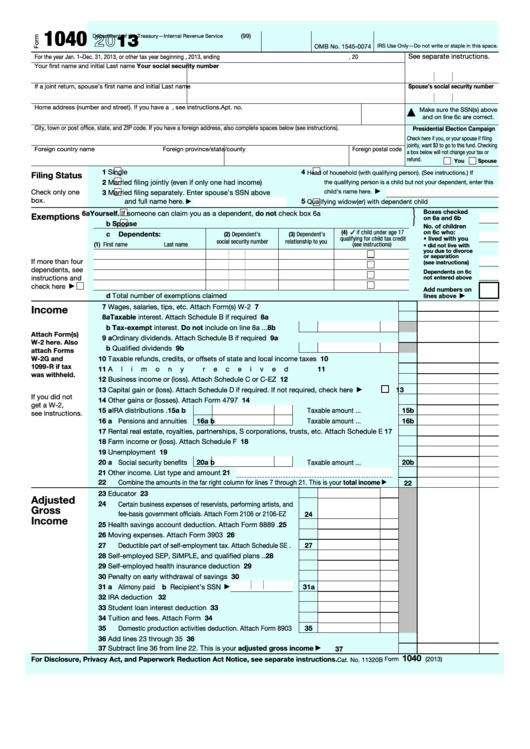

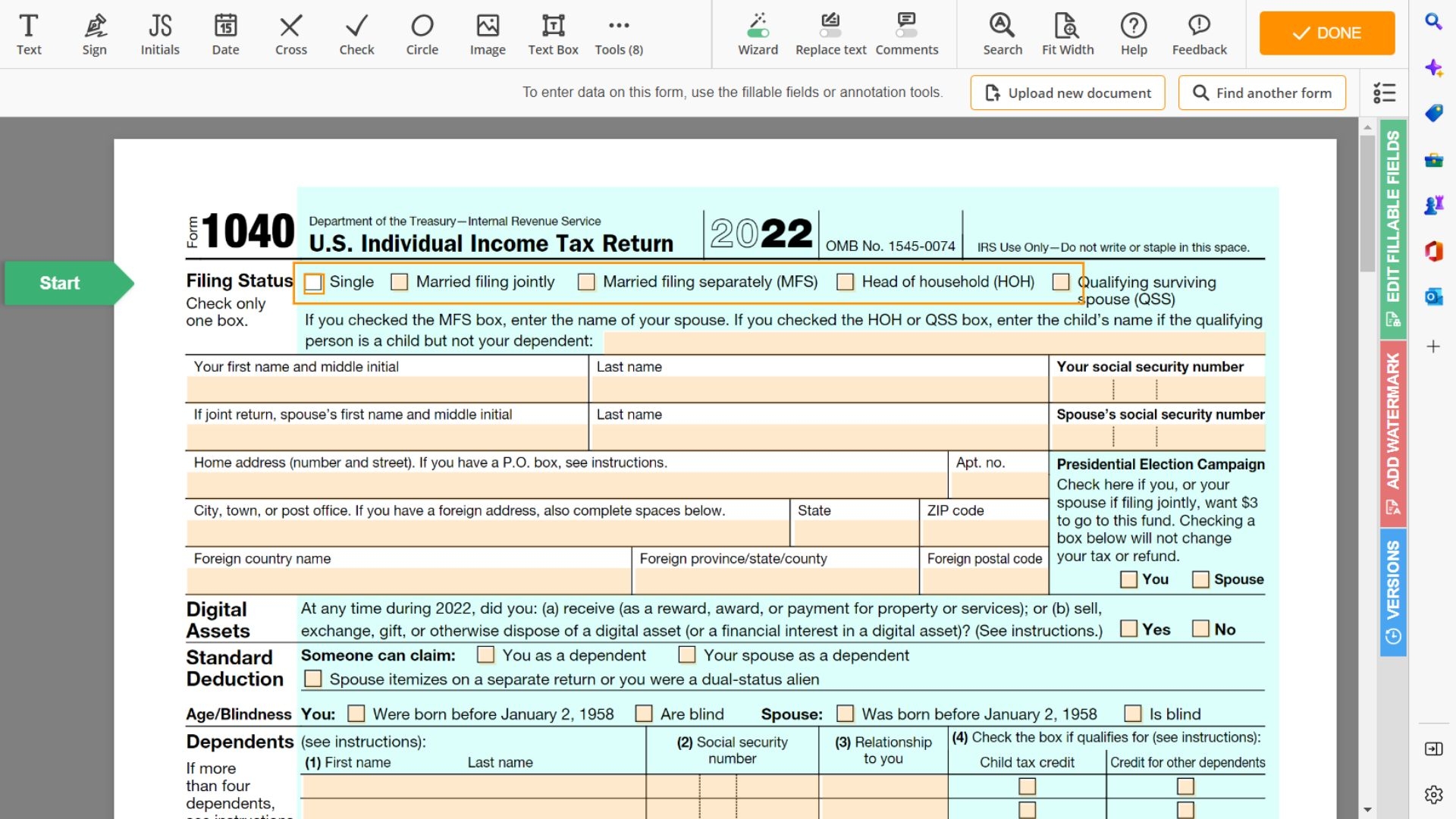

As tax season approaches, individuals and businesses alike are gearing up to file their taxes. One of the most commonly used tax forms in the United States is the 1040 form. This form is used to report an individual’s or a couple’s income and determine how much tax they owe to the government. It is crucial to accurately fill out this form to avoid any penalties or audits from the IRS.

For those who prefer to file their taxes manually or do not have access to tax software, printable 1040 tax forms are readily available online. These forms can be easily downloaded, printed, and filled out at your convenience. Having a printable 1040 tax form on hand can make the tax filing process much more manageable and efficient.

Printable 1040 Tax Form

When using a printable 1040 tax form, it is essential to ensure that you are using the correct version for the tax year you are filing for. The IRS updates the form annually to reflect any changes in tax laws or regulations. Be sure to download the most recent version of the form from the official IRS website to avoid any discrepancies or errors in your tax return.

Once you have obtained the printable 1040 tax form, carefully review the instructions provided by the IRS to accurately fill out the form. You will need to report your income, deductions, credits, and any other relevant information required by the IRS. Double-check your calculations and ensure that all the information provided is correct before submitting your tax return.

After completing the printable 1040 tax form, you can either mail it to the IRS or file electronically using an approved e-file provider. Make sure to keep a copy of your tax return for your records and follow up with the IRS to confirm that your return has been received and processed. By using a printable 1040 tax form, you can efficiently file your taxes and fulfill your obligations as a taxpayer.

In conclusion, printable 1040 tax forms are a convenient and accessible option for individuals looking to file their taxes manually. By following the instructions provided by the IRS and accurately filling out the form, you can ensure a smooth and hassle-free tax filing process. Be proactive and start gathering your tax documents early to avoid any last-minute stress. Remember, it is always better to file your taxes accurately and on time to avoid any penalties or issues with the IRS.