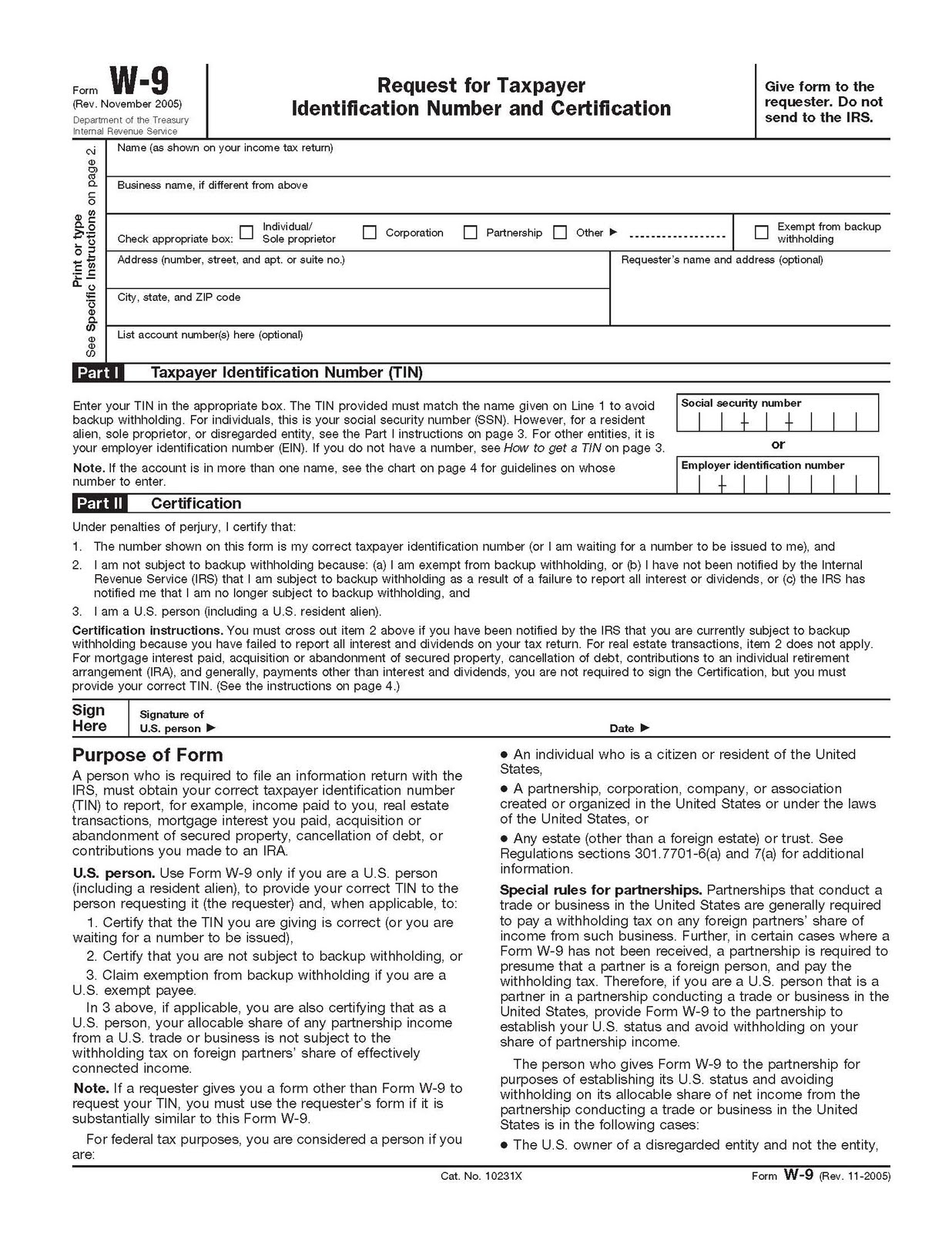

Form W-9 is a document that is used in the United States for tax purposes. It is used by businesses to request the taxpayer identification number (TIN) of a person or entity. The form is also used by freelancers and independent contractors who need to provide their TIN to clients. Form W-9 is important for reporting income and ensuring that taxes are properly withheld.

