Keeping track of your finances is essential for managing your money effectively. One tool that can help you stay organized is a check register for your checkbook. A printable check register allows you to record all your transactions in one place, making it easy to monitor your spending and balance your accounts.

With a printable check register, you can track every check you write, every deposit you make, and every transaction you have on your account. This can help you avoid overdraft fees, identify any errors, and keep a close eye on your finances. By using a check register, you can ensure that your account is always up to date and accurate.

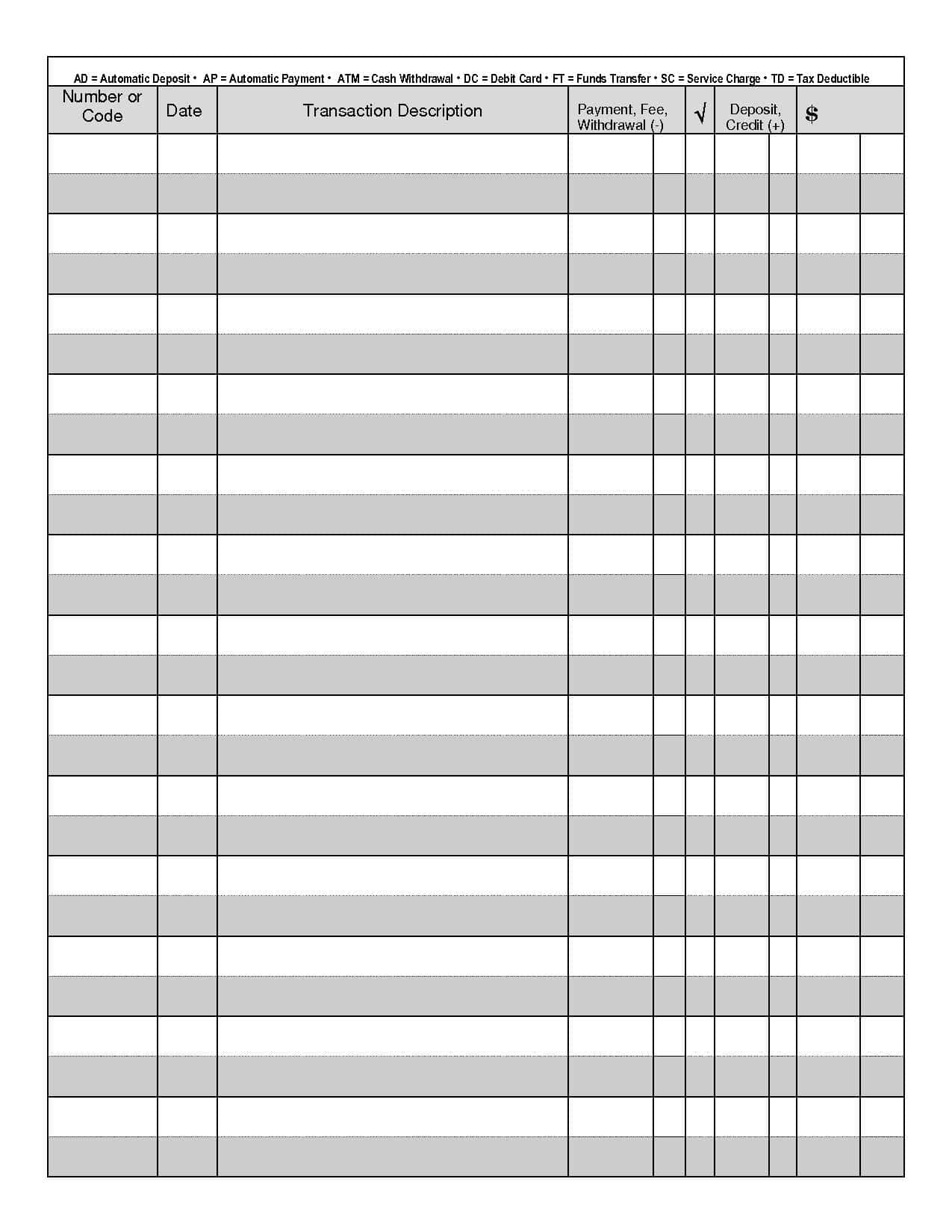

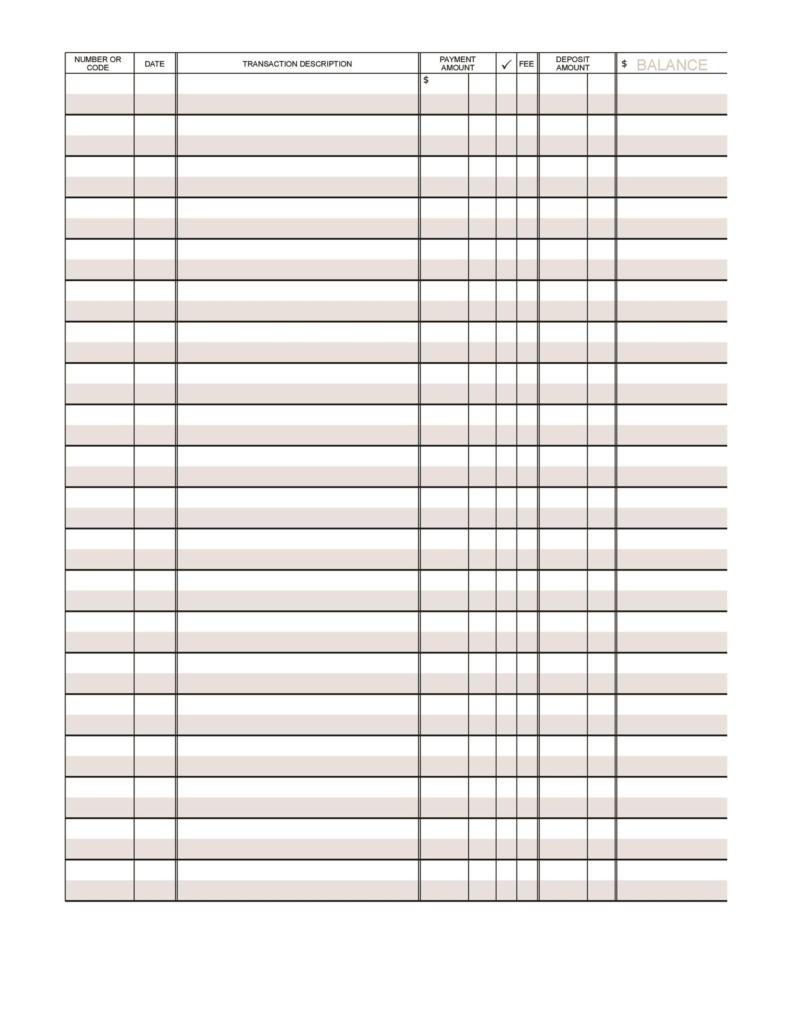

Printable Check Register For Checkbook

Printable Check Register For Checkbook

Printable check registers come in various formats, including templates that you can download and print for free. These templates typically have columns for the date, check number, description, and amount of each transaction. Some templates also include columns for the deposit amount, balance, and any additional notes you may want to add. You can customize the register to suit your needs and preferences.

Using a printable check register can also help you create a budget and set financial goals. By tracking your expenses and income, you can see where your money is going and make adjustments as needed. You can also identify any areas where you may be overspending and find ways to save money. With a clear picture of your finances, you can make more informed decisions about your spending and saving habits.

In conclusion, a printable check register is a valuable tool for managing your finances and staying organized. By recording all your transactions in one place, you can easily track your spending, avoid overdrafts, and monitor your account balance. Using a check register can also help you create a budget, set financial goals, and make informed decisions about your money. Consider using a printable check register for your checkbook to take control of your finances and achieve your financial goals.