Keeping track of your finances is essential for maintaining a healthy budget and avoiding any potential overdraft fees or missed payments. One useful tool for managing your finances is a check ledger, which allows you to record all your transactions and monitor your spending.

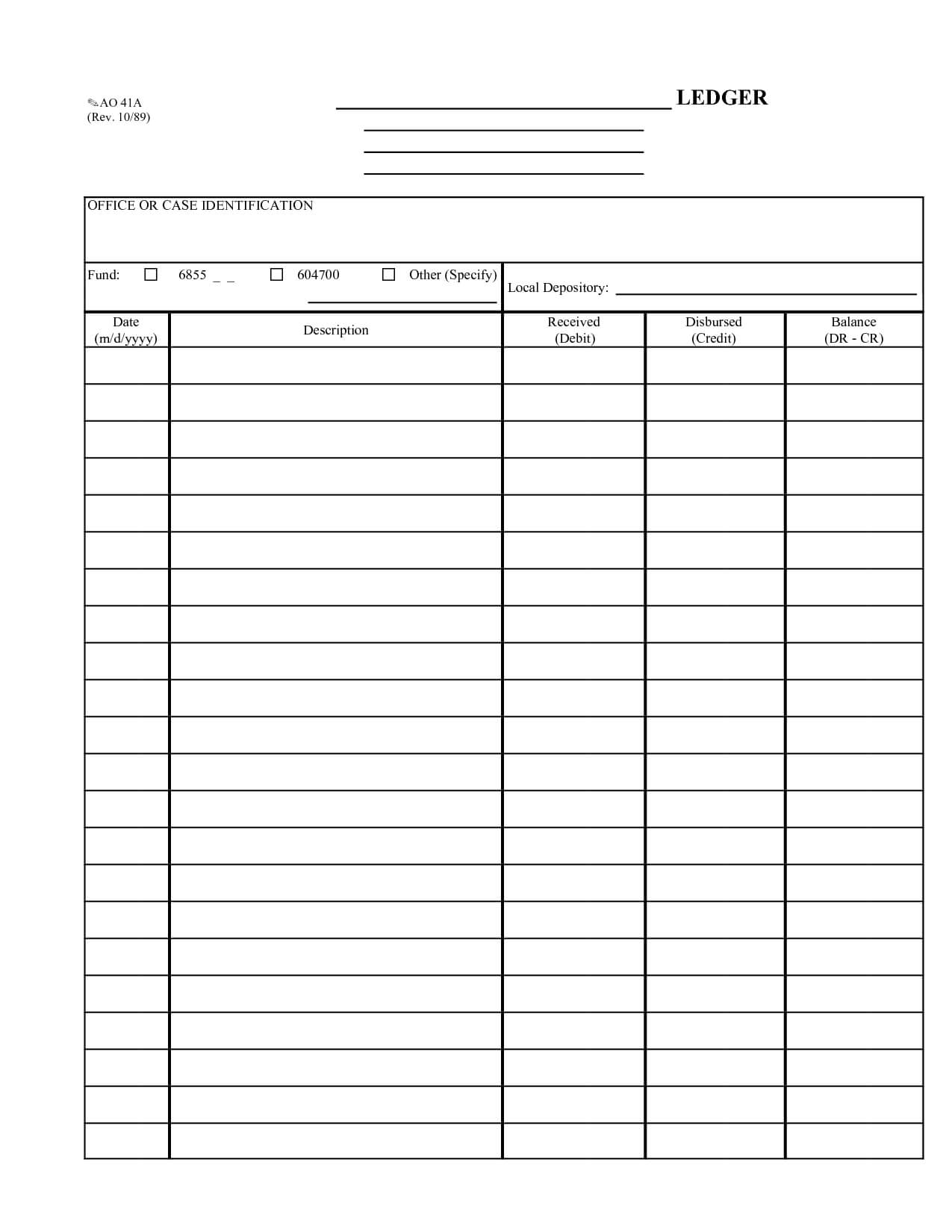

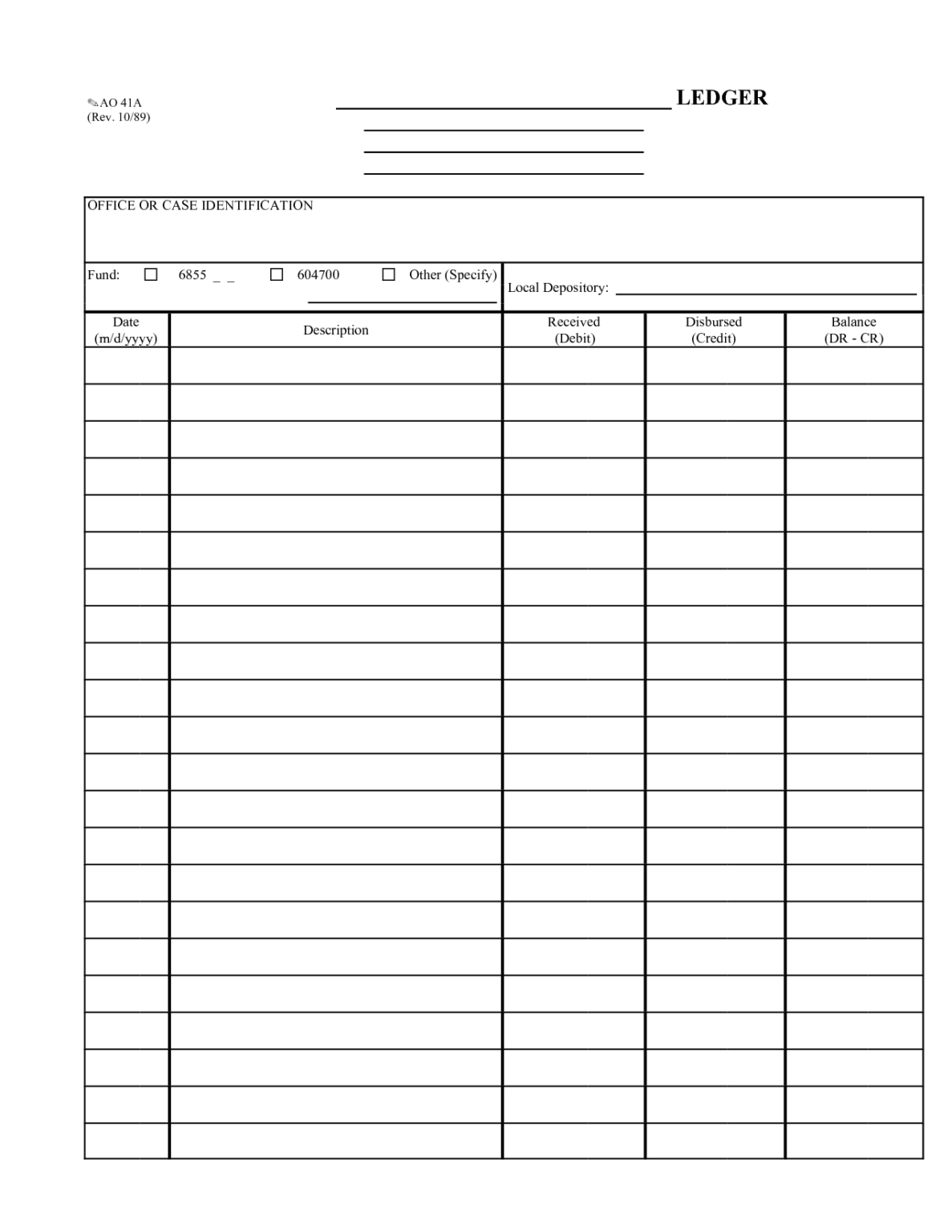

A printable check ledger is a convenient way to stay organized and keep track of your financial transactions. By having a physical record of your checks, deposits, and withdrawals, you can easily reconcile your bank statement and ensure that all your transactions are accounted for.

With a printable check ledger, you can easily input information such as the date of the transaction, the payee or recipient, the amount, and the current balance. This helps you to have a clear overview of your financial activity and make informed decisions about your spending.

Printable check ledgers come in various formats, from simple templates that you can fill in by hand to more advanced spreadsheets that you can customize to suit your specific needs. You can also find online tools and apps that allow you to track your transactions digitally and generate reports on your financial activity.

Whether you prefer a traditional pen-and-paper approach or a digital solution, using a printable check ledger can help you stay on top of your finances and avoid any financial pitfalls. By taking the time to record your transactions and review your spending habits, you can make smarter financial decisions and work towards achieving your financial goals.

In conclusion, a printable check ledger is a valuable tool for managing your finances and staying organized. Whether you choose to use a physical ledger or a digital solution, keeping track of your transactions is essential for maintaining a healthy budget and avoiding any financial surprises. By using a check ledger, you can take control of your finances and work towards a more secure financial future.