When it comes to filing taxes as a business owner or independent contractor, the 1099-NEC form is an essential document to have. This form is used to report nonemployee compensation paid to individuals or vendors during the tax year. It is important to accurately fill out this form to avoid any penalties or fines from the IRS.

One of the key benefits of the 1099-NEC printable form is that it allows you to easily report nonemployee compensation without the need for specialized software or online tools. You can simply download the form from the IRS website, fill it out manually, and then submit it along with your tax return.

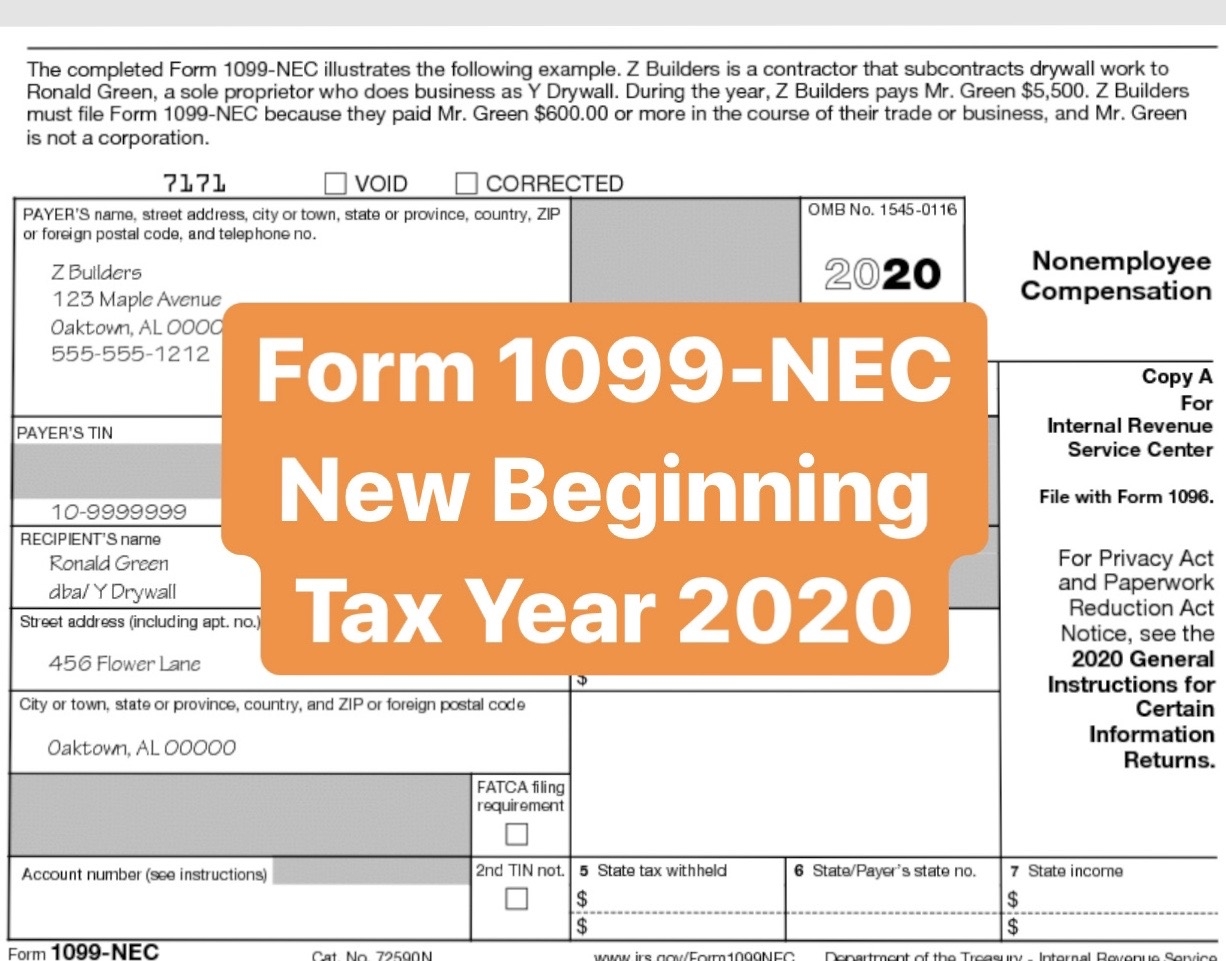

When filling out the 1099-NEC form, you will need to provide information such as the recipient’s name, address, and taxpayer identification number (TIN). You will also need to report the total amount of nonemployee compensation paid to the recipient during the tax year. Once the form is completed, you can either mail it to the recipient or file it electronically with the IRS.

It is important to note that the deadline for filing the 1099-NEC form is January 31st of each year. Failure to file the form on time or inaccurately reporting nonemployee compensation can result in penalties from the IRS. By using the 1099-NEC printable form, you can ensure that you are meeting your tax obligations and avoiding any potential issues with the IRS.

In conclusion, the 1099-NEC printable form is a valuable tool for businesses and independent contractors to report nonemployee compensation accurately and efficiently. By using this form, you can streamline the tax filing process and avoid any potential penalties from the IRS. Make sure to download the form from the IRS website and fill it out carefully to stay compliant with tax laws.