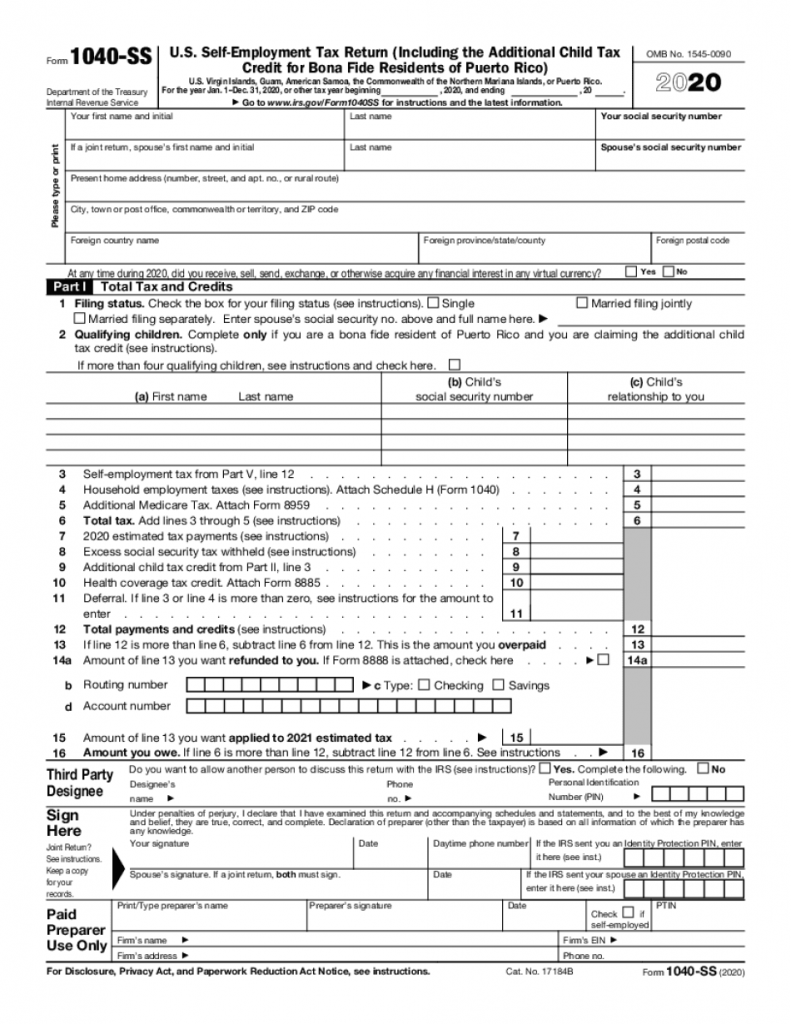

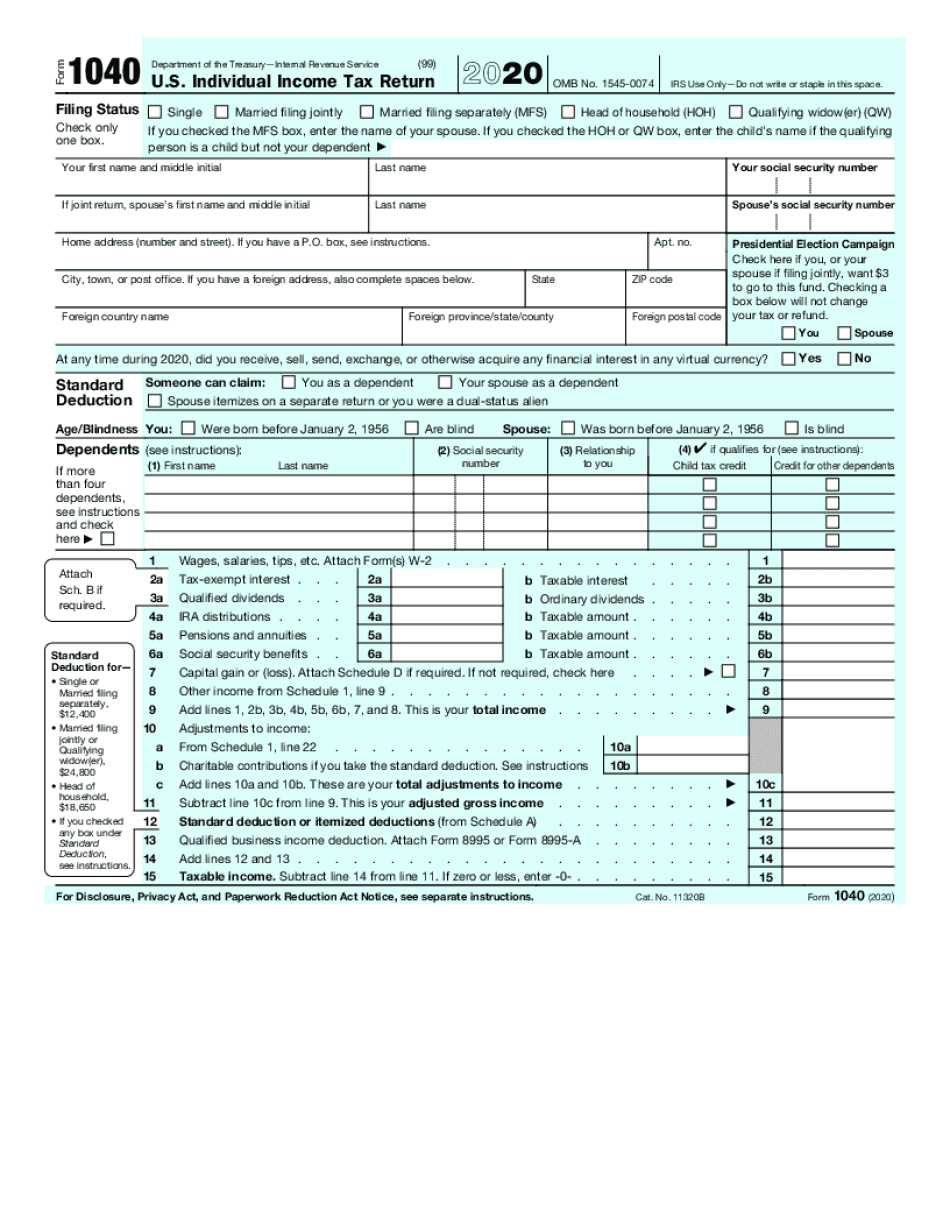

When it comes to filing your taxes, having the right forms is essential. One of the most commonly used forms is the IRS Form 1040, which is used by individuals to report their annual income and calculate their tax liability. This form is crucial for accurately reporting your financial information to the Internal Revenue Service (IRS) and ensuring that you are paying the correct amount of taxes.

Printable IRS Form 1040 is readily available online for individuals to download and fill out. This form is used to report various types of income, deductions, and credits, and is the main form used by most taxpayers to file their federal income tax return. By using the printable version of Form 1040, you can easily fill out the form at your convenience and submit it to the IRS either electronically or by mail.

When filling out IRS Form 1040, it is important to carefully follow the instructions provided and ensure that all information is accurate and up to date. The form is divided into several sections, including personal information, income, deductions, and credits. By filling out each section correctly, you can avoid errors and potential audits from the IRS.

One of the key benefits of using the printable version of IRS Form 1040 is that it allows you to access the form at any time and fill it out at your own pace. This can be particularly helpful for individuals who prefer to file their taxes on their own and want to take their time reviewing their financial information before submitting it to the IRS.

Additionally, using the printable version of IRS Form 1040 can help you save time and money by avoiding the need to visit a tax professional or purchase expensive tax software. By simply downloading the form from the IRS website, you can easily fill it out on your computer or print it out and complete it by hand.

In conclusion, Printable IRS Form 1040 is a valuable tool for individuals who need to report their annual income and calculate their tax liability. By using the printable version of this form, you can easily access and fill out the form at your convenience, ensuring that you accurately report your financial information to the IRS.