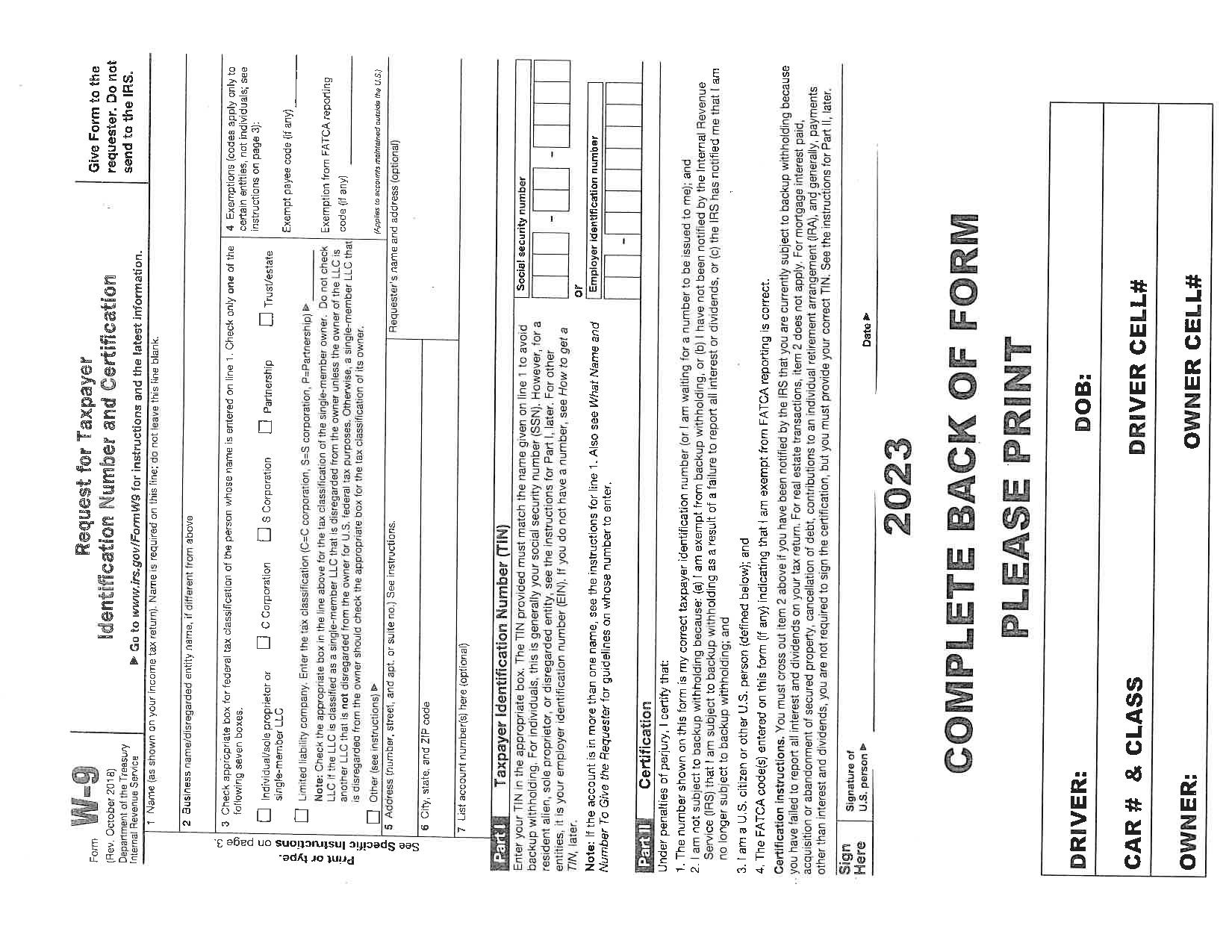

One of the convenient ways to obtain Form W-9 is through the printable version available online. This allows individuals to easily access the form, fill it out, and submit it as needed. The printable version of Form W-9 can be found on the official website of the Internal Revenue Service (IRS) or through various other tax preparation websites.

When filling out Form W-9, individuals will need to provide their name, address, and TIN. They will also need to certify that the TIN provided is correct and that they are not subject to backup withholding. Once the form is completed, it can be submitted to the requesting party either electronically or by mail.

It is important for individuals to keep a copy of Form W-9 for their records. This will help ensure that they have documentation of the information provided in case it is needed for tax purposes in the future. Additionally, individuals should be aware of any deadlines for submitting the form to avoid any potential penalties or issues with reporting income.

Overall, Form W-9 is a crucial document for tax compliance in the United States. By utilizing the printable version of the form, individuals can easily provide their TIN to businesses and clients as needed. It is important to accurately complete the form and keep a copy for personal records to ensure proper tax reporting.

In conclusion, Form W-9 Printable is a valuable resource for individuals and businesses alike. By obtaining and completing the form when necessary, individuals can ensure that their tax information is accurately reported and that they are in compliance with IRS regulations. Utilizing the printable version of Form W-9 makes the process simple and convenient for all parties involved.