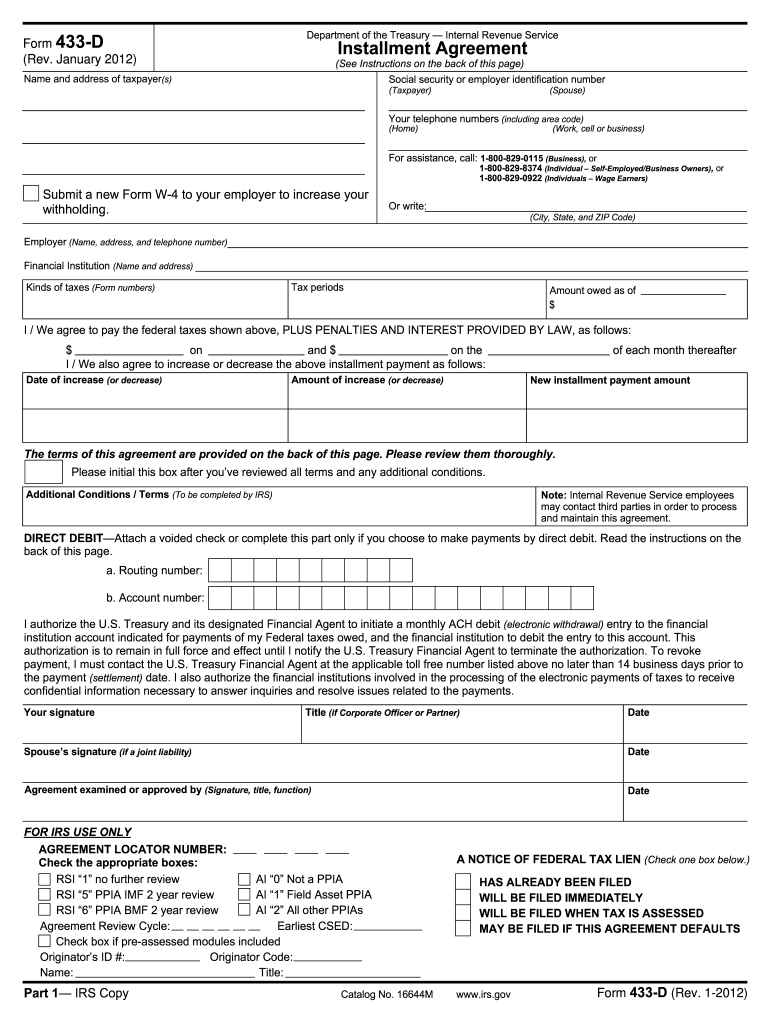

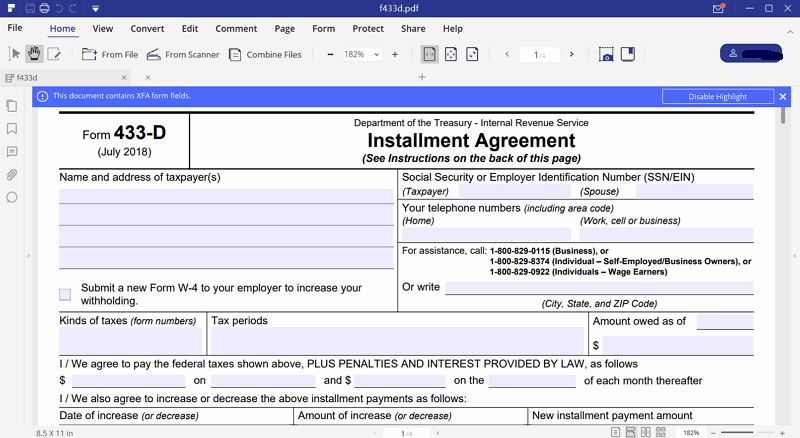

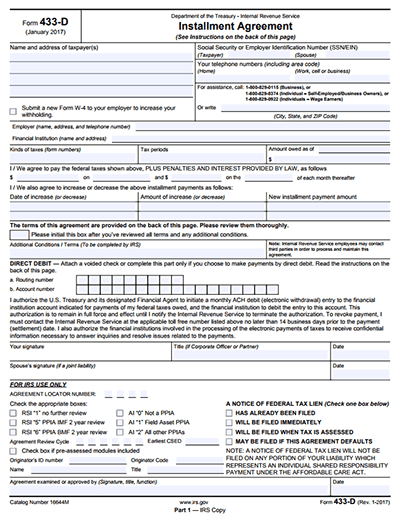

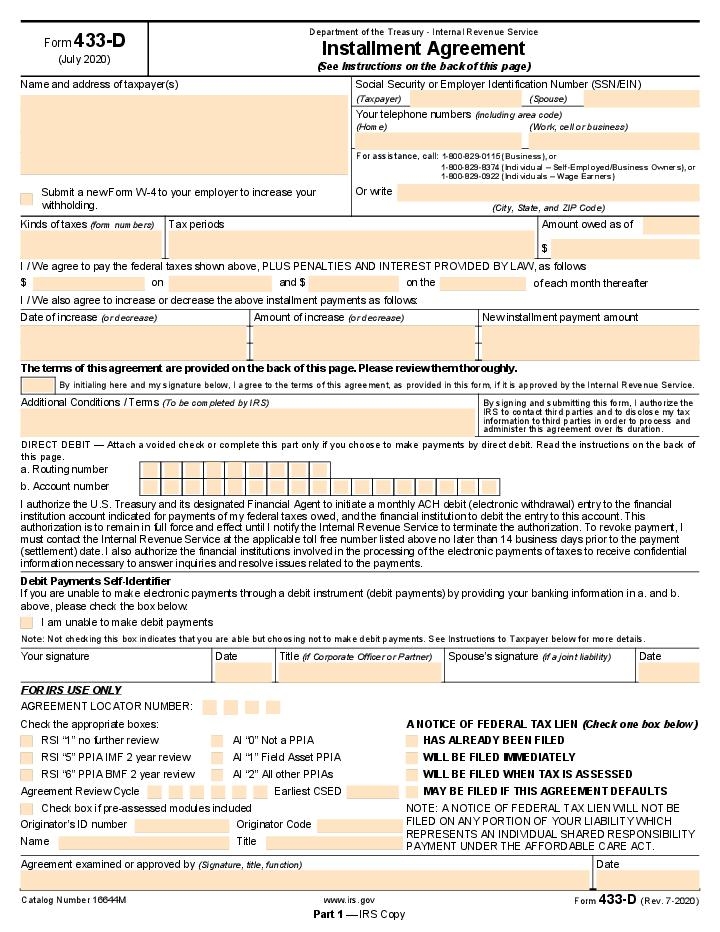

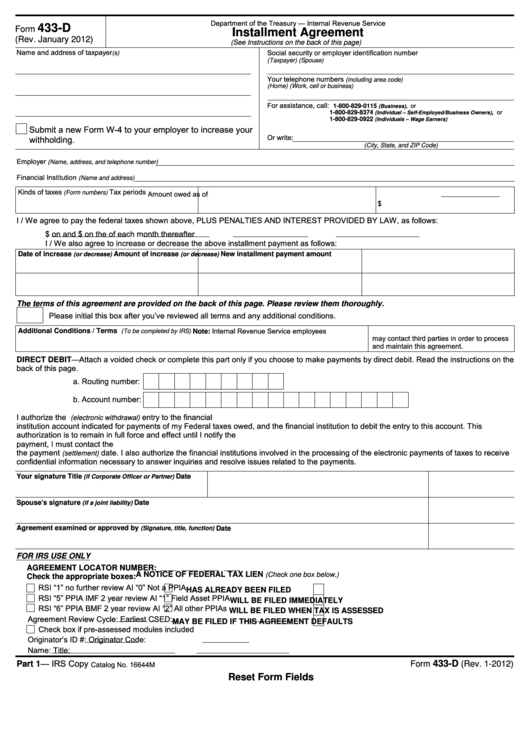

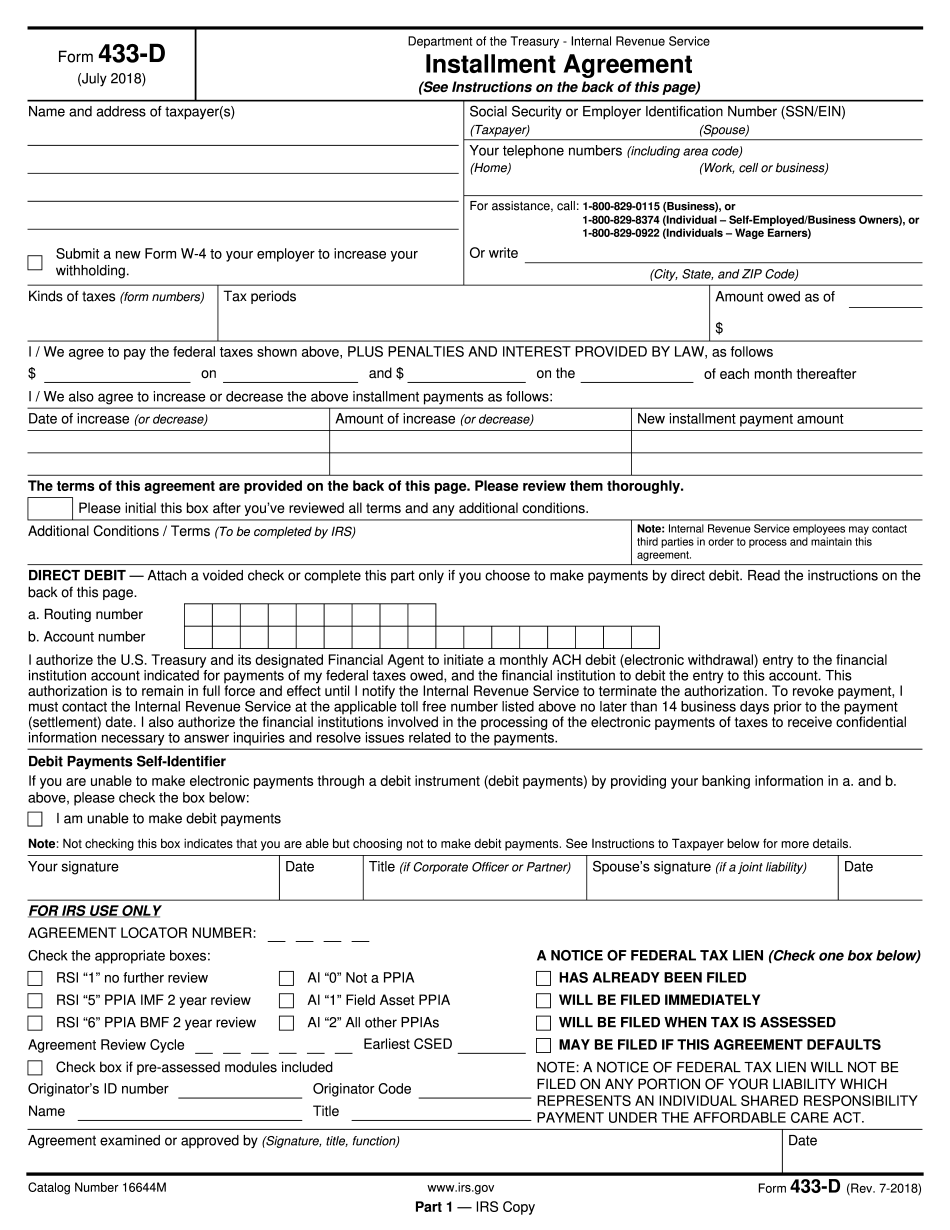

When dealing with tax debt, it is important to be proactive in finding a solution. One common form used by the Internal Revenue Service (IRS) to gather information about a taxpayer’s financial situation is Form 433-D. This form helps the IRS assess an individual’s ability to pay off their tax debt and determine an appropriate payment plan.

Form 433-D is used to calculate a taxpayer’s monthly disposable income, which is the amount of money left over after necessary expenses are deducted. This form requires detailed information about the taxpayer’s income, assets, expenses, and debts. It is crucial to accurately fill out this form to avoid any discrepancies that could lead to further complications with the IRS.

One of the advantages of Form 433-D is that it allows taxpayers to propose a payment plan that fits their financial situation. By providing a clear picture of their income and expenses, taxpayers can negotiate a manageable monthly payment with the IRS. This can help alleviate the burden of tax debt and prevent more severe consequences, such as wage garnishment or asset seizure.

