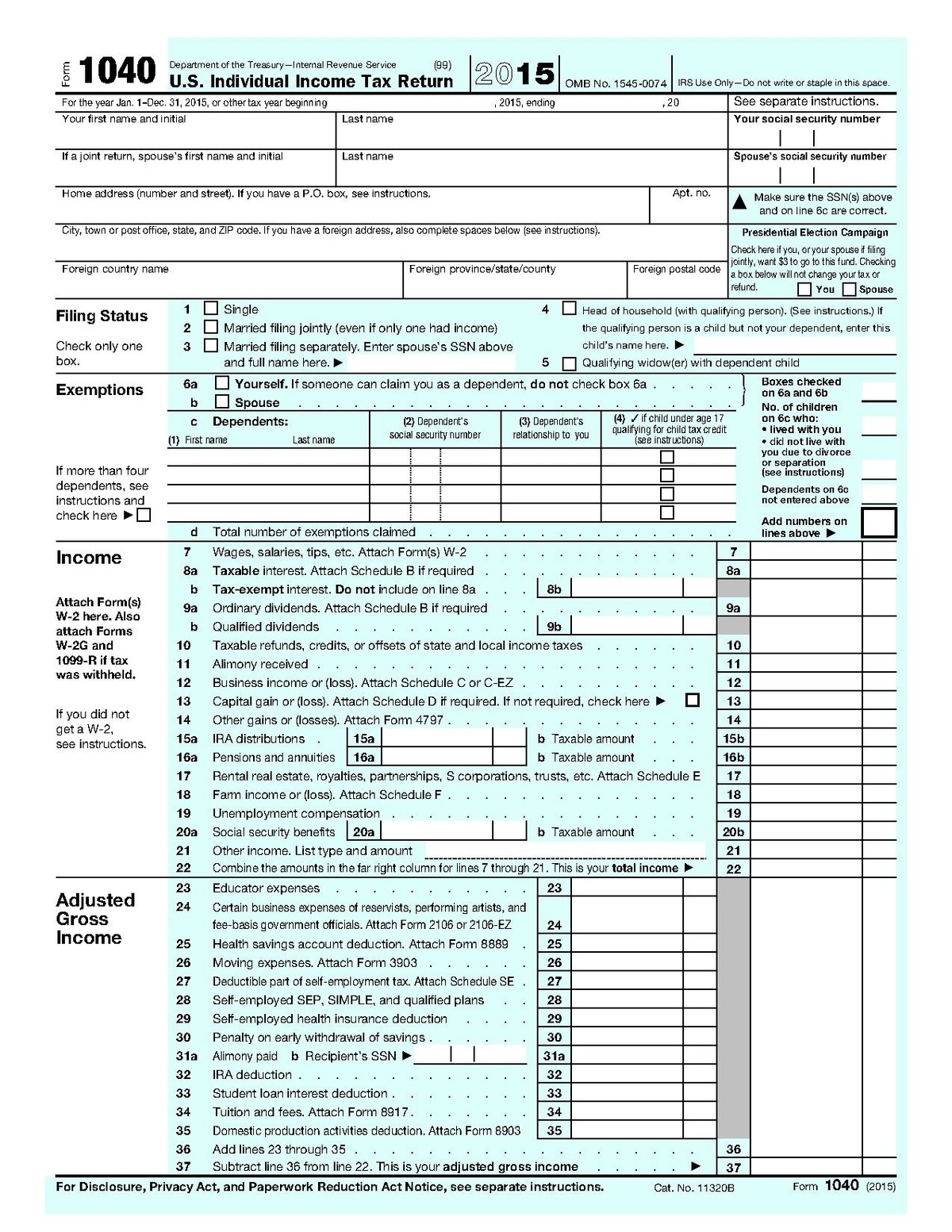

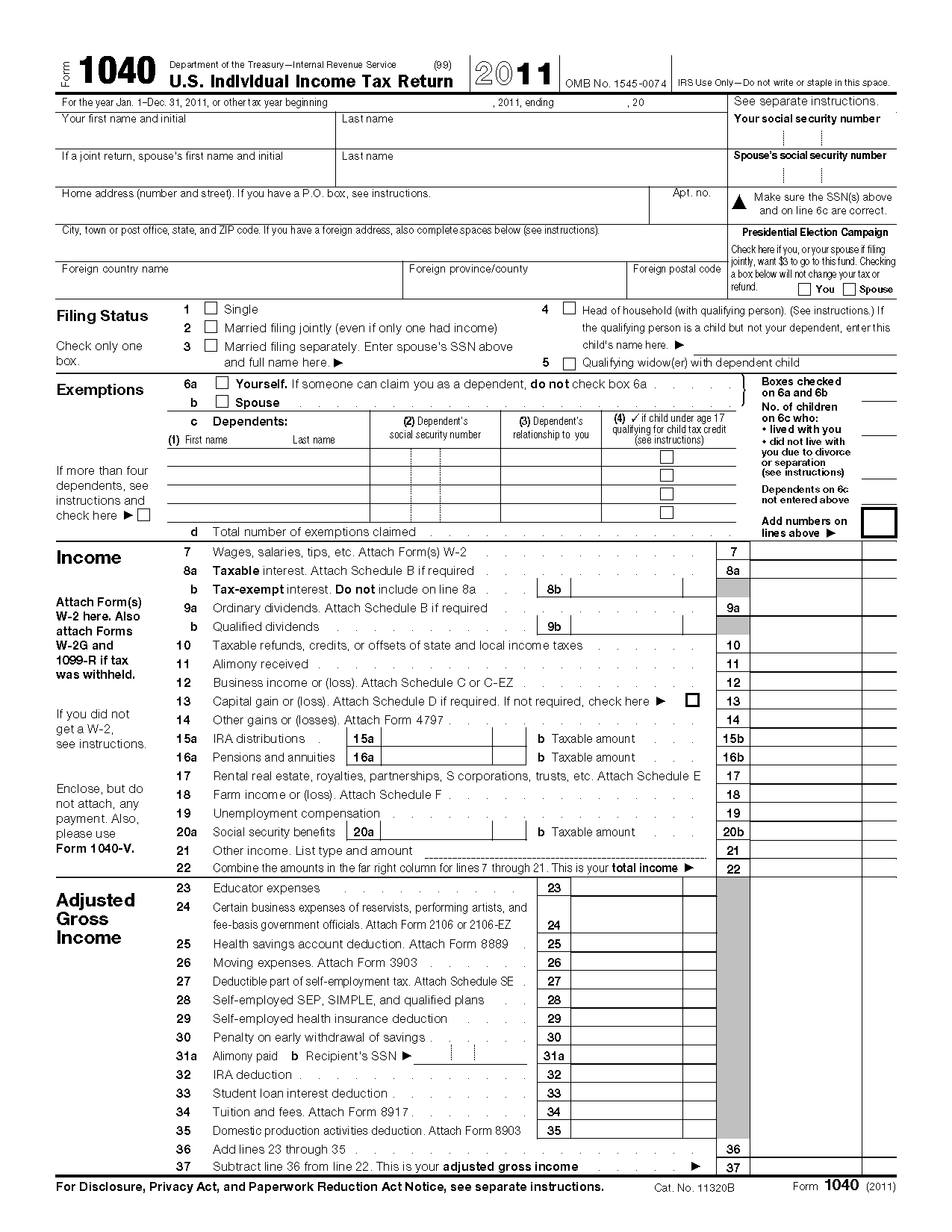

Filing your taxes can be a daunting task, but with the help of IRS printable forms 1040, the process becomes much easier. These forms are essential for reporting your income, deductions, and credits to the Internal Revenue Service (IRS) each year.

IRS Form 1040 is the standard U.S. individual income tax return form that taxpayers use to file their annual income tax returns. It is a crucial document that helps determine how much tax you owe or how much of a refund you will receive.

Irs Printable Forms 1040

There are several variations of Form 1040, including Form 1040, 1040A, and 1040EZ. The main form, Form 1040, is the most comprehensive and allows you to report all types of income, deductions, and credits. Form 1040A is a shorter version of the form for those with less complex tax situations, while Form 1040EZ is the simplest form for those with no dependents and only basic income sources.

When filling out Form 1040, you will need to gather all relevant financial documents, such as W-2s, 1099s, and receipts for deductions. You will then enter this information on the form, including your income, deductions, and credits. Make sure to double-check your entries for accuracy before submitting your return to the IRS.

Once you have completed Form 1040, you can either file it electronically or mail it to the IRS. If you choose to mail your return, be sure to use certified mail and keep a copy of your return for your records. The IRS typically processes paper returns within six to eight weeks.

Overall, IRS printable forms 1040 are essential for accurately reporting your income and ensuring compliance with federal tax laws. By following the instructions provided on the form and double-checking your entries, you can file your taxes with confidence and avoid any potential penalties or audits.

In conclusion, IRS printable forms 1040 play a crucial role in the tax-filing process and help individuals accurately report their income to the IRS. Whether you use Form 1040, 1040A, or 1040EZ, it is important to carefully review your entries and submit your return on time to avoid any issues. With the right documentation and attention to detail, you can successfully navigate the tax-filing process and fulfill your financial obligations.