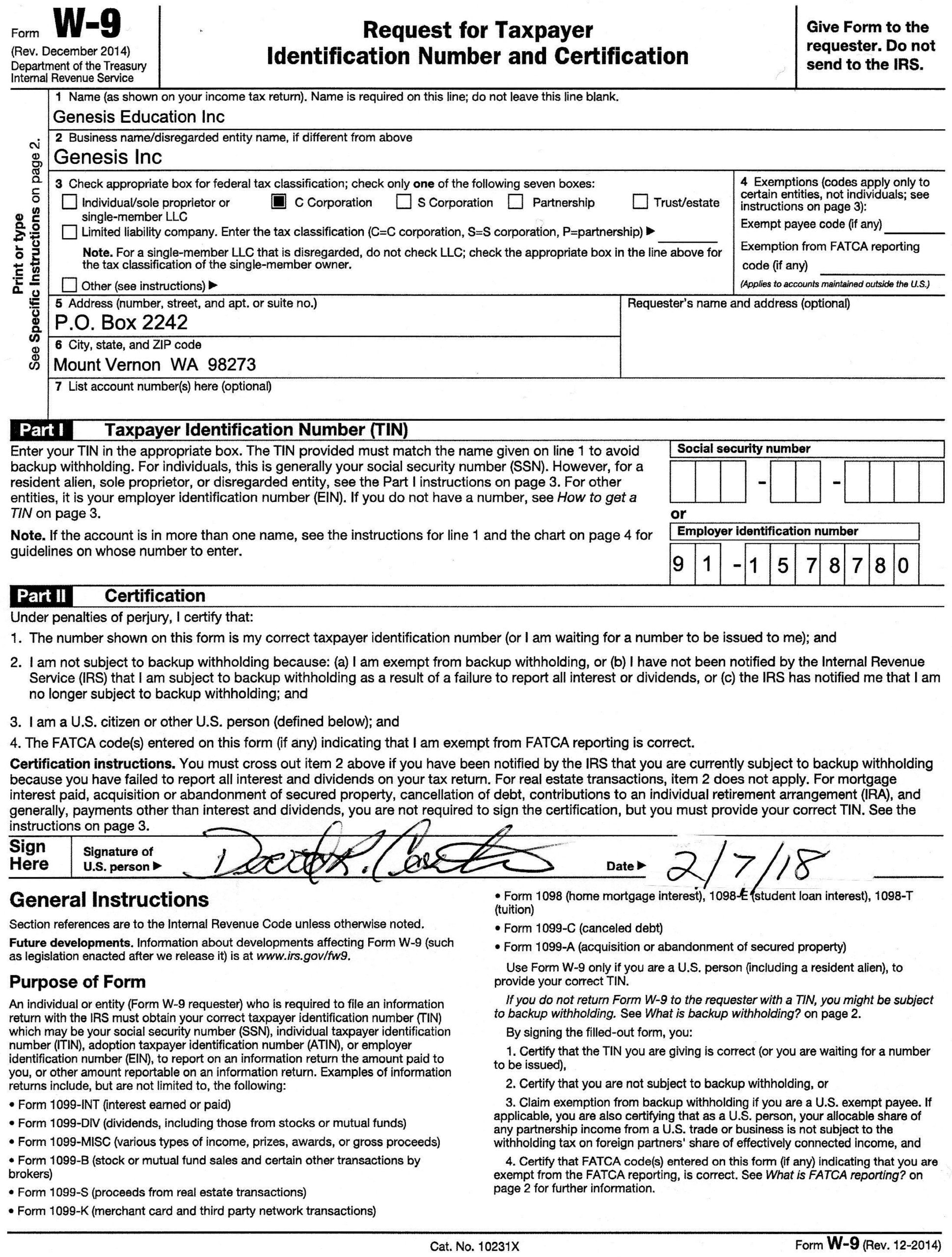

When it comes to tax season, filling out forms can be a daunting task. One of the most common forms that individuals and businesses need to complete is the W-9 form. This form is used to request taxpayer identification numbers (TINs) from individuals or entities that are earning income.

