Completing your taxes can be a daunting task, but the IRS 1040 Form 2024 Printable can make it much easier. This form is essential for individuals to report their annual income and calculate their tax liability. By having a printable version of the form, taxpayers can easily fill it out at their convenience and submit it to the IRS.

With the IRS 1040 Form 2024 Printable, taxpayers can accurately report their income, deductions, and credits to determine how much they owe or are owed in taxes. This form is the standard document used by individuals to file their federal income tax returns, and it is crucial to have an accurate and complete submission to avoid any penalties or audits from the IRS.

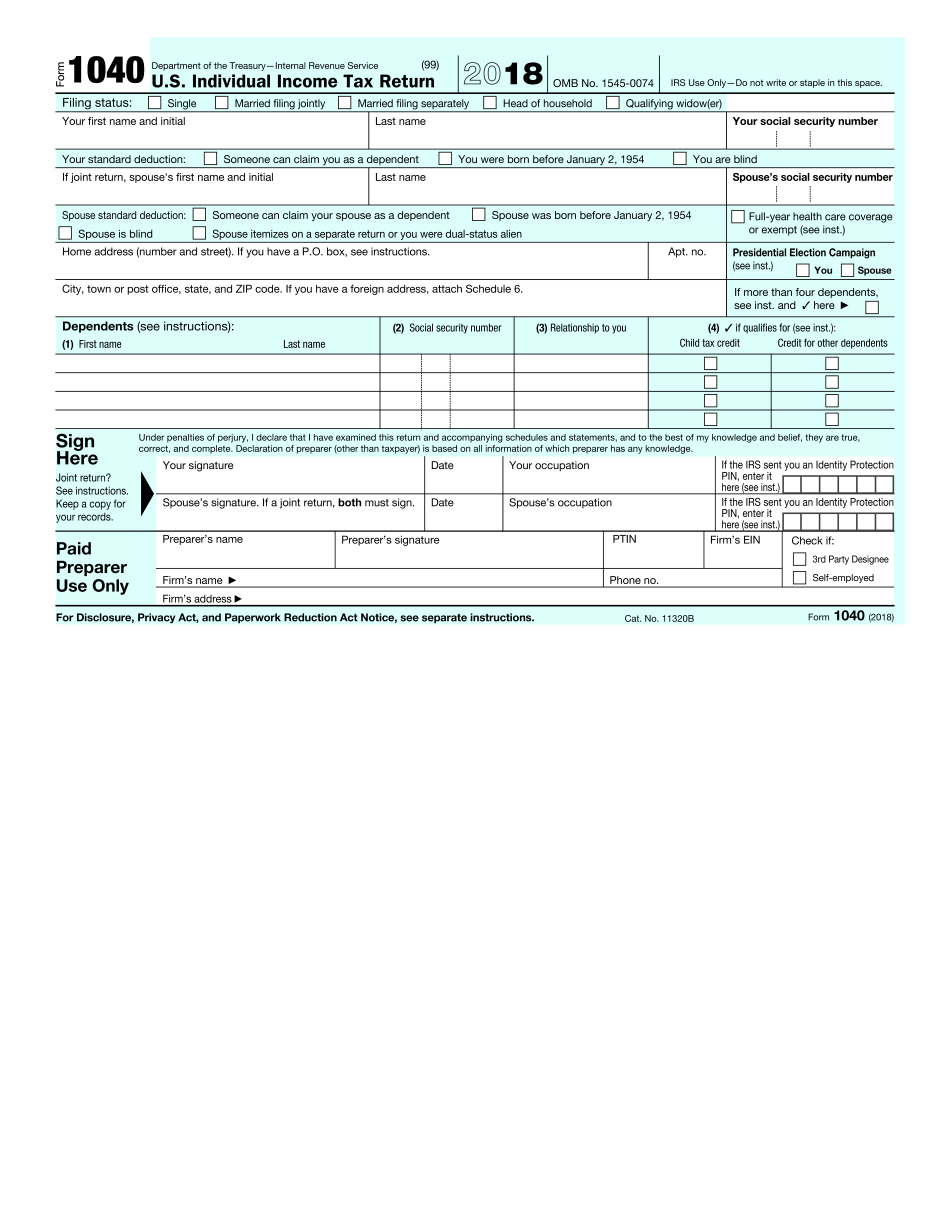

IRS 1040 Form 2024 Printable

The IRS 1040 Form 2024 Printable is a comprehensive document that includes all the necessary information for taxpayers to report their income and expenses. It provides detailed instructions on how to fill out each section, making it easy for individuals to navigate through the form. Additionally, the printable version allows taxpayers to make corrections or updates as needed before submitting their final return.

One of the key benefits of using the IRS 1040 Form 2024 Printable is that it helps individuals to organize their financial information and ensure that they are not missing any important details. By following the instructions provided on the form, taxpayers can accurately report their income, deductions, and credits, which can help them maximize their tax refund or minimize their tax liability.

Overall, the IRS 1040 Form 2024 Printable is a valuable tool for individuals to file their taxes accurately and efficiently. By utilizing this form, taxpayers can avoid common mistakes and ensure that their tax return is submitted correctly and on time. With the convenience of a printable version, individuals can easily access and complete the form, making the tax filing process much smoother and less stressful.

In conclusion, the IRS 1040 Form 2024 Printable is an essential document for individuals to report their annual income and calculate their tax liability. By using this form, taxpayers can accurately report their financial information and avoid any potential errors or omissions. With the convenience of a printable version, individuals can easily complete the form and submit it to the IRS, ensuring that their tax return is filed accurately and on time.