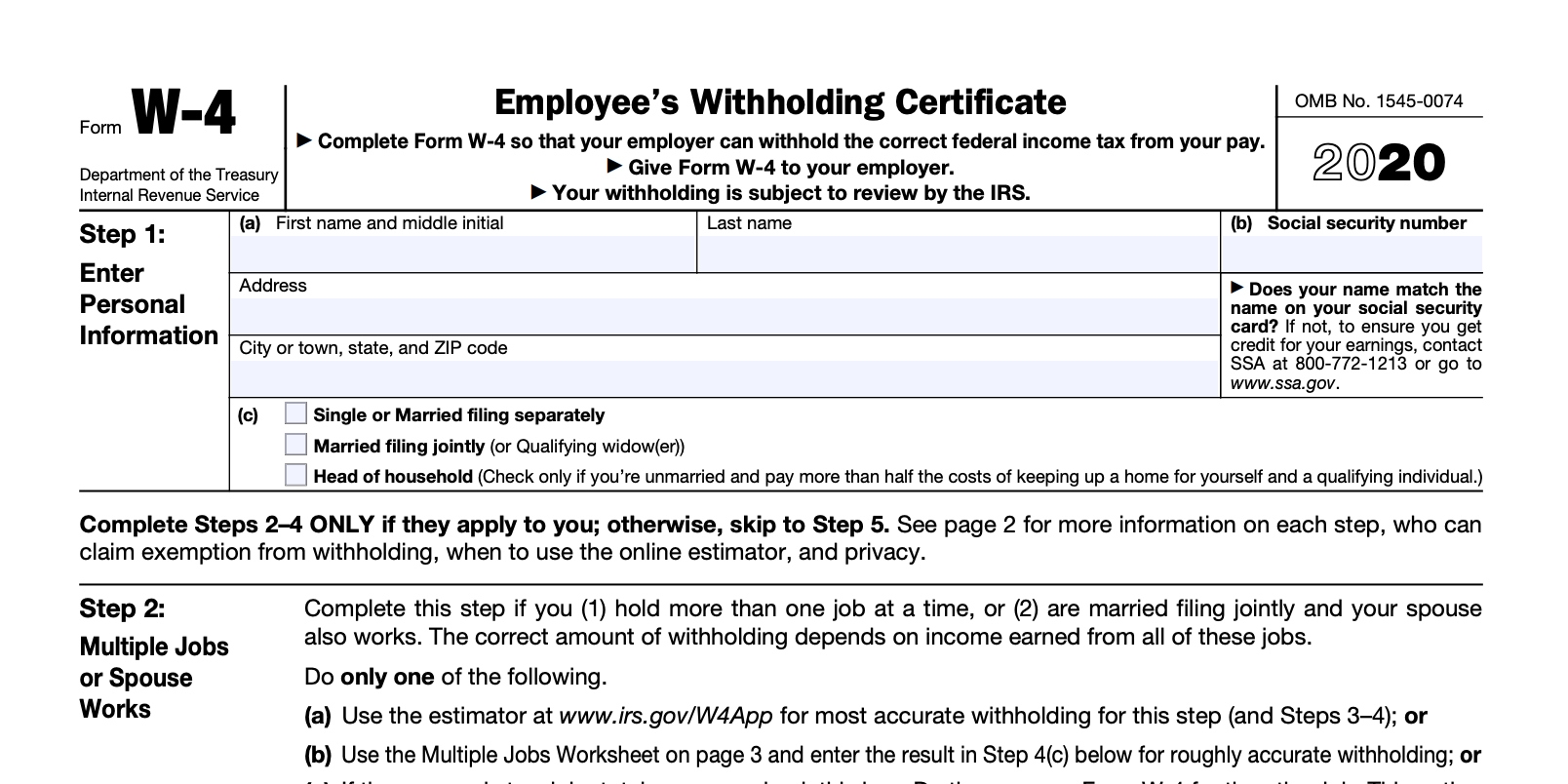

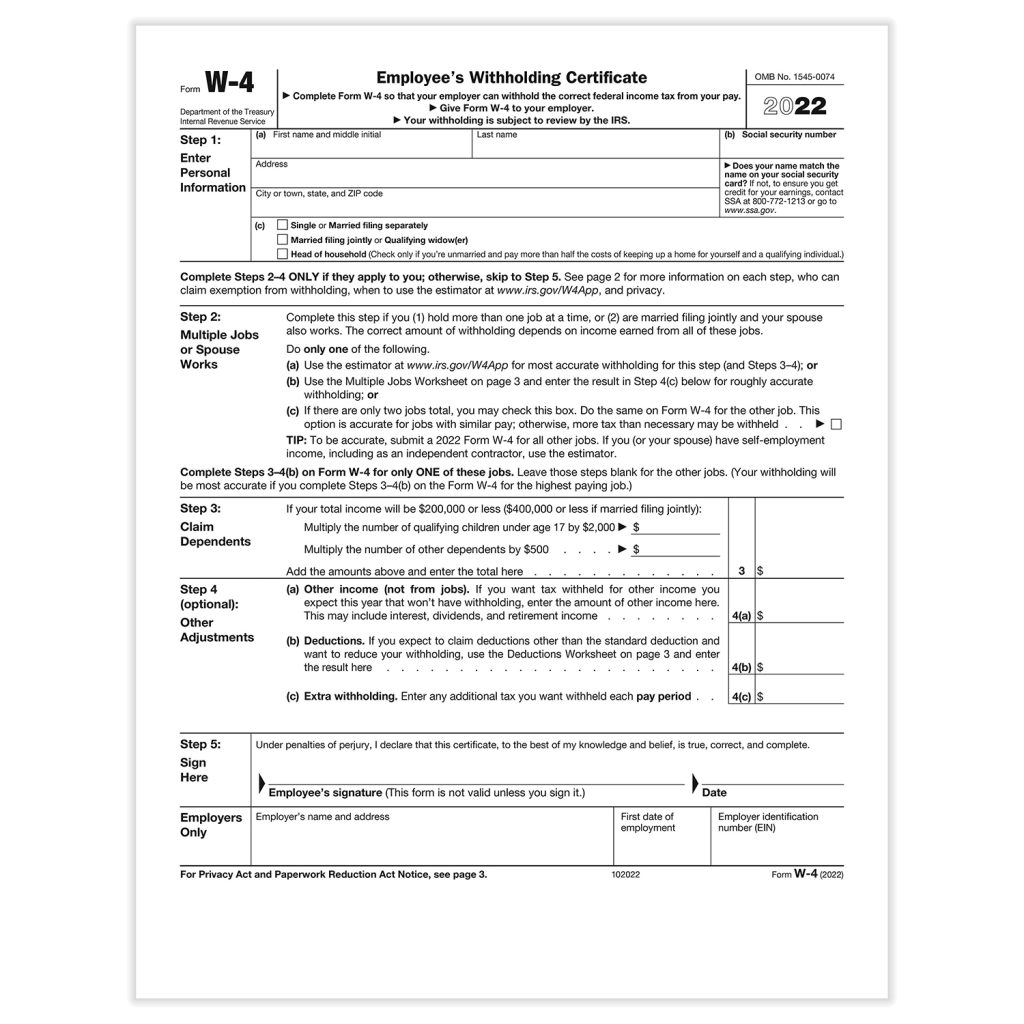

When starting a new job, one of the first things you will need to do is fill out a W4 form. This form is essential for determining how much federal income tax should be withheld from your pay. It is important to fill out this form correctly to avoid any potential issues with your taxes in the future.

Many employers provide their employees with a W4 form that they can fill out electronically. However, if you prefer to fill out a physical copy of the form, you can easily find a W4 form printable online. This allows you to fill out the form at your own pace and have a physical copy for your records.

W4 Form Printable

When searching for a W4 form printable, make sure to look for the most up-to-date version of the form. The IRS regularly updates the W4 form to reflect changes in tax laws and regulations, so it is important to use the most current form available. Once you have found the correct form, simply download and print it out.

When filling out the W4 form, be sure to provide accurate information about your filing status, number of dependents, and any additional income you expect to receive. This will help ensure that the correct amount of federal income tax is withheld from your pay. Once you have completed the form, you can submit it to your employer for processing.

Remember, it is important to review and update your W4 form regularly, especially if you experience any major life changes such as getting married, having children, or changing jobs. By keeping your W4 form up to date, you can avoid any surprises when it comes time to file your taxes.

In conclusion, having access to a W4 form printable can make the process of filling out this important tax form much easier. By taking the time to accurately complete your W4 form, you can ensure that the correct amount of federal income tax is withheld from your pay, helping you avoid any potential issues with your taxes in the future.