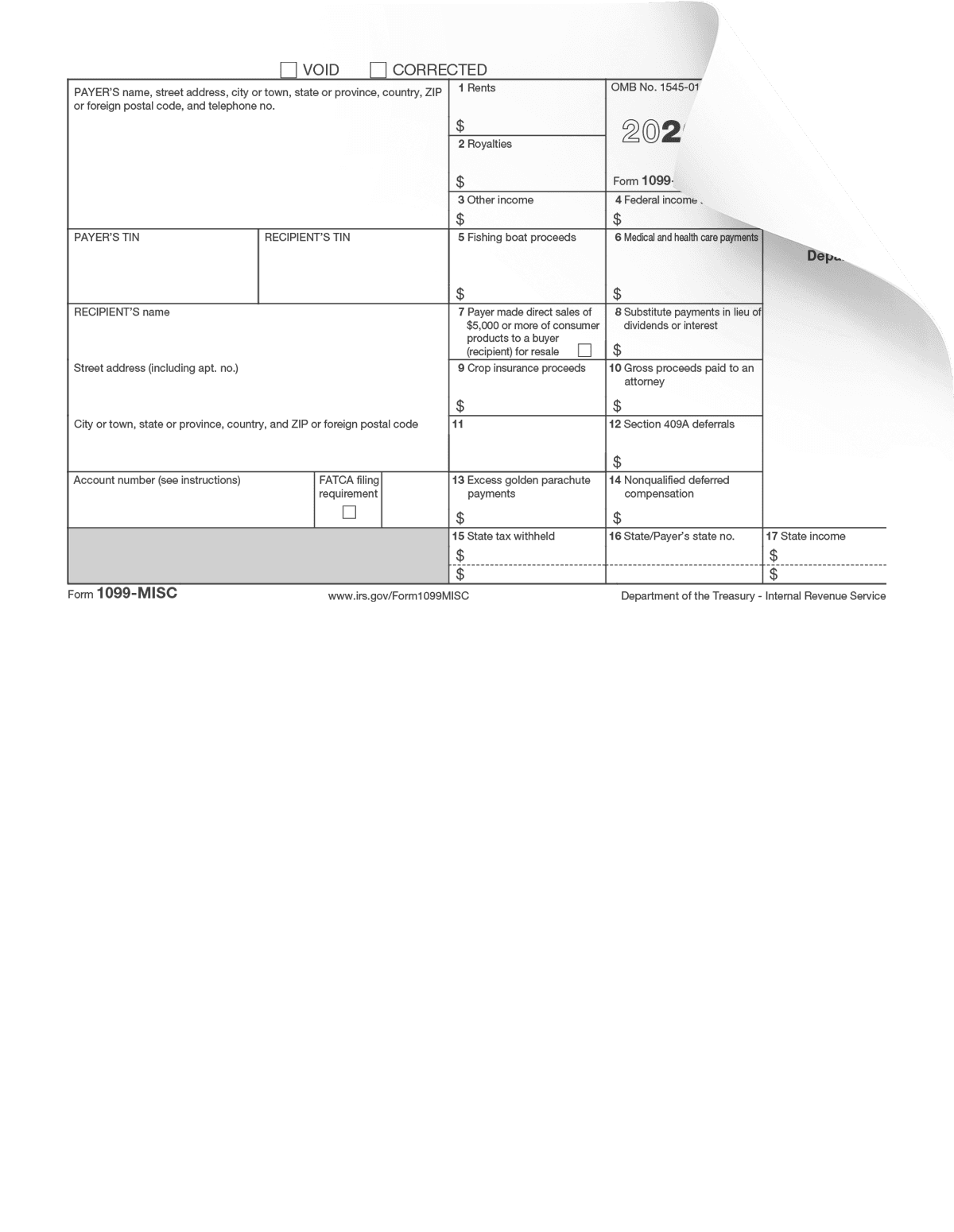

As an independent contractor, it is important to stay organized and keep track of your income for tax purposes. One essential document you will need is the 1099 form, which is used to report income received as a contractor. This form is crucial for accurately reporting your earnings to the IRS and ensuring you are compliant with tax laws.

While some companies may provide you with a 1099 form at the end of the year, it is always a good idea to have a printable version on hand. This way, you can easily fill it out as needed and keep track of your earnings throughout the year. Having a printable 1099 form can save you time and hassle when it comes time to file your taxes.

