When it comes to tax season, one of the most important forms you may encounter is the W-9 Printable Form. This form is used by businesses to collect information from independent contractors, freelancers, and other non-employee workers. It is essential for ensuring that the business has accurate information for tax reporting purposes.

By filling out a W-9 form, the individual provides their name, address, and taxpayer identification number (TIN) to the business. This information is used to report payments made to the individual to the IRS. It is crucial for both the business and the individual to ensure that the information provided on the form is accurate to avoid any potential tax issues down the road.

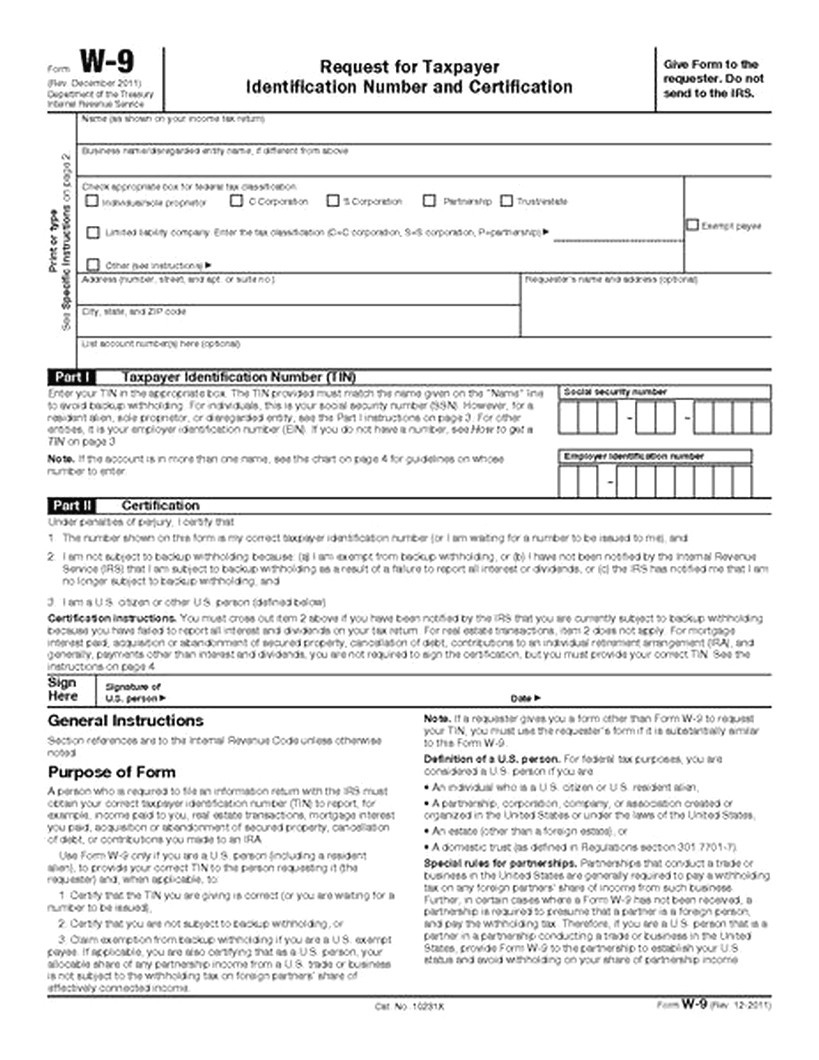

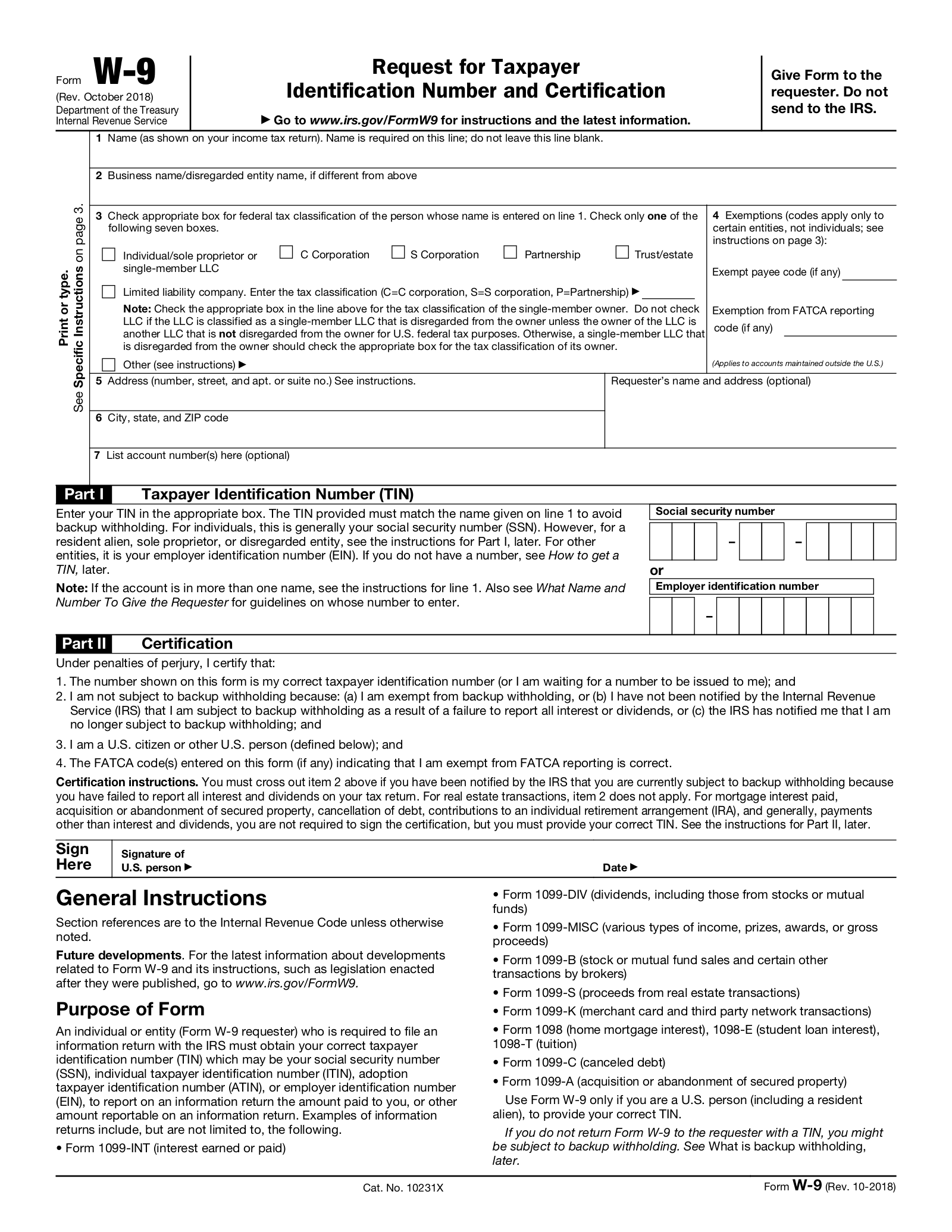

W-9 Printable Form

The W-9 form is a simple one-page document that can be easily downloaded and printed from the IRS website. It includes fields for the individual’s name, address, TIN, and signature. Once the form is completed, it can be submitted to the business that is requesting the information.

It is important to note that the information provided on the W-9 form is confidential and should only be used for tax reporting purposes. It is not a form that is submitted to the IRS directly, but rather kept on file by the business that requested it. The IRS may request a copy of the form in the event of an audit, so it is important to keep a copy for your records.

Overall, the W-9 Printable Form is a crucial document for both businesses and independent contractors. It helps ensure that accurate information is reported to the IRS, which is essential for complying with tax laws. By understanding the purpose of the form and completing it accurately, you can help prevent any potential tax issues in the future.

So, the next time you are asked to fill out a W-9 form, make sure to do so promptly and accurately. It is a simple step that can save you a lot of headaches come tax time.