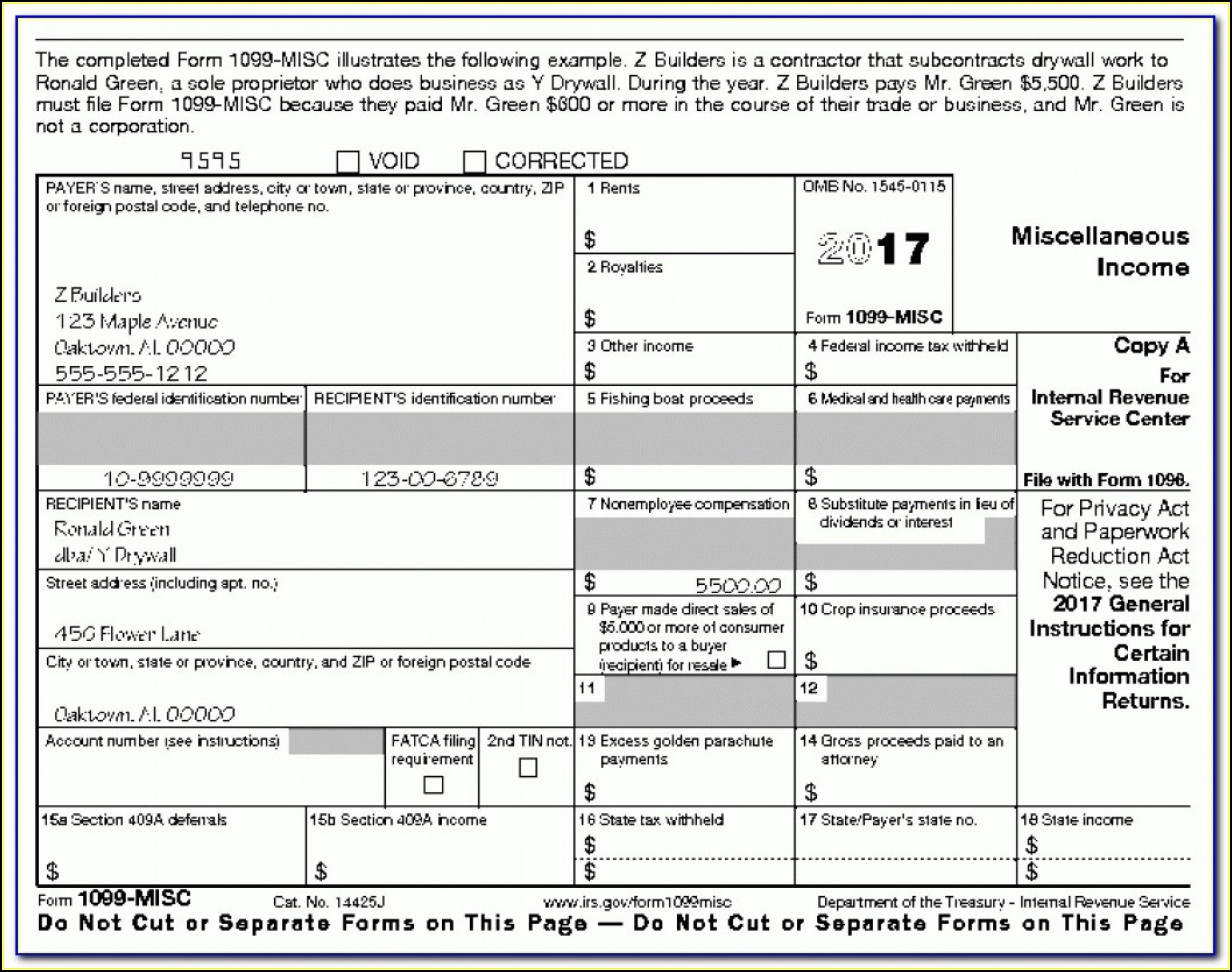

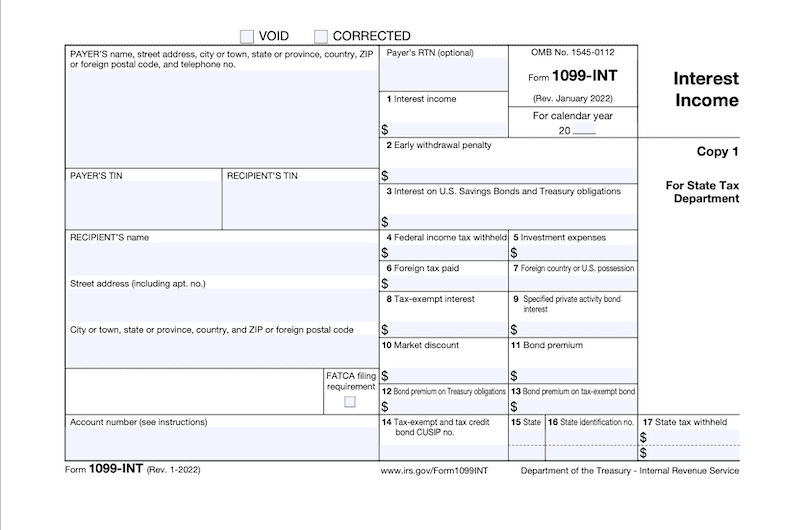

Independent contractors play a vital role in today’s workforce, providing specialized skills and services to businesses without the commitment of full-time employment. As an independent contractor, it is important to keep track of your income and taxes, which is where 1099 forms come into play. These forms are used to report income earned as a contractor and are essential for filing taxes accurately.

Printable 1099 forms are a convenient option for independent contractors who prefer to handle their tax reporting on their own. These forms can be easily downloaded from the IRS website or other reputable sources and filled out with the necessary information. By using printable forms, contractors can save time and money compared to purchasing physical forms or hiring a professional to handle their tax reporting.

Printable 1099 Forms For Independent Contractors

Printable 1099 Forms For Independent Contractors

One of the key benefits of printable 1099 forms is the ability to customize them to meet individual needs. Contractors can easily input their income information, deductions, and any other relevant details to ensure accurate reporting. Additionally, printable forms can be saved electronically for future reference, making it easier to track income and expenses throughout the year.

Another advantage of printable 1099 forms is the flexibility they offer. Contractors can choose to fill out the forms online and then print them for submission, or they can print the forms and fill them out by hand. This versatility allows contractors to choose the method that works best for them and their unique preferences.

Overall, printable 1099 forms provide independent contractors with a convenient and cost-effective solution for handling their tax reporting. By utilizing these forms, contractors can ensure accurate reporting of their income and expenses, ultimately helping them to stay compliant with tax laws and avoid potential penalties. Whether filling out the forms digitally or by hand, printable 1099 forms offer flexibility and ease of use for contractors looking to take control of their tax reporting.

In conclusion, printable 1099 forms are a valuable tool for independent contractors seeking a convenient and customizable solution for tax reporting. By utilizing these forms, contractors can streamline the process of reporting their income and expenses, ultimately helping them to stay organized and compliant with tax laws. Whether opting to fill out the forms online or by hand, printable 1099 forms offer flexibility and ease of use for contractors looking to simplify their tax reporting process.