In the world of taxation and financial transactions, the W9 form holds significant importance. It is a document that businesses use to collect information from independent contractors, freelancers, and vendors they hire. This form is essential for reporting to the Internal Revenue Service (IRS) and ensuring compliance with tax regulations.

Whether you are a business owner or an individual contractor, understanding the purpose and use of the W9 form is crucial. It helps in facilitating smooth transactions, reporting income accurately, and avoiding any potential legal issues related to tax compliance.

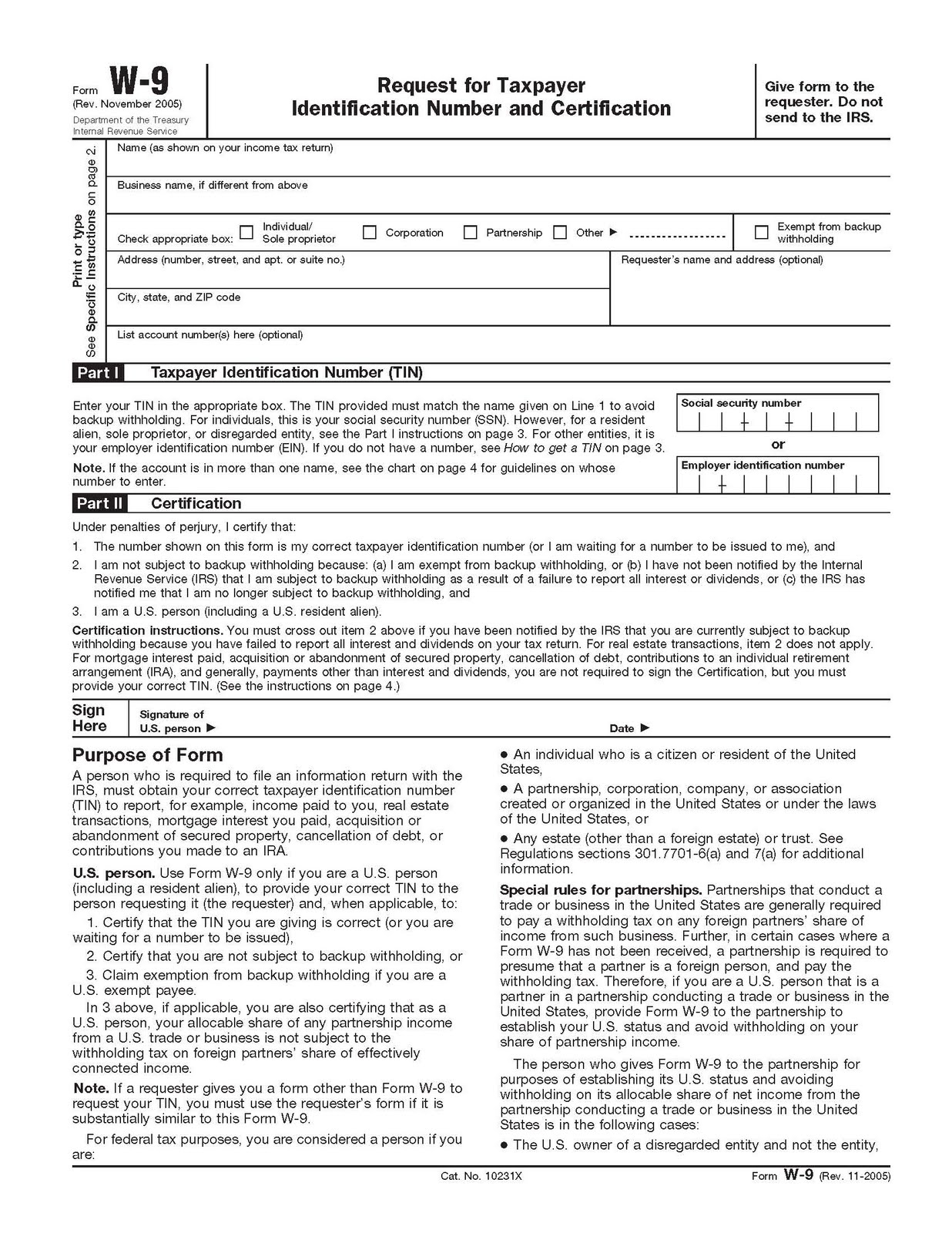

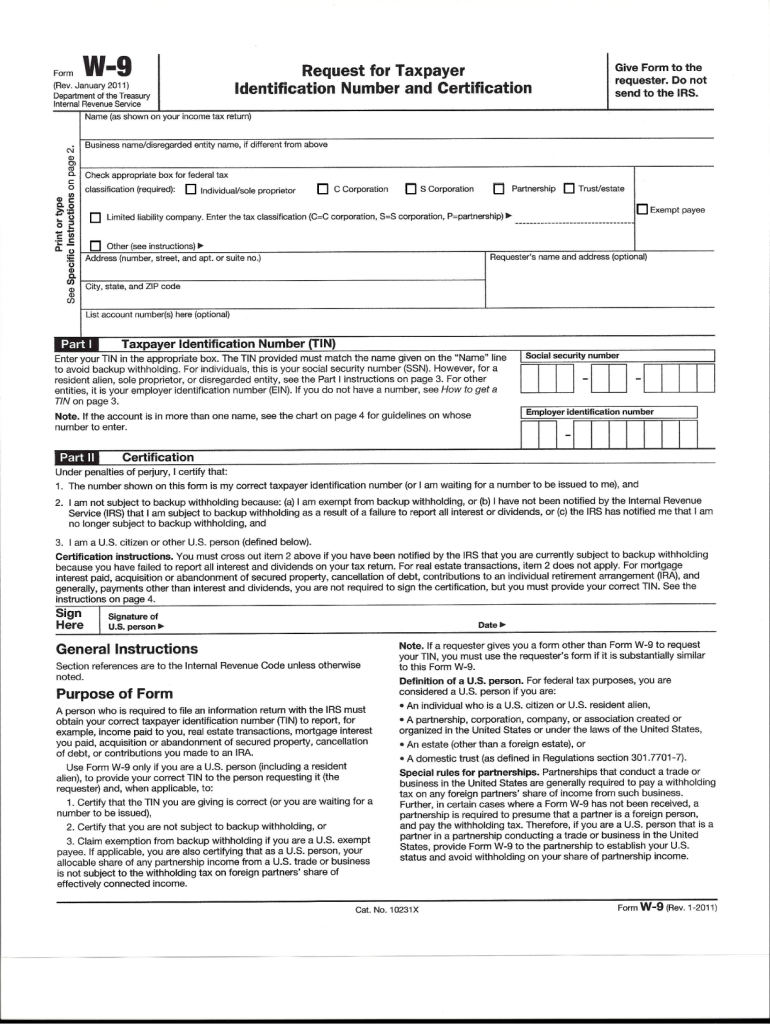

W9 Printable Form

The W9 form is a standardized document created by the IRS for businesses to gather essential information from individuals or entities they plan to pay for services rendered. This form includes details such as the recipient’s name, address, taxpayer identification number (TIN), and certification of tax status. By completing and submitting a W9 form, the recipient provides their consent for tax reporting purposes.

It is essential for businesses to have a W9 form on file for each independent contractor or vendor they work with. This document helps in accurately reporting payments made to these individuals or entities, and it ensures that the business complies with tax laws and regulations. Failing to collect and retain W9 forms can result in penalties and legal consequences for businesses.

For individuals or entities required to fill out a W9 form, it is important to provide accurate and up-to-date information. Any discrepancies or errors in the information provided can lead to delays in payments, issues with tax reporting, and potential audits by the IRS. It is advisable to review the completed W9 form carefully before submitting it to the business requesting the information.

Overall, the W9 printable form plays a crucial role in ensuring transparency, compliance, and accuracy in financial transactions between businesses and independent contractors or vendors. By understanding the purpose and importance of this document, both parties can establish a smooth and efficient working relationship while adhering to tax regulations.

So, whether you are a business owner or a contractor, make sure to familiarize yourself with the W9 form and its requirements to avoid any potential issues in the future.