Printable Form 1099 is an essential document used for reporting various types of income to the Internal Revenue Service (IRS). It is typically used by employers, financial institutions, and other entities to report income earned by individuals, such as independent contractors, freelancers, and investors.

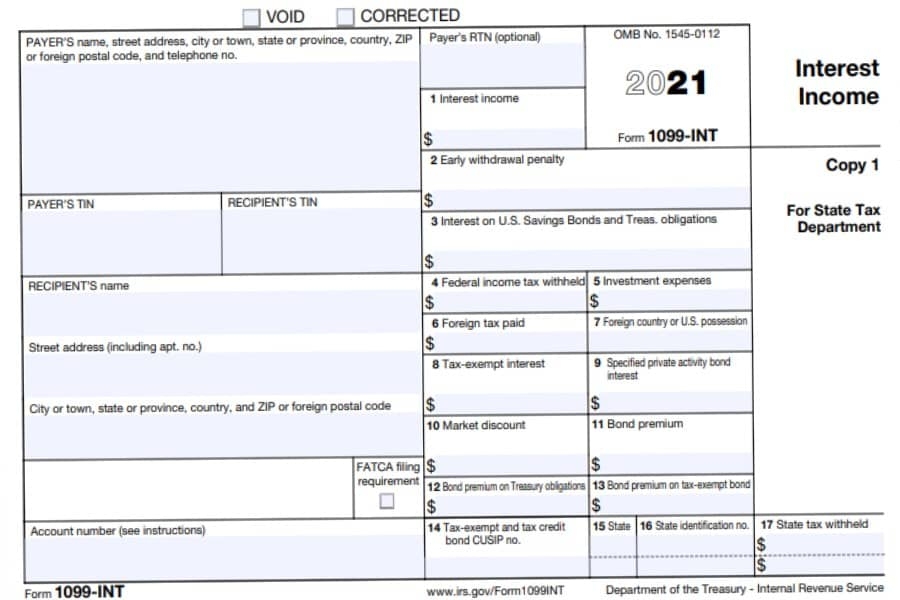

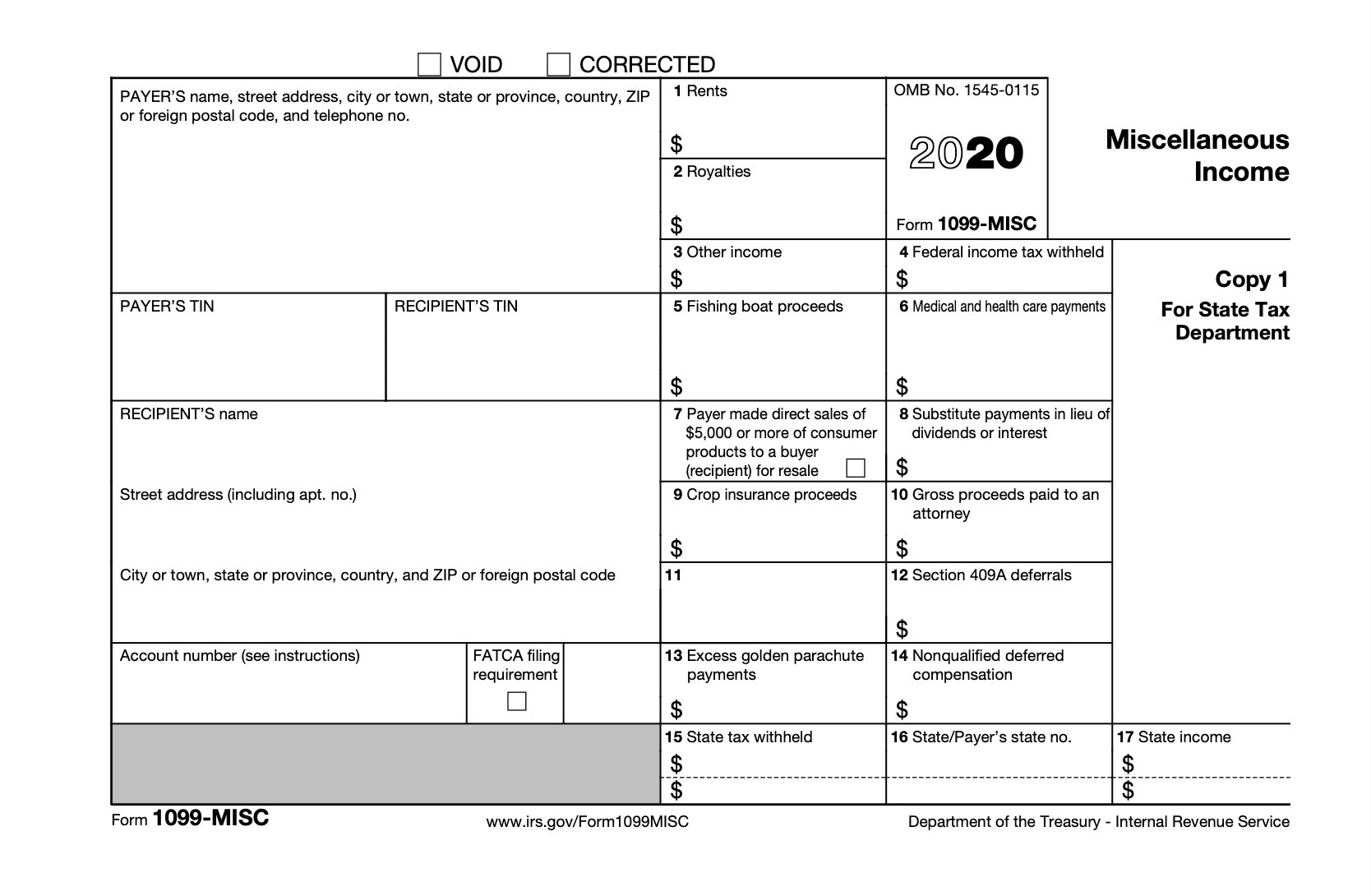

Form 1099 comes in several variations, each used to report different types of income. Some common types of Form 1099 include Form 1099-MISC for miscellaneous income, Form 1099-INT for interest income, and Form 1099-DIV for dividend income. These forms are crucial for individuals to accurately report their income and ensure compliance with tax laws.

One of the benefits of Printable Form 1099 is that it provides a standardized format for reporting income, making it easier for individuals to understand and fill out. Additionally, printable versions of Form 1099 are readily available online, allowing individuals to easily access and print the forms they need for tax purposes.

When using Printable Form 1099, it is important to carefully review the information provided on the form to ensure accuracy. Any discrepancies or errors should be addressed promptly to avoid potential penalties or audits by the IRS. It is also advisable to keep copies of all Form 1099 documents for your records.

In conclusion, Printable Form 1099 is a vital tool for accurately reporting income to the IRS. By utilizing these forms and ensuring their accuracy, individuals can avoid potential tax issues and comply with federal tax laws. Remember to consult with a tax professional if you have any questions or concerns about using Form 1099 for tax reporting purposes.