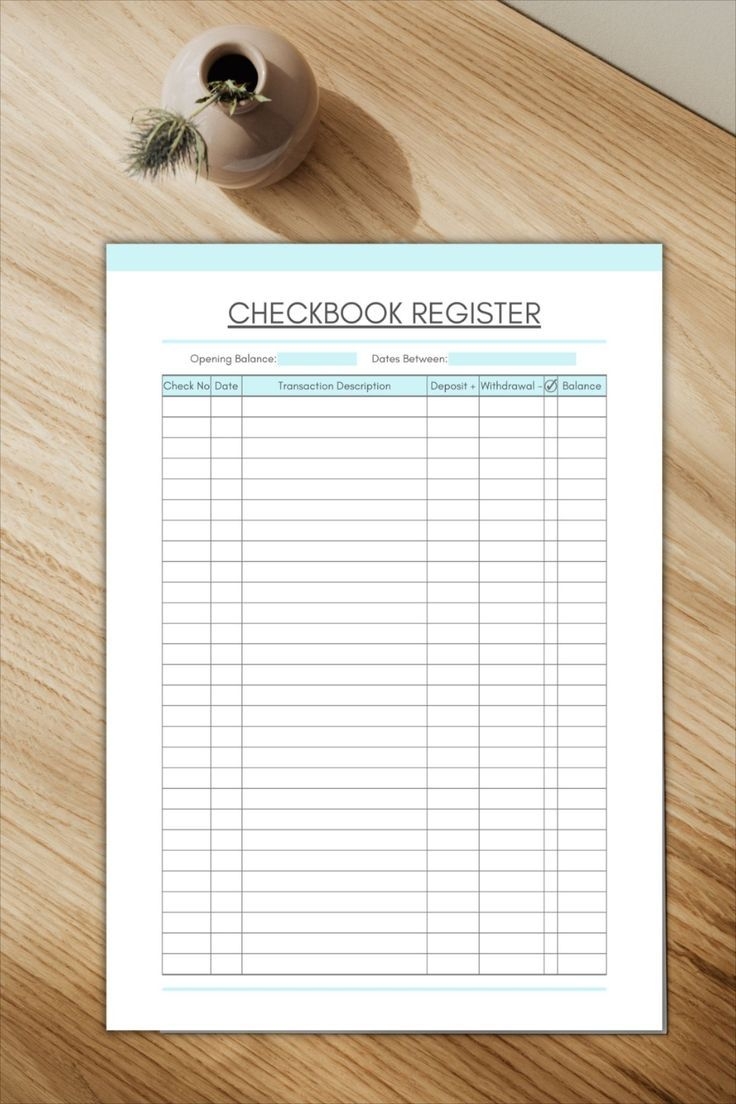

Managing your finances is an essential part of adulting, and one way to stay on top of your expenses is by using a checking register. A printable checking register can help you keep track of your transactions, monitor your spending habits, and ensure that you have enough funds in your account to cover your expenses.

