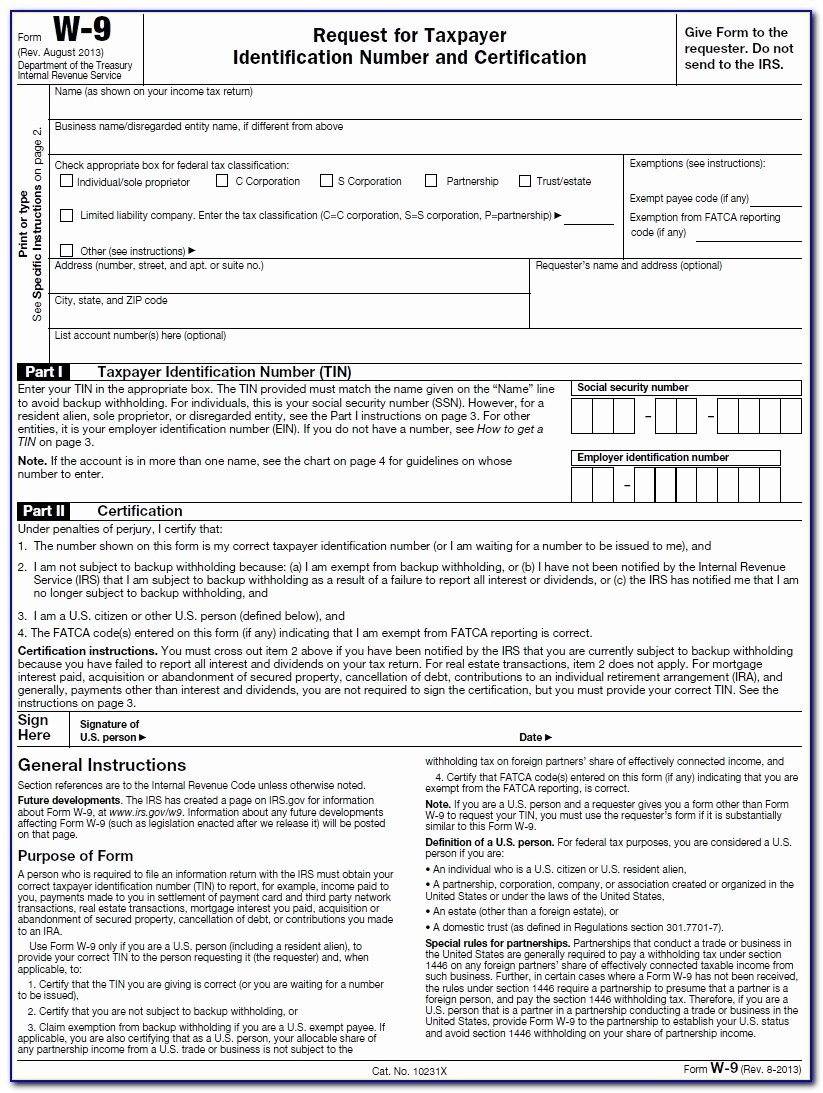

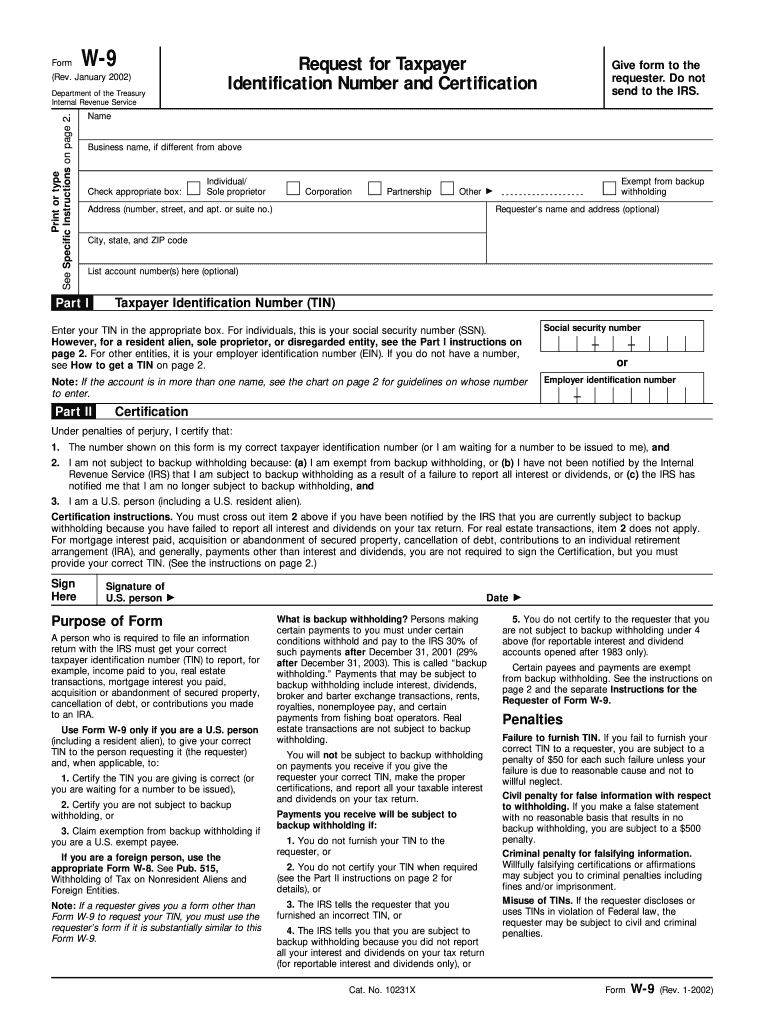

IRS Form W-9 is a document used by businesses to request taxpayer identification information from individuals, freelancers, independent contractors, and vendors. This form is essential for companies to accurately report payments made to these individuals for tax purposes.

Form W-9 is used to collect the taxpayer’s name, address, and taxpayer identification number (TIN) or Social Security number (SSN). It is important for businesses to have a completed W-9 form on file for each individual or entity they make payments to.

When a company needs to request this information, they can provide the individual with a printable version of Form W-9. This allows the individual to easily fill out the form and return it to the company for their records.

Form W-9 is typically used for various purposes, including reporting income paid to independent contractors, reporting interest income, and reporting mortgage interest payments. It is important for both the payer and the payee to accurately complete this form to ensure proper tax reporting.

Businesses can download a printable version of IRS Form W-9 from the official IRS website or various online tax resources. Once the form is completed, it should be kept on file by the business for at least four years, as the IRS may request to review it during an audit.

Overall, IRS Form W-9 is a crucial document for businesses to collect taxpayer information from individuals and entities they make payments to. By providing a printable version of this form, companies can streamline the process of gathering necessary information for tax reporting purposes.