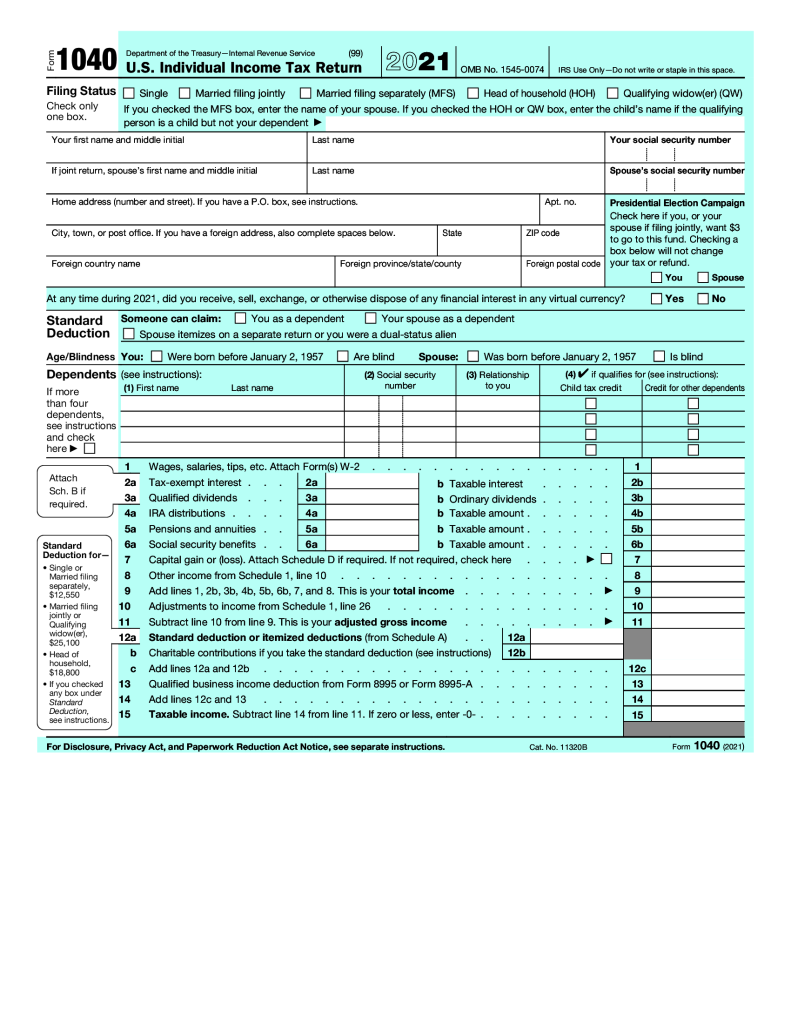

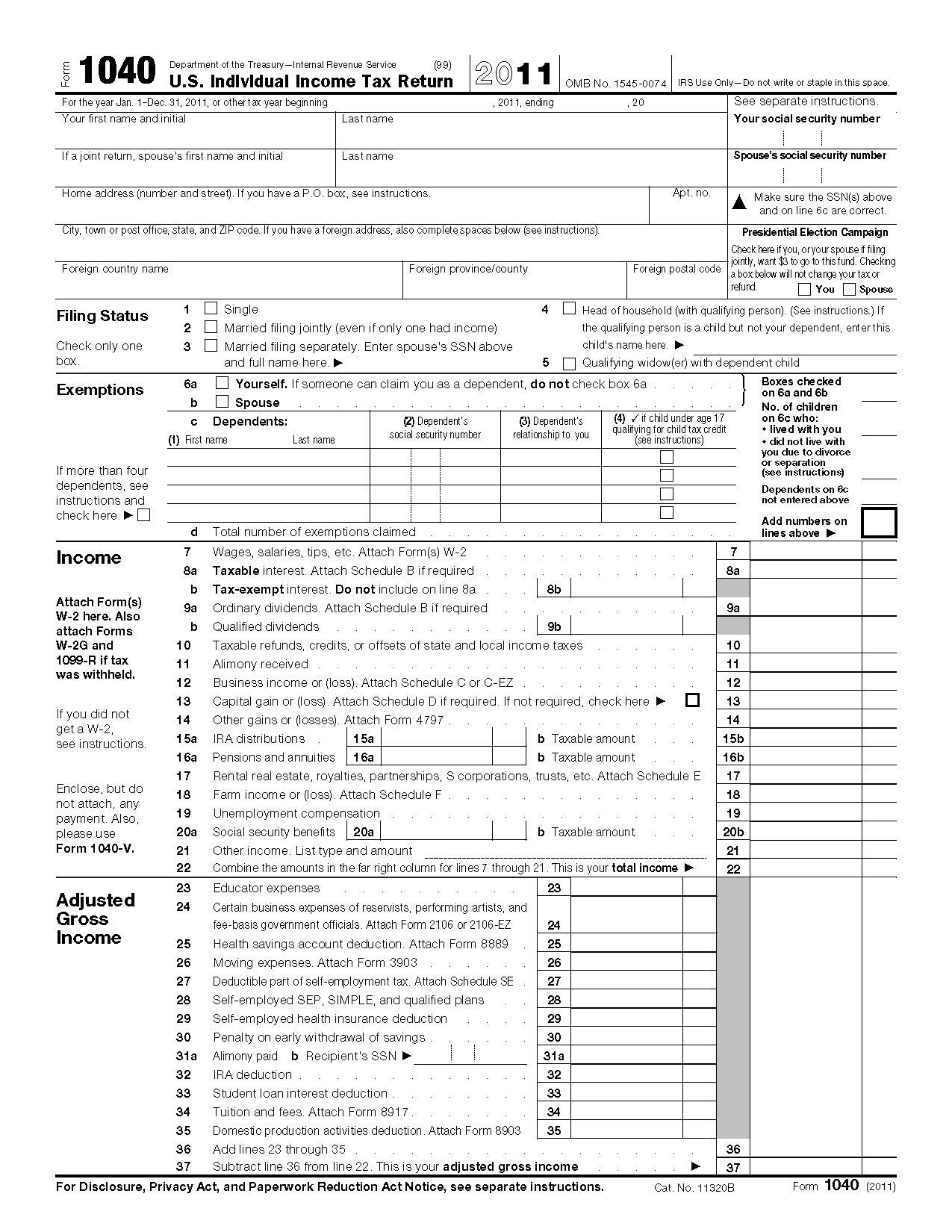

Filing taxes can be a daunting task for many individuals and businesses. However, having the necessary forms ready can make the process much smoother. One of the most common tax forms used by individuals in the United States is the 1040 form. This form is used to report an individual’s income and determine how much tax they owe to the government.

Printable 1040 tax forms are readily available online, making it convenient for taxpayers to access and fill out the form without having to visit an IRS office or wait for forms to be mailed to them. These printable forms can be easily downloaded and printed from the IRS website or other reputable tax websites.

When filling out the 1040 form, taxpayers will need to provide information about their income, deductions, credits, and other relevant financial details. Having a printable form on hand can help individuals organize their tax information and ensure that they are accurately reporting their income and claiming any eligible tax deductions and credits.

It is important for taxpayers to carefully review the instructions provided with the 1040 form to ensure that they are filling out the form correctly. Mistakes or omissions on the form can result in penalties or delays in receiving a tax refund. By using a printable 1040 tax form, individuals can take their time to fill out the form accurately and double-check their information before submitting it to the IRS.

Overall, printable 1040 tax forms are a valuable resource for individuals and businesses looking to file their taxes accurately and efficiently. By having access to these forms online, taxpayers can save time and effort in preparing their tax returns and ensure that they are complying with the tax laws. Whether you are filing as an individual or a business, having a printable 1040 tax form on hand can help simplify the tax filing process.

So, if you are getting ready to file your taxes, be sure to download and print a 1040 form from a reliable source to help streamline the process and ensure that you are meeting your tax obligations.