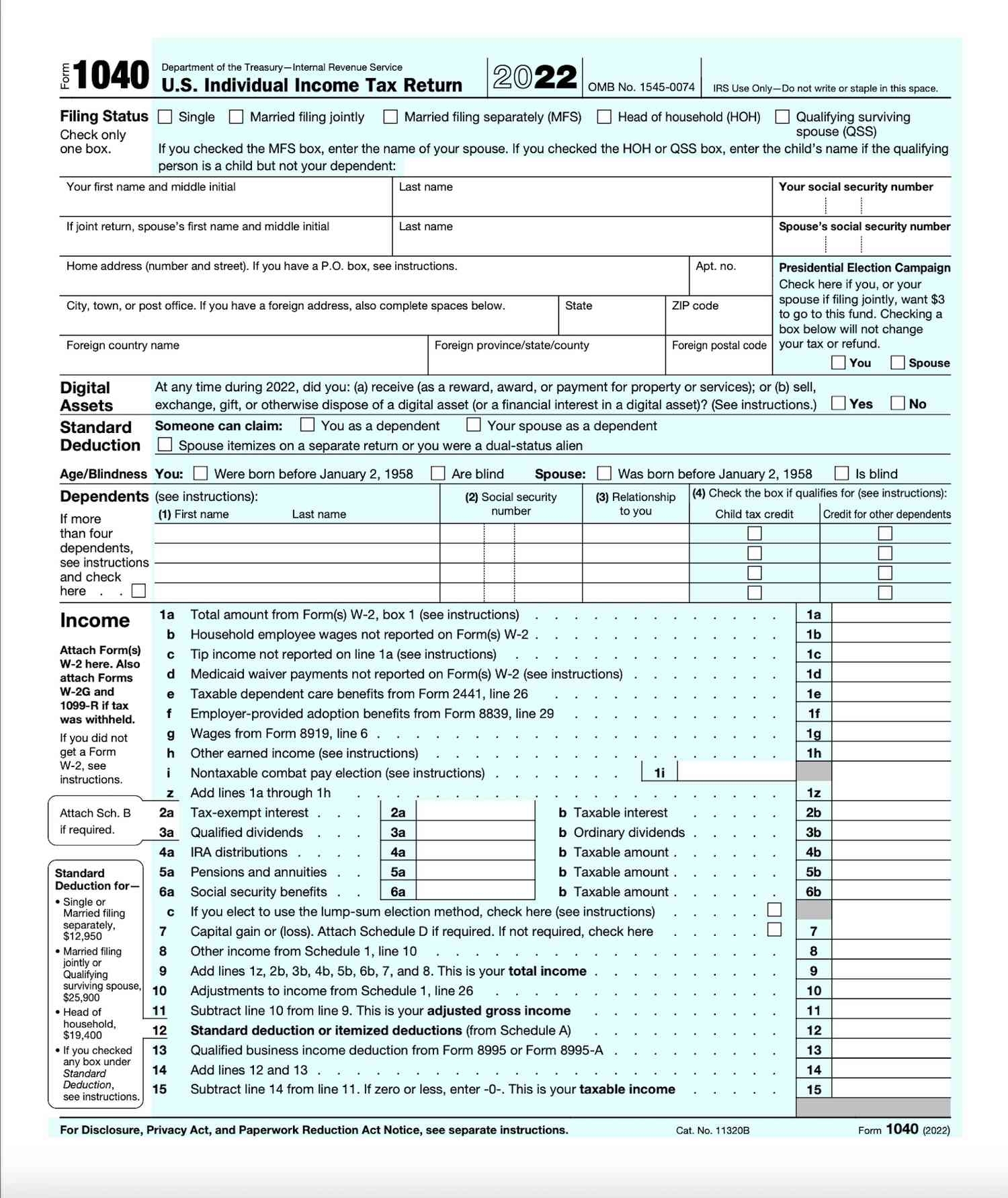

When it comes to filing your taxes, the 1040 form is one of the most important documents you’ll need. This form is used by individuals to report their annual income to the Internal Revenue Service (IRS) and determine how much tax they owe. It is essential to fill out this form accurately and completely to avoid any potential issues with the IRS.

One of the benefits of the 1040 Printable Tax Form is that it is easily accessible online. You can download the form from the IRS website and print it out from the comfort of your own home. This makes it convenient for individuals who prefer to fill out their taxes manually rather than using tax software.

When filling out the 1040 form, it is important to gather all necessary documentation, such as W-2 forms, 1099 forms, and any other income statements. You will also need to report any deductions or credits you may be eligible for, such as mortgage interest, student loan interest, or charitable contributions. Filling out the form accurately will ensure that you pay the correct amount of taxes and avoid any potential penalties.

Once you have completed the 1040 form, you can either mail it to the IRS or submit it electronically. If you choose to mail it, be sure to send it to the correct address and include any additional documentation that may be required. If you opt to file electronically, you can use IRS-approved software or a tax professional to submit your form securely and efficiently.

In conclusion, the 1040 Printable Tax Form is an essential document for individuals to report their income and pay their taxes to the IRS. By filling out this form accurately and completely, you can ensure that you comply with tax laws and avoid any potential issues with the IRS. Make sure to gather all necessary documentation and consider seeking assistance from a tax professional if needed to ensure that your taxes are filed correctly.