As the tax filing deadline approaches, many individuals find themselves scrambling to gather all their necessary documents and information. However, for those who need a little extra time to file their taxes, the IRS offers an extension with Form 4868. This form allows taxpayers to request an additional six months to submit their tax return, giving them until October 15th to file.

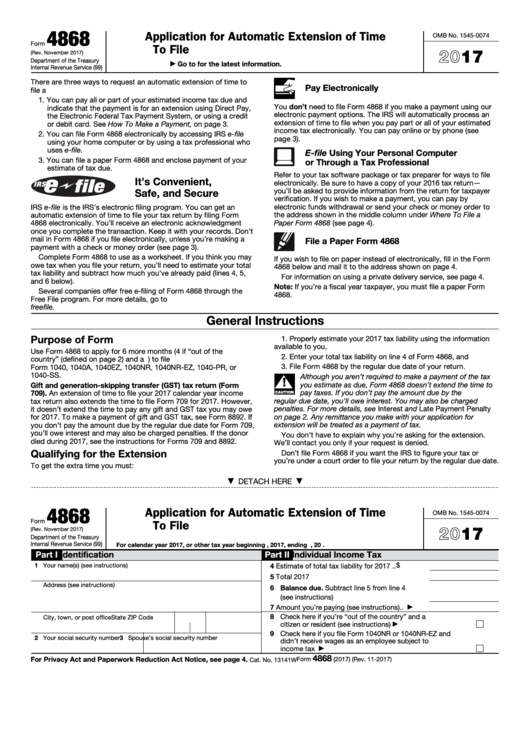

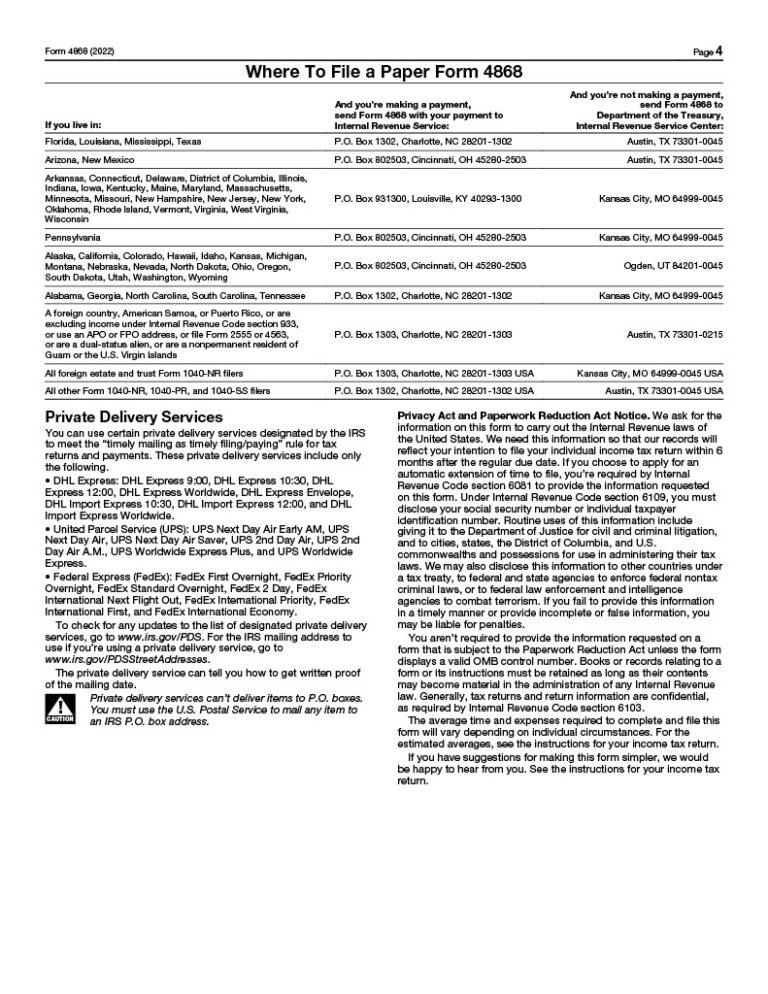

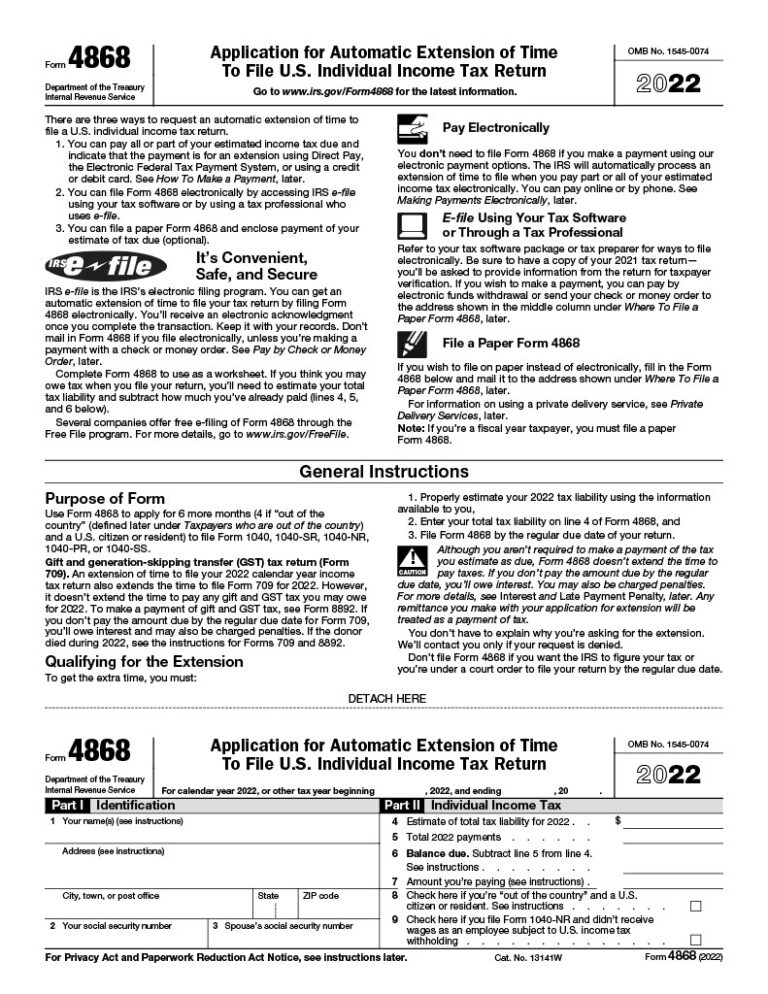

