When it comes to tax season, staying organized is key. One of the best ways to ensure you have all the necessary documents in order is by utilizing IRS printable forms. These forms are essential for filing your taxes accurately and on time. Whether you’re a business owner or an individual taxpayer, having access to printable IRS forms can make the process much smoother.

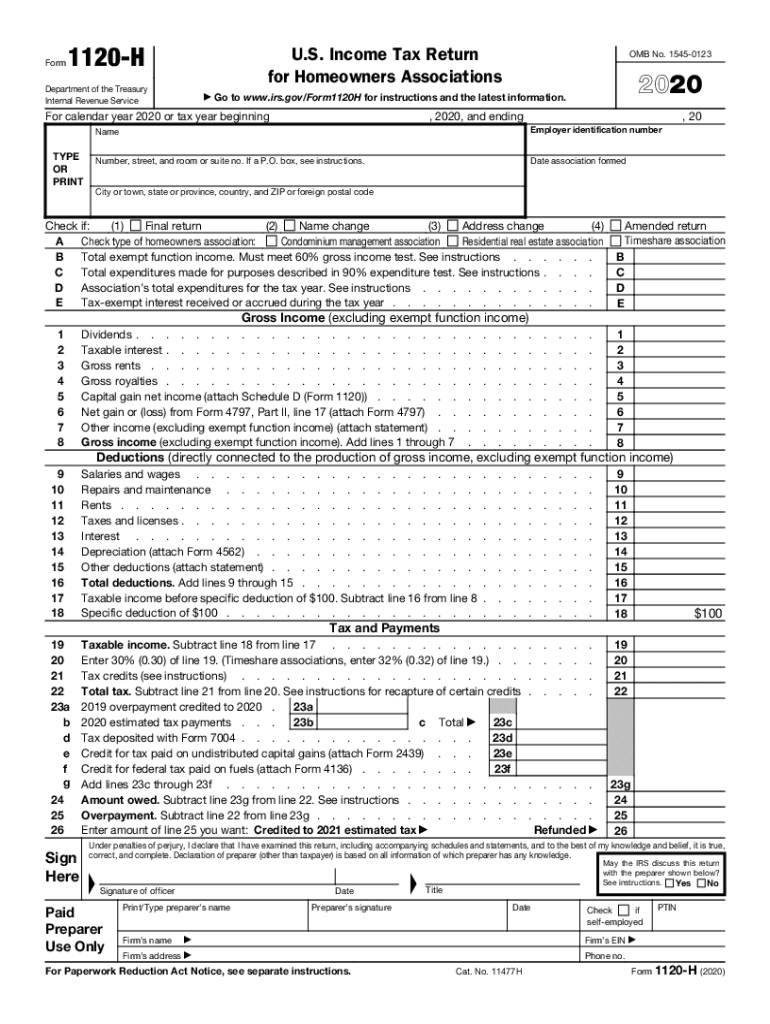

IRS printable forms cover a wide range of tax-related topics, including income tax, employment tax, and various credits and deductions. These forms are available for download on the IRS website and can be easily printed out for your convenience. By having these forms on hand, you can fill them out at your own pace and avoid any last-minute scrambling to find the necessary paperwork.

IRS Printable Forms

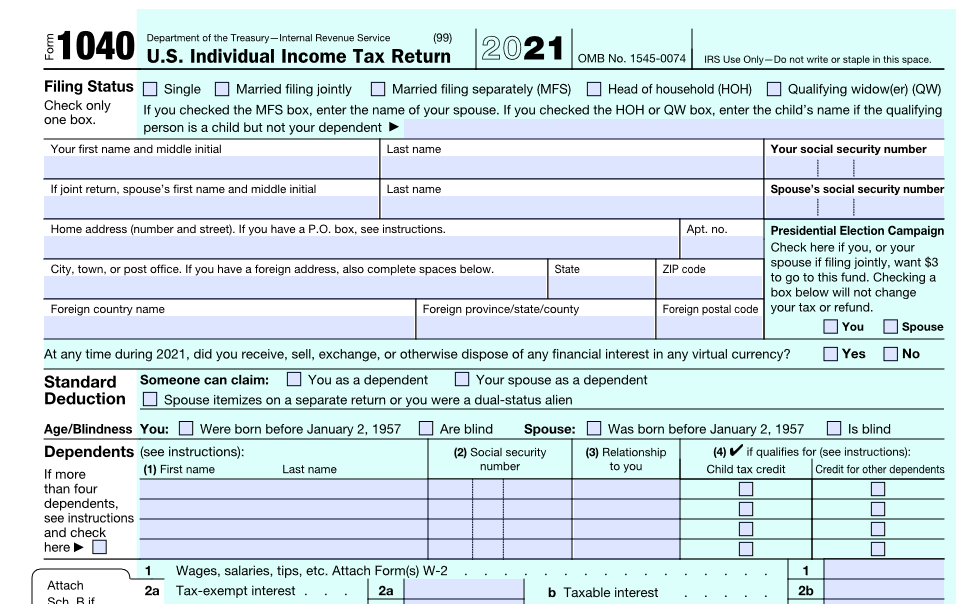

One of the most commonly used IRS printable forms is the Form 1040, which is used by individuals to report their annual income and calculate their tax liability. This form is essential for anyone who earns income in the United States and must be filed by the tax deadline each year. Additionally, businesses may need to use forms such as the W-2, 1099, and Schedule C to report their income and expenses.

Another important IRS printable form is the Form W-4, which is used by employees to indicate their tax withholding preferences to their employers. By filling out this form accurately, you can ensure that the correct amount of taxes are withheld from your paycheck throughout the year. This can help you avoid any surprises come tax time and ensure you are not hit with a big tax bill.

It’s important to note that while many IRS forms can be filled out electronically using tax software, having printable forms on hand can be helpful in case you encounter any technical difficulties or simply prefer to fill out the forms manually. Additionally, having physical copies of your tax documents can come in handy in case you ever need to provide proof of income or deductions to the IRS.

In conclusion, IRS printable forms are a valuable resource for taxpayers of all kinds. By having these forms readily available, you can stay organized and ensure that you are meeting all of your tax obligations. Whether you’re filing as an individual or a business, having access to printable IRS forms can make the tax-filing process much smoother and less stressful.