Printable 1099 Form Independent Contractor

Printable 1099 Form Independent Contractor

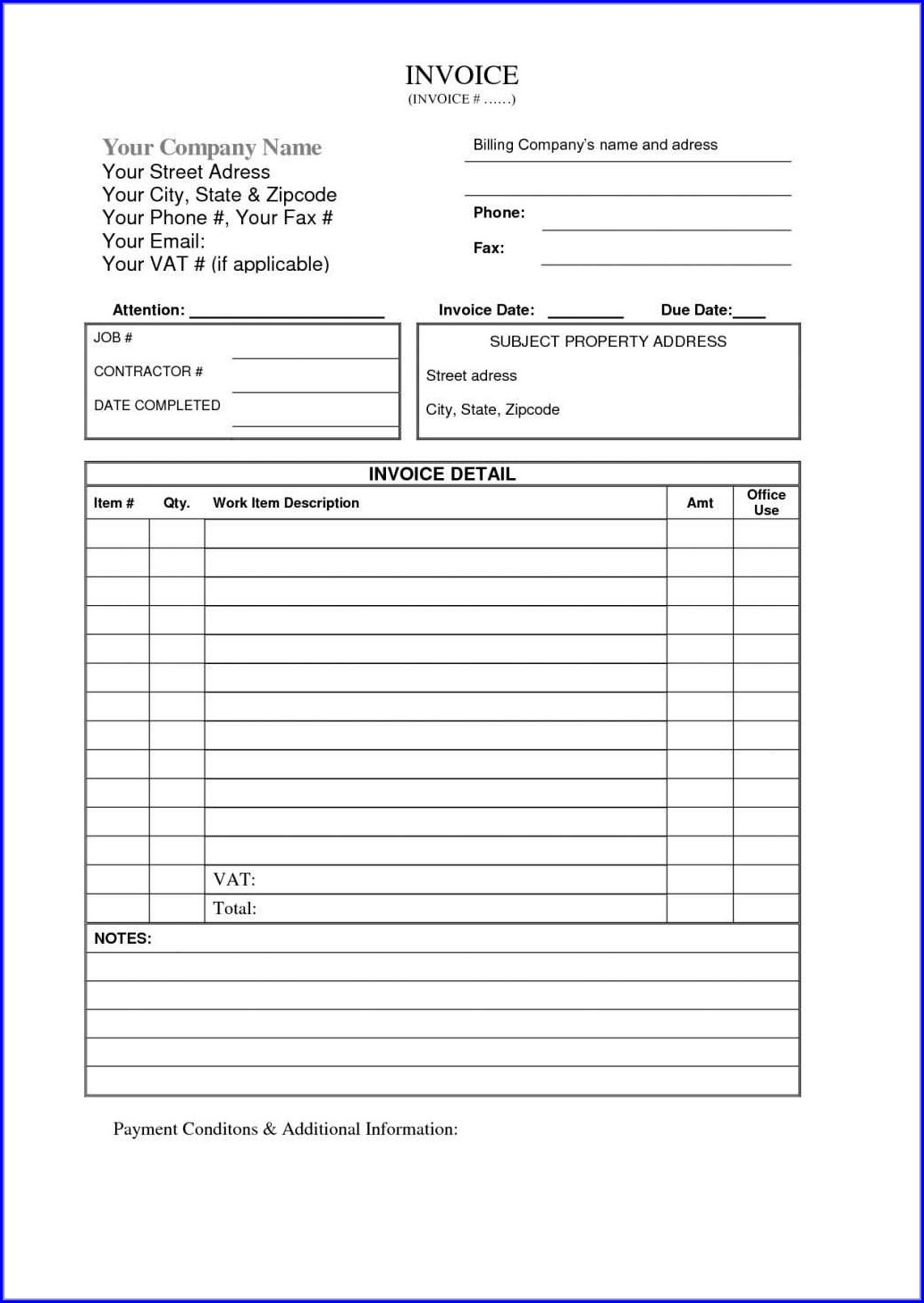

Printable 1099 forms are readily available online and can be easily downloaded and printed for your use. There are several websites that offer free templates for 1099 forms that you can customize with your information. These forms typically include all the necessary fields for reporting your income, such as your name, address, and Social Security number, as well as the income you received as an independent contractor.

By utilizing a printable 1099 form, you can ensure that you are accurately reporting your income and complying with tax laws. It is important to keep thorough records of your earnings and expenses as an independent contractor, and having a printable 1099 form is a valuable tool in this process. Make sure to fill out the form completely and accurately to avoid any issues with the IRS.

Overall, having a printable 1099 form as an independent contractor is essential for staying organized and compliant with tax laws. Make sure to keep track of your income throughout the year and utilize the form to accurately report your earnings to the IRS. By staying on top of your finances and tax obligations, you can ensure a smooth and hassle-free tax season.