.

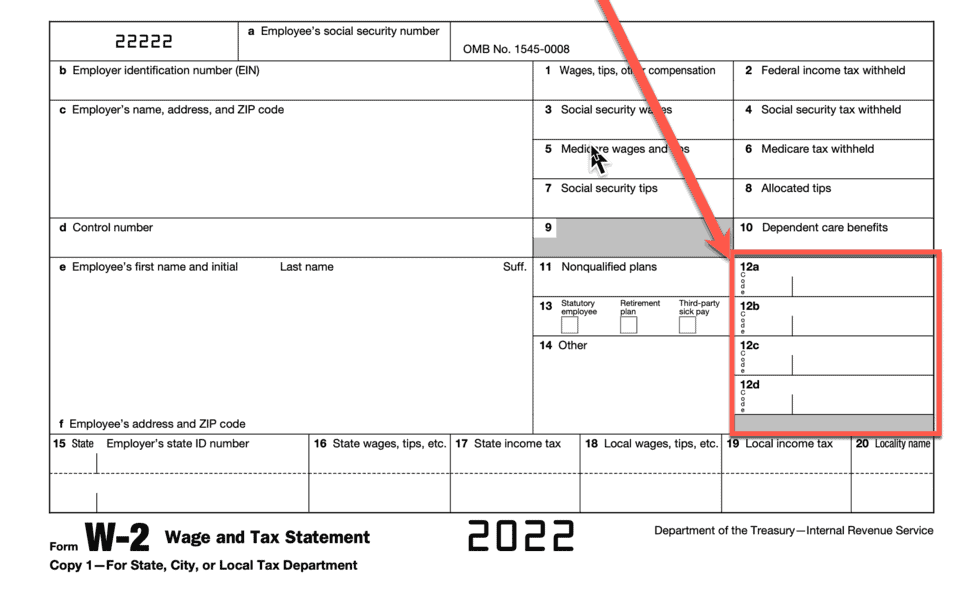

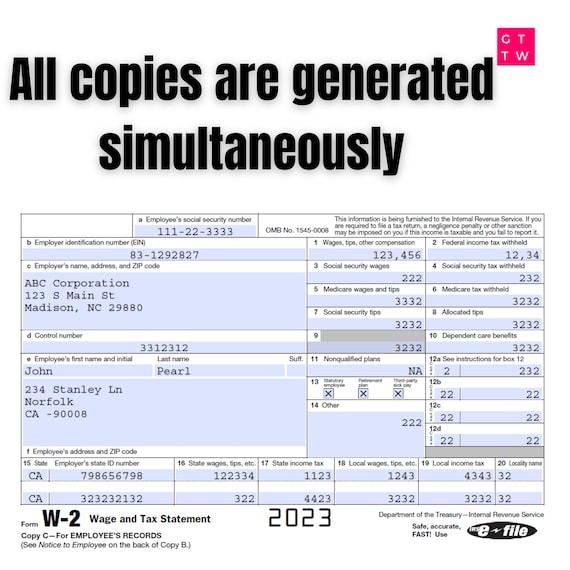

There are several websites and tools available that offer printable W-2 forms for free. These forms typically come in a standard format that is accepted by the IRS. You can easily fill in your information and use it for your tax filing purposes.

It’s important to ensure that the information on your W-2 form is accurate and matches your records. Any discrepancies could lead to delays in processing your tax return or even trigger an audit. Double-check all the numbers and figures before submitting your taxes.

Once you have completed your tax return using the information from your W-2 form, make sure to keep a copy of both documents for your records. It’s always a good idea to have a backup in case you need to refer back to them in the future.

Overall, having access to a printable W-2 form can make the tax-filing process much more manageable and convenient. Make sure to take advantage of this resource if you need to print out a copy of your form for any reason.