It is important to note that Form 433-D is not a one-size-fits-all solution. Each taxpayer’s financial situation is unique, and the IRS will evaluate the information provided on the form to determine an appropriate course of action. It is advisable to seek the assistance of a tax professional or financial advisor when completing Form 433-D to ensure accuracy and compliance with IRS regulations.

Overall, Form 433-D is a valuable tool for taxpayers who are struggling with tax debt and need to establish a payment plan with the IRS. By providing detailed information about their financial situation, taxpayers can work towards resolving their tax debt in a structured and manageable way. Remember to consult with a professional to ensure the accuracy and completeness of the information provided on Form 433-D.

In conclusion, Form 433-D is an essential document for taxpayers seeking to address their tax debt with the IRS. By accurately completing this form and proposing a reasonable payment plan, individuals can take control of their financial situation and work towards a resolution with the IRS. Don’t hesitate to seek help when filling out Form 433-D to ensure a smooth and successful process.

Quickly Access and Print Irs Form 433 D Printable

Irs Form 433 D Fillable Printable Forms Free Online

Irs Form 433 D Fillable Printable Forms Free Online

Irs Form 433 D Printable Printable Forms Free Online

Irs Form 433 D Printable Printable Forms Free Online

Irs Form 433 D Printable Printable Forms Free Online

Irs Form 433 D Printable Printable Forms Free Online

Irs Form 433 D Printable Printable Forms Free Online

Irs Form 433 D Printable Printable Forms Free Online

Irs Form 433 D Printable Printable Form 2024

Irs Form 433 D Printable Printable Form 2024

In conclusion, Irs Form 433 D Printable remain a cost-effective, simple, and trusted solution for businesses of all sizes. They help in streamlining payroll processing, ensuring on-time employee payments and accurate financial records. With easy-to-use templates and professional software, you can print checks without third-party services. Whether you’re a small business or growing enterprise, printable payroll checks enhance efficiency and minimize admin work. Start today with a reliable Irs Form 433 D Printable solution to streamline your payroll process.