When starting a nonprofit organization, one of the most important steps is applying for tax-exempt status with the IRS. This status allows your organization to receive tax-deductible donations and grants, making it easier to fundraise and operate effectively. The IRS 501c3 Application Form 1023 is a crucial document that must be completed and submitted to obtain this status.

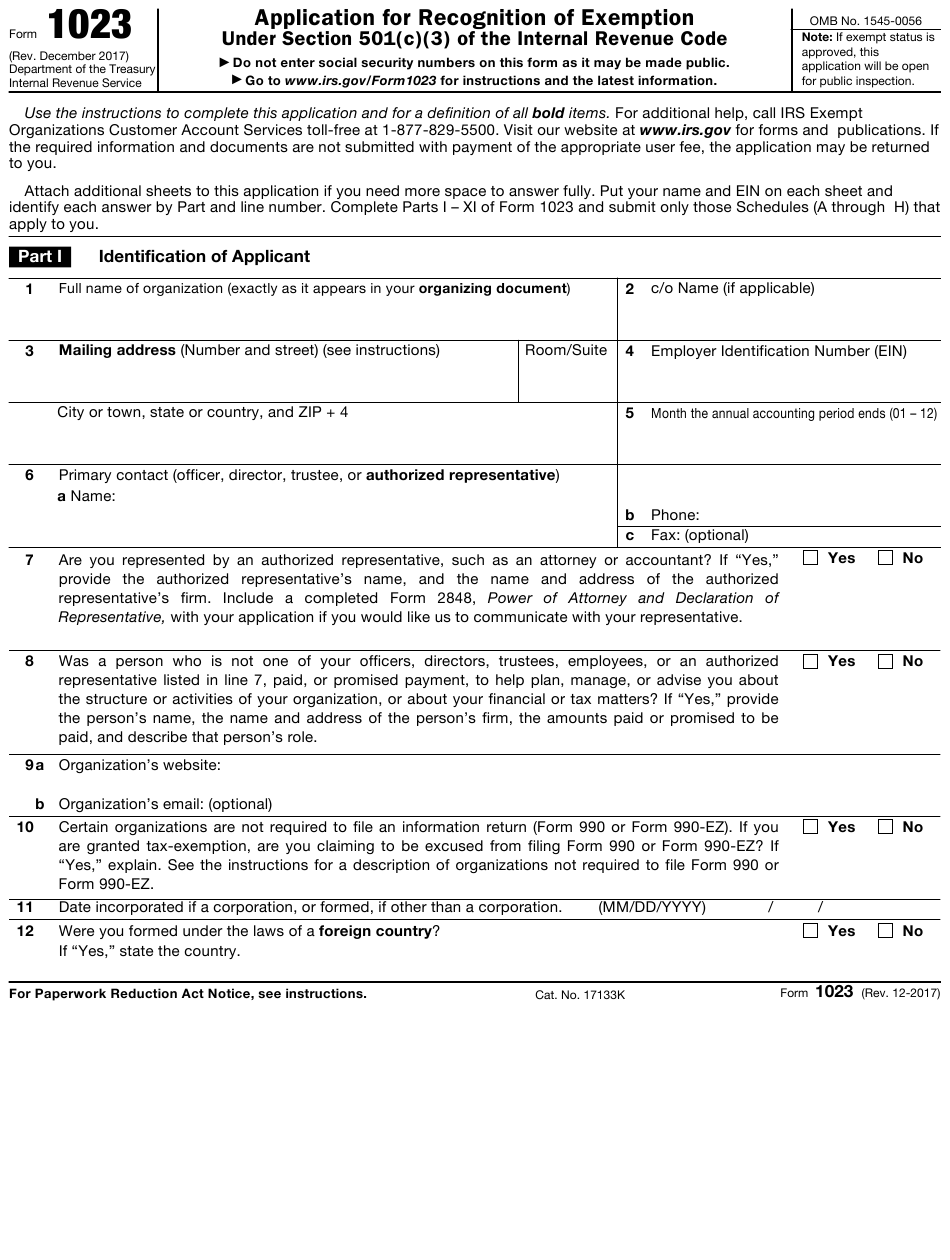

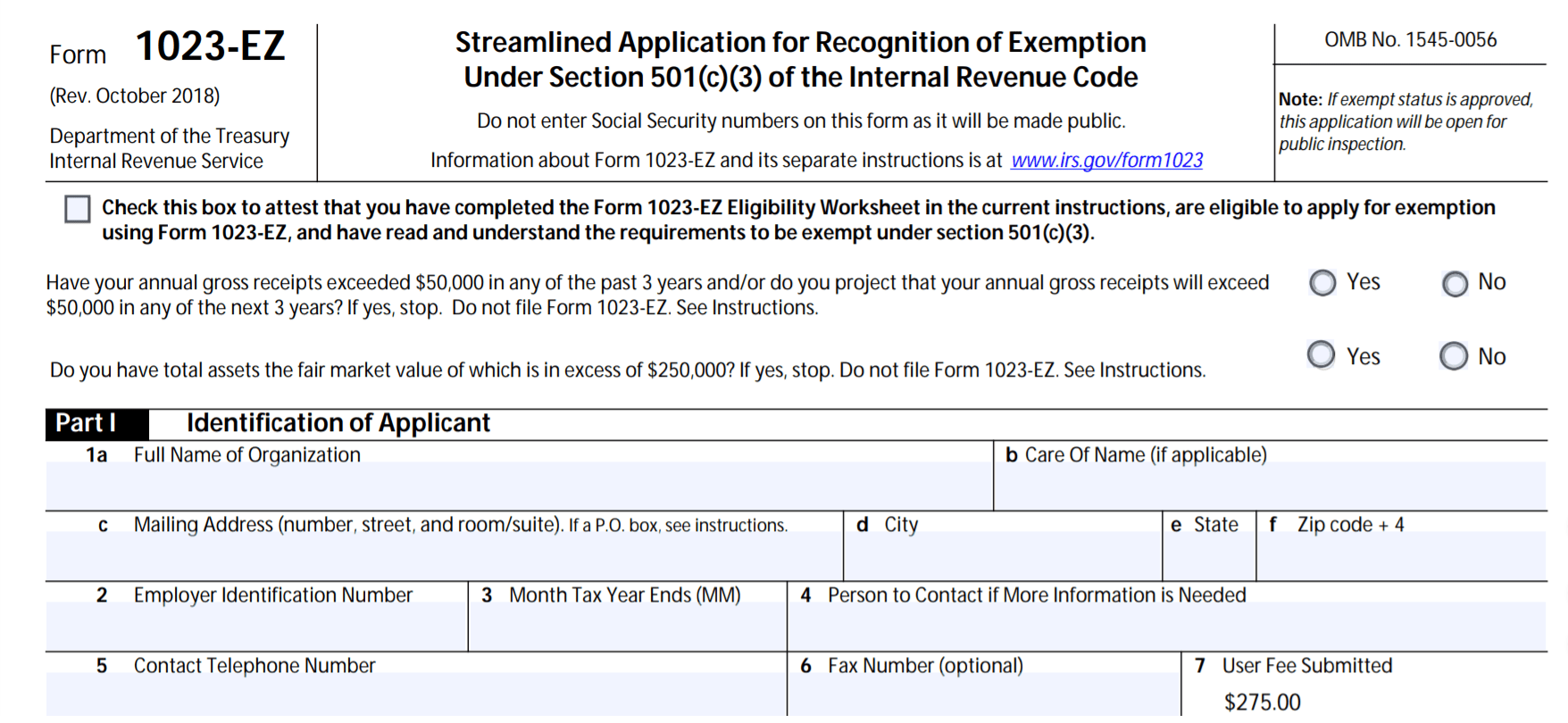

Form 1023 is used to apply for recognition of exemption under Section 501(c)(3) of the Internal Revenue Code. This form requires detailed information about your organization, including its purpose, activities, finances, and governance structure. It is important to carefully fill out this form to ensure that your organization meets the requirements for tax-exempt status.

Irs 501c3 Application Form 1023 Printable

Irs 501c3 Application Form 1023 Printable

Before filling out Form 1023, it is recommended to review the instructions provided by the IRS to ensure that you understand the requirements and guidelines. The form can be complex and time-consuming to complete, so it is important to gather all necessary documentation and information before starting the application process.

One option for completing Form 1023 is to use the printable version provided by the IRS. This allows you to fill out the form offline and then submit it by mail. The printable version can be downloaded from the IRS website and is available in a PDF format for easy printing.

Once you have completed Form 1023, it is important to review it carefully to ensure accuracy and completeness. Any errors or missing information could delay the processing of your application. After submitting the form, it may take several months for the IRS to review and approve your tax-exempt status, so it is important to be patient throughout the process.

In conclusion, obtaining tax-exempt status for your nonprofit organization is a critical step in its success. The IRS 501c3 Application Form 1023 is a key document in this process, and it is important to carefully complete and submit it to ensure that your organization meets the requirements for tax-exempt status. By following the guidelines and instructions provided by the IRS, you can increase your chances of a successful application.