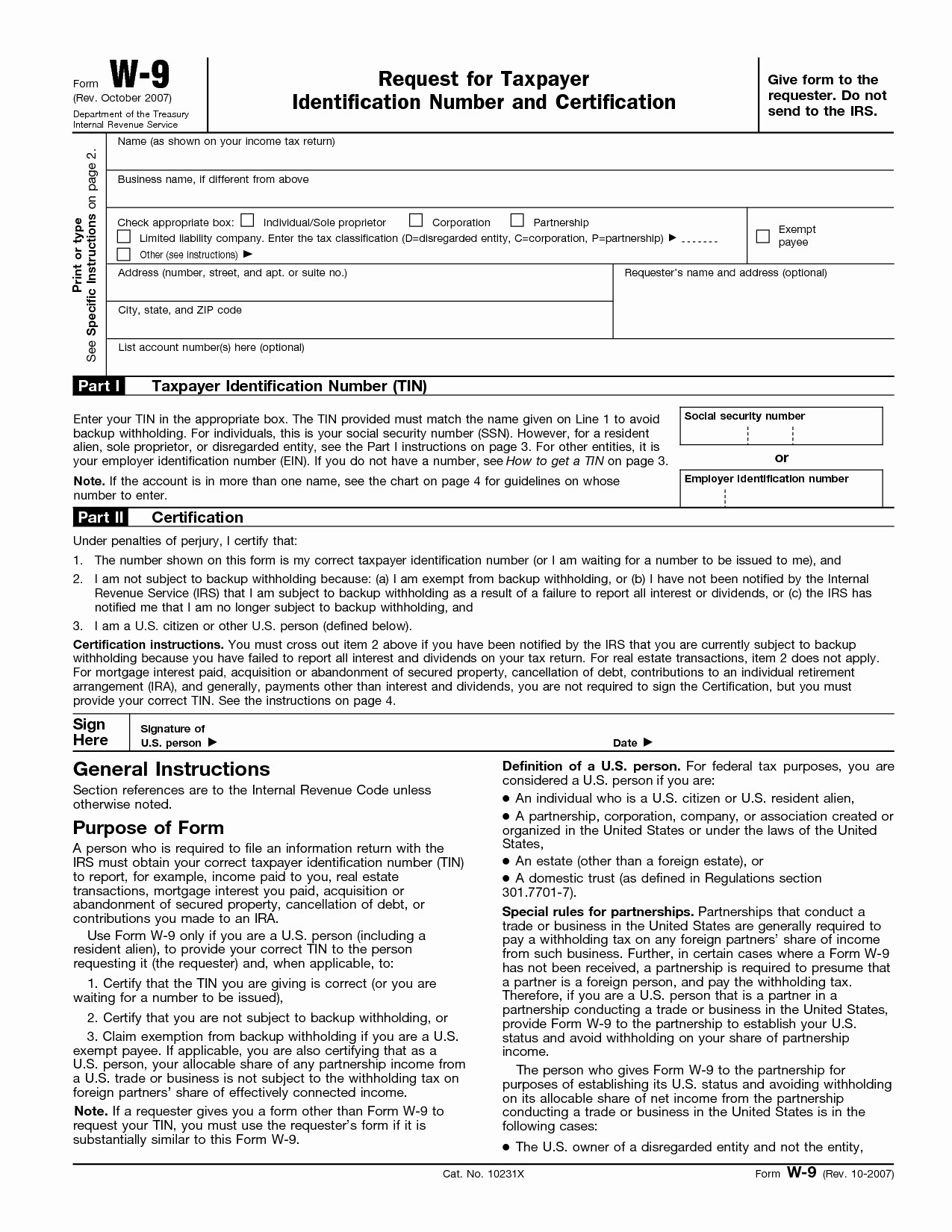

Having a printable version of the W-9 form can make the process much easier. It allows you to fill out the form at your own pace and ensure that all the necessary information is accurate before submitting it to the appropriate parties.

It is important to note that the W-9 form is not submitted to the IRS, but rather to the entity that is requesting your taxpayer information. This form is used for various purposes such as reporting income, withholding taxes, and verifying taxpayer information.

When filling out the W-9 form, you will need to provide basic information such as your name, address, and taxpayer identification number. It is crucial to ensure that all the information provided is correct to avoid any potential issues down the line.

Having a printable W-9 form on hand can also be useful for keeping track of your income and tax-related documents. By having a physical copy of the form, you can easily refer back to it when needed and maintain organized records for your financial matters.

Overall, having access to a printable W-9 form can simplify the process of providing taxpayer information to the necessary parties. It allows you to fill out the form accurately and efficiently, ensuring that your tax-related obligations are met in a timely manner.