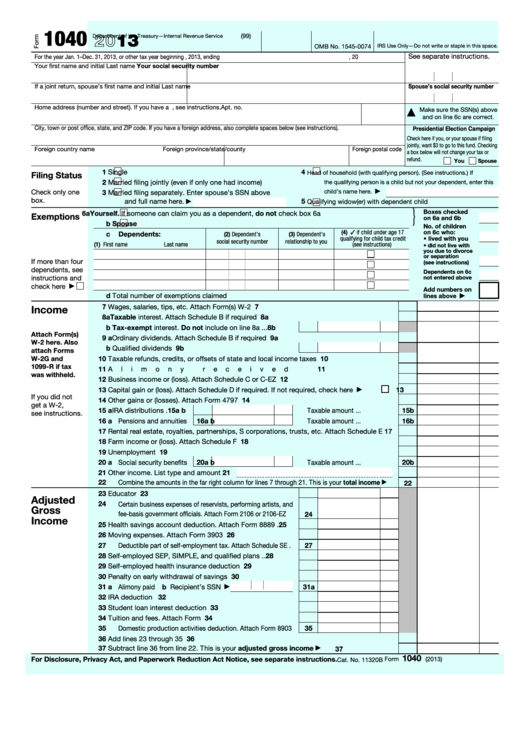

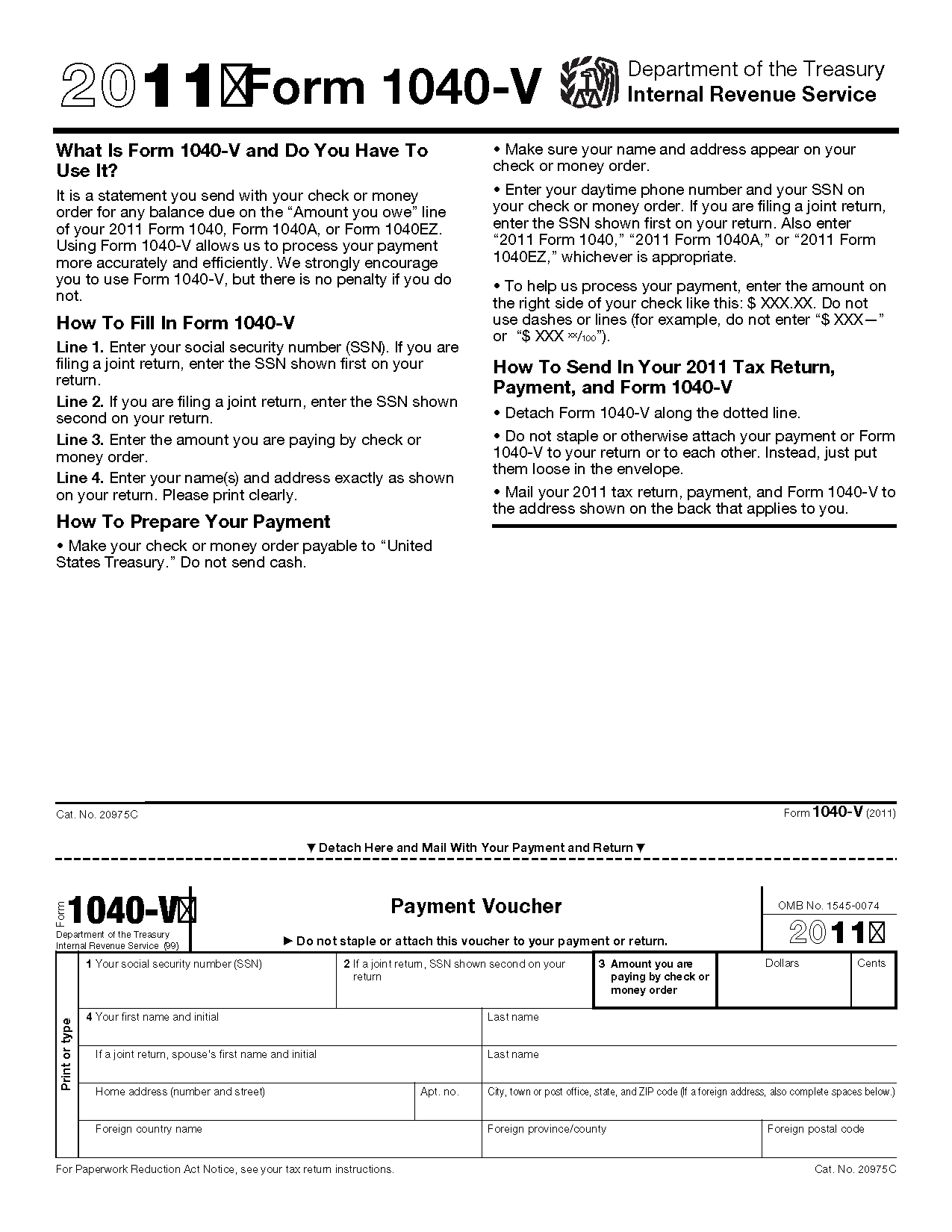

As tax season approaches, many individuals are looking for ways to easily file their taxes. One popular option is using Tax Form 1040 Printable. This form is widely used by taxpayers to report their income, deductions, and credits to the IRS. It is essential for accurately filing taxes and ensuring compliance with tax laws.

With Tax Form 1040 Printable, taxpayers can easily access and download the form online. This printable version allows individuals to fill out the necessary information at their own pace and convenience. It provides a straightforward way to report income and deductions, making the tax filing process more manageable for taxpayers.

When using Tax Form 1040 Printable, taxpayers must carefully review their income sources, deductions, and credits to ensure accuracy. Any errors or omissions on the form can lead to delays in processing or potential audits by the IRS. It is crucial to double-check all information before submitting the form to avoid any issues with tax filing.

Additionally, taxpayers can use Tax Form 1040 Printable to claim various credits and deductions that may lower their tax liability. This includes credits for education expenses, child and dependent care, and retirement savings. By taking advantage of these credits, individuals can potentially reduce the amount of taxes they owe or increase their tax refund.

In conclusion, Tax Form 1040 Printable is a valuable tool for taxpayers to accurately report their income, deductions, and credits to the IRS. By utilizing this printable form, individuals can easily file their taxes and ensure compliance with tax laws. It is essential to carefully review all information before submitting the form to avoid any potential issues with tax filing. Overall, Tax Form 1040 Printable simplifies the tax filing process for taxpayers and helps them navigate the complexities of the tax system.