As tax season approaches, it’s important for businesses and individuals to ensure that they have all the necessary forms in order to report their income accurately. One such form that is commonly used is the 1099 form, which is used to report various types of income, such as freelance work, rental income, and more.

For those who prefer to fill out their 1099 forms manually, printable 1099 forms are readily available online. These forms can be easily downloaded, filled out, and printed, making it convenient for individuals and businesses to report their income accurately and on time.

When using printable 1099 forms, it’s important to ensure that all the information is filled out correctly and accurately. Any errors or omissions could result in delays or penalties when filing taxes, so it’s crucial to double-check all the information before submitting the form to the IRS.

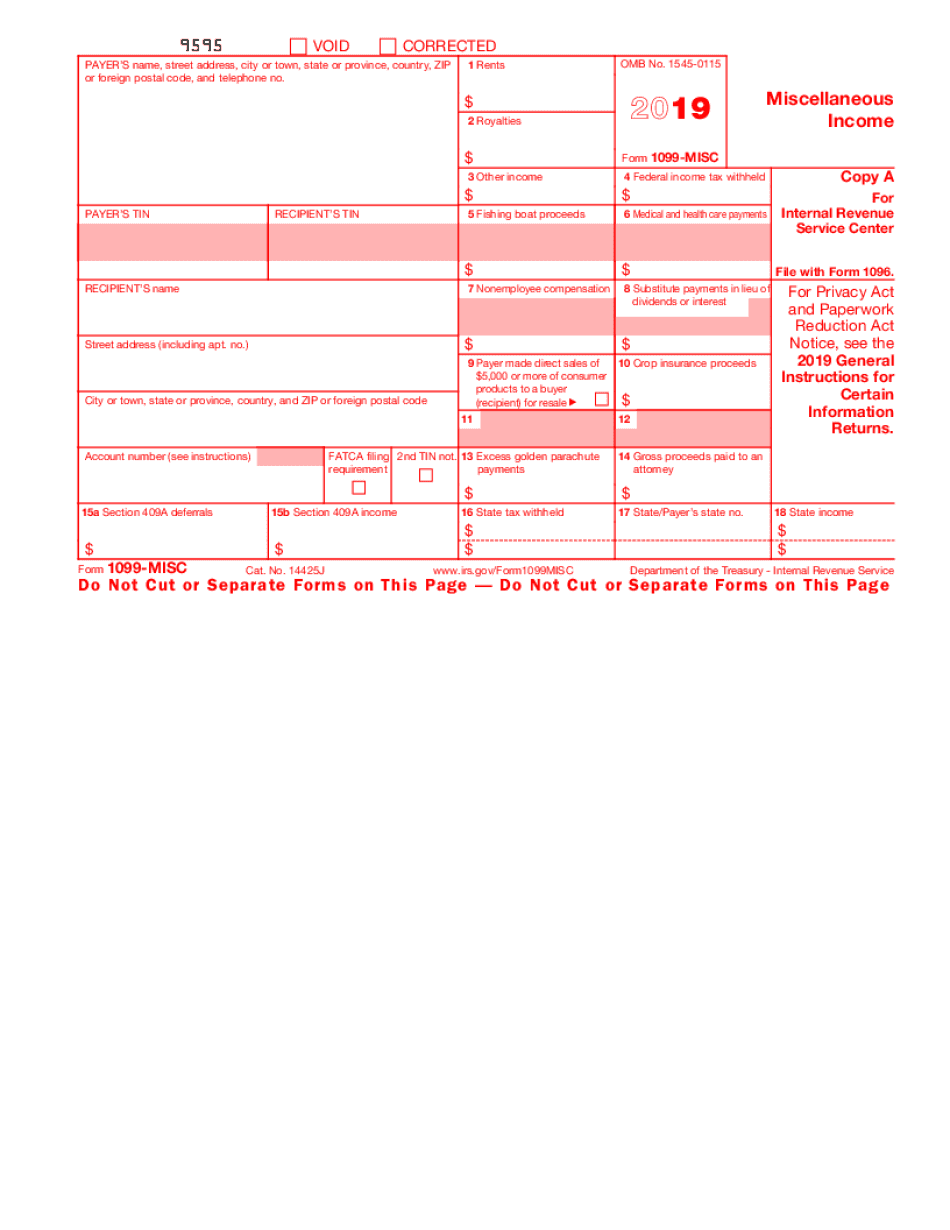

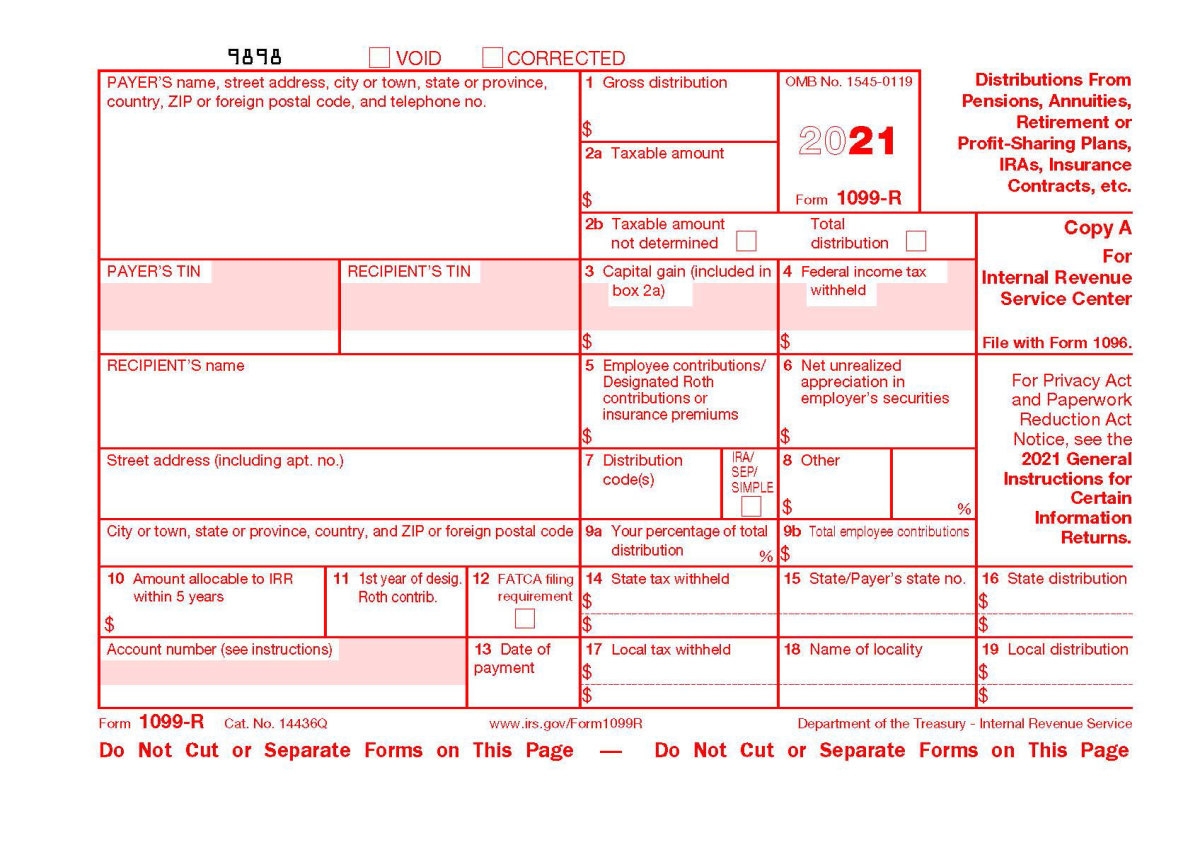

Printable 1099 forms are available for various types of income, including 1099-MISC for miscellaneous income, 1099-INT for interest income, and 1099-DIV for dividend income. By using these forms, individuals and businesses can report their income accurately and in compliance with IRS regulations.

Overall, printable 1099 forms are a convenient and easy way to report income for tax purposes. By ensuring that all the information is filled out correctly and accurately, individuals and businesses can avoid any potential issues when filing their taxes. So, make sure to download and use printable 1099 forms for a hassle-free tax season!