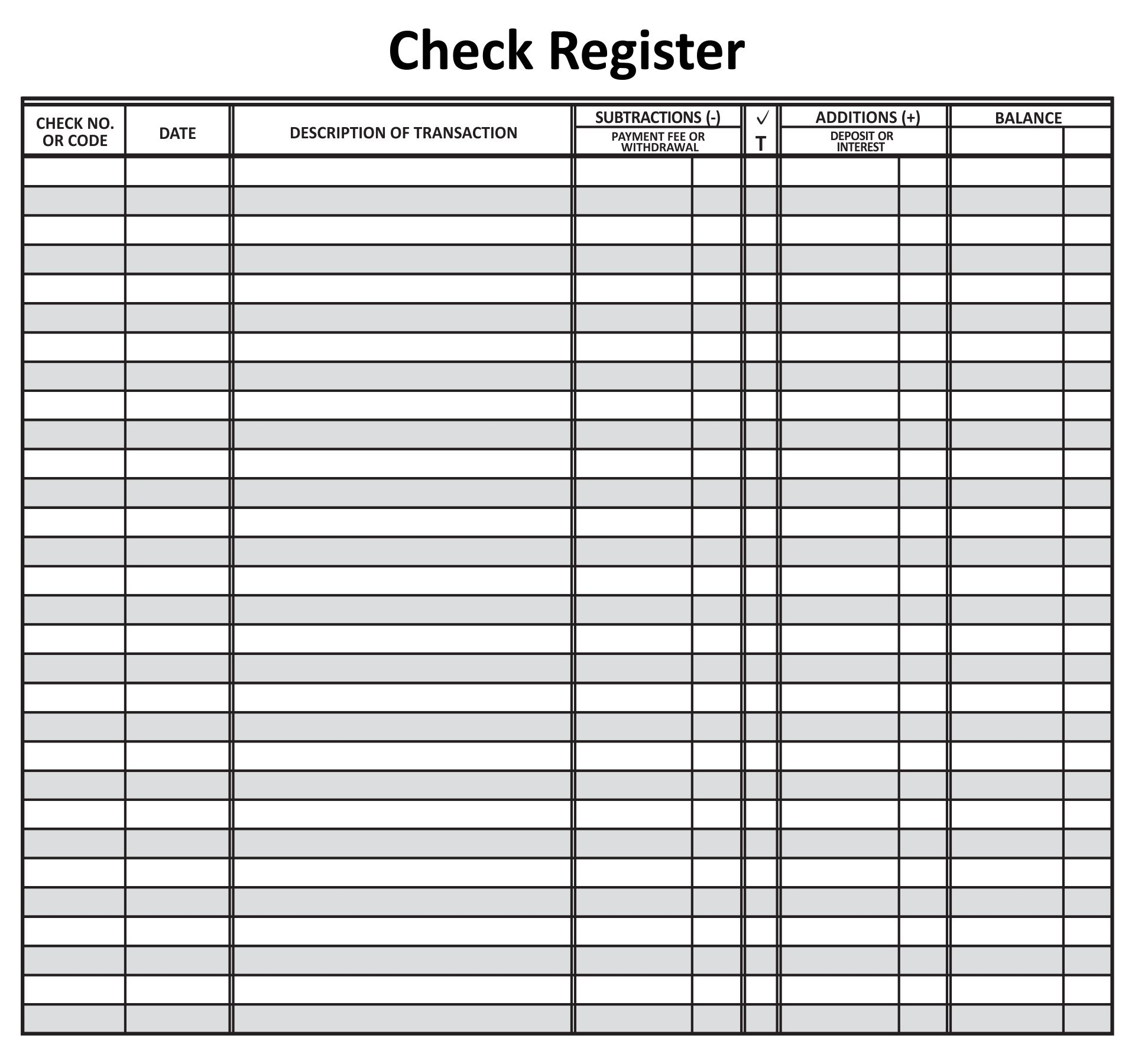

A printable checking register is a simple and effective tool that allows you to record all of your deposits, withdrawals, and other transactions in one place. By keeping a detailed record of your finances, you can easily track your account balance, identify any discrepancies, and avoid overdrawing your account.

One of the main benefits of using a printable checking register is that it provides a visual representation of your financial activity. By writing down each transaction, you can see where your money is going and make informed decisions about your spending habits. This can help you identify areas where you may be overspending and make adjustments to your budget accordingly.

In addition to helping you track your expenses, a printable checking register can also serve as a backup in case of discrepancies with your bank statement. By comparing your register to your monthly statement, you can quickly identify any errors or unauthorized transactions and take action to resolve them. This can help you avoid costly fees and protect your account from fraud.

Furthermore, using a printable checking register can help you stay organized and in control of your finances. By regularly updating your register with each transaction, you can ensure that you always have an accurate picture of your account balance. This can give you peace of mind knowing that you are on top of your finances and can make informed decisions about your money.

In conclusion, a printable checking register is a valuable tool for managing your finances and staying on top of your expenses. By keeping a detailed record of your transactions, you can track your spending habits, avoid overdrawing your account, and protect yourself from fraud. So, why not give it a try and see the difference it can make in your financial management?