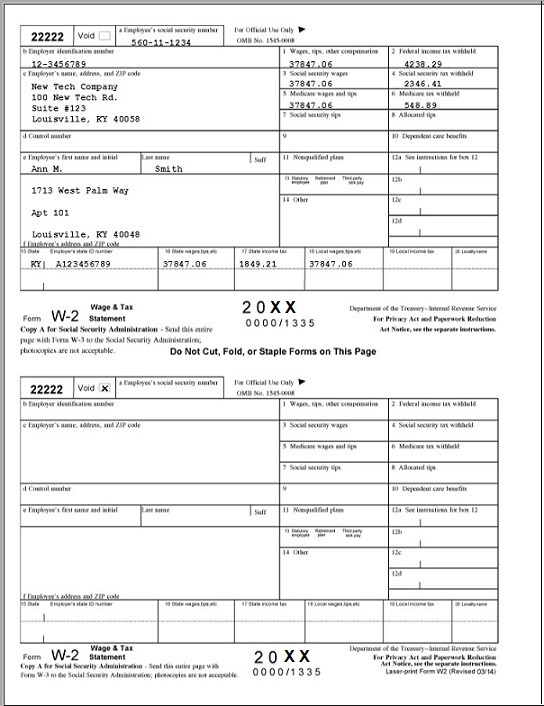

When tax season rolls around, one of the most important documents you’ll need is your Form W-2. This form provides information about your wages and taxes withheld by your employer, which is essential for filing your tax return. While many employers now provide electronic copies of Form W-2, having a printable version on hand can be useful for various purposes.

Printable Form W-2 allows you to have a hard copy of your tax information that you can easily reference or share with tax professionals. It also serves as a backup in case you encounter any issues with accessing the electronic version. Having a physical copy can provide peace of mind knowing that you have all the necessary information at your fingertips.

Printable Form W-2

Obtaining a printable Form W-2 is relatively simple. Many employers provide employees with access to their W-2 forms through online portals. Once you log in to your account, you can typically find an option to download and print your Form W-2. If you’re unable to access it online, you can contact your employer’s human resources department to request a physical copy.

It’s important to note that the IRS requires employers to provide employees with their Form W-2 by January 31st each year. If you haven’t received your W-2 by this date, be sure to follow up with your employer to ensure you receive it in a timely manner. You’ll need this form to accurately report your income and taxes when filing your tax return.

Once you have your printable Form W-2 in hand, be sure to review it carefully for accuracy. Check that your personal information, such as your name and Social Security number, is correct. Verify that your wages, taxes withheld, and other pertinent information are also accurate. If you notice any discrepancies, notify your employer immediately to have them corrected.

In conclusion, having a printable Form W-2 is essential for ensuring accurate tax reporting and compliance. By having a hard copy of this important document, you can easily reference it when needed and provide it to tax professionals if necessary. Be proactive in obtaining your Form W-2 and verifying its accuracy to avoid any issues come tax time.