As tax season approaches, it’s essential to have all the necessary forms ready to file your federal taxes. One of the most important steps in completing your taxes is ensuring you have the correct forms to accurately report your income and deductions. With the availability of printable federal tax forms for 2023, you can easily access and fill out the necessary paperwork from the comfort of your own home.

By using printable federal tax forms, you can save time and money by avoiding the need to visit a tax professional or purchase expensive software. These forms are readily available online and can be easily downloaded and printed for your convenience. Whether you are a W-2 employee, self-employed individual, or small business owner, having access to printable tax forms can streamline the filing process and ensure you meet all necessary deadlines.

Federal Tax Forms 2023 Printable

Federal Tax Forms 2023 Printable

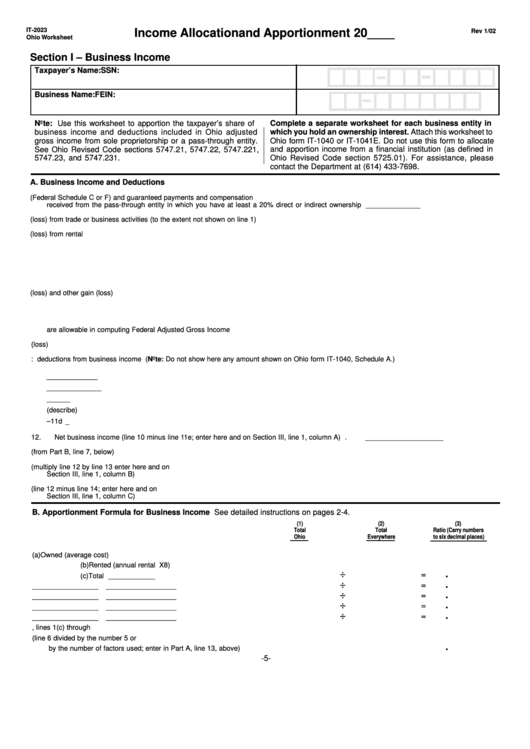

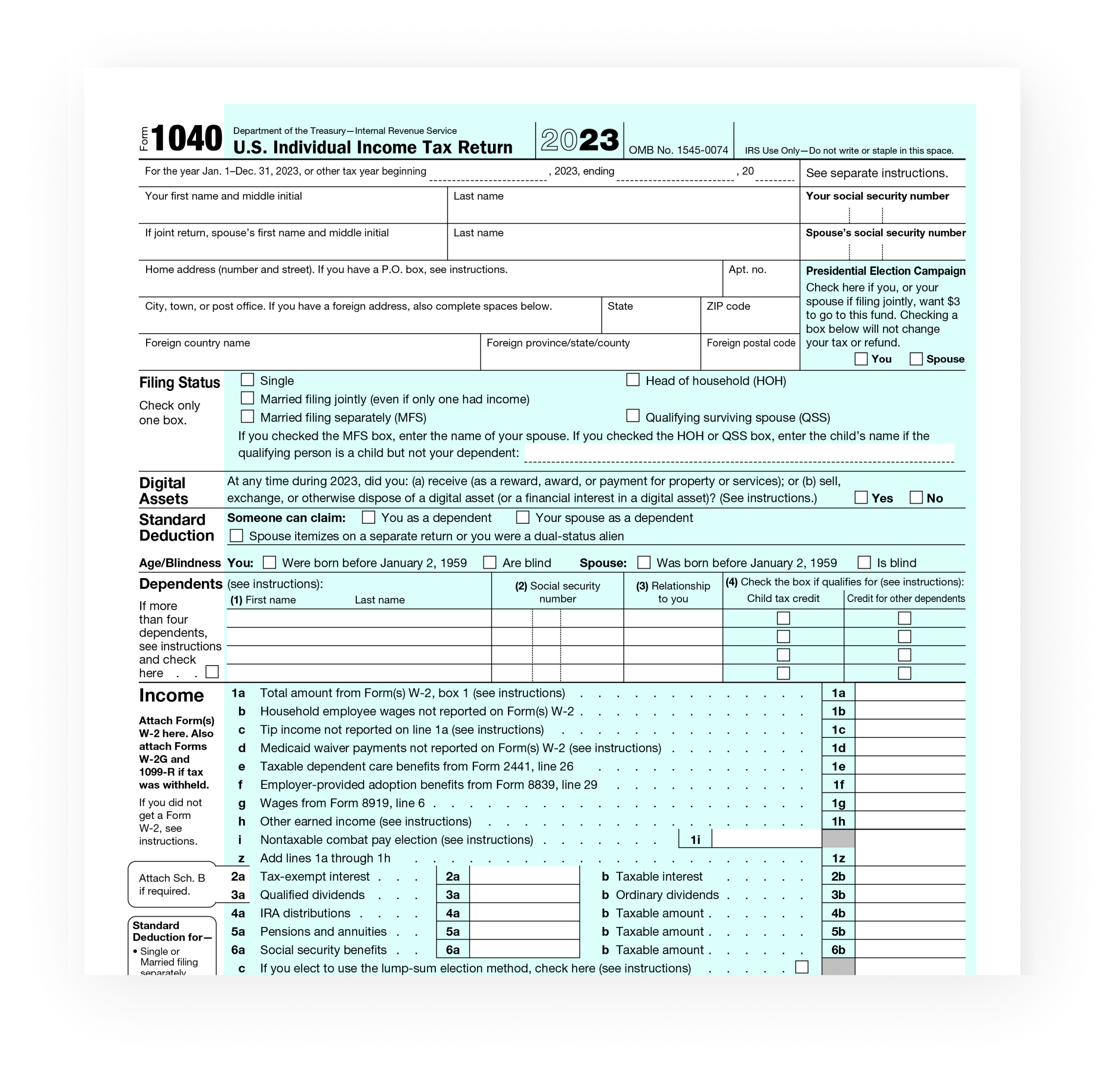

When downloading and printing federal tax forms for 2023, it’s important to ensure you have the most up-to-date versions to avoid any errors or delays in processing your return. The IRS website is a reliable source for accessing printable tax forms, including Form 1040 for individual tax filers, Form 1099 for reporting various types of income, and Form 941 for employers to report payroll taxes. By carefully reviewing and completing these forms, you can accurately report your financial information and maximize your potential tax refund.

In addition to federal tax forms for individuals and businesses, there are also printable forms available for specific deductions and credits, such as the Earned Income Tax Credit (EITC) and Child Tax Credit. By utilizing these forms, you can ensure you are claiming all eligible tax benefits and reducing your overall tax liability. Whether you are a first-time filer or a seasoned taxpayer, having access to printable federal tax forms can simplify the filing process and help you navigate the complexities of the tax code.

Overall, printable federal tax forms for 2023 offer a convenient and cost-effective solution for individuals and businesses to complete their taxes accurately and on time. By taking advantage of these resources, you can avoid common pitfalls and ensure you are in compliance with federal tax laws. So don’t wait until the last minute – start gathering your documents and download the necessary forms today to make this tax season a smooth and stress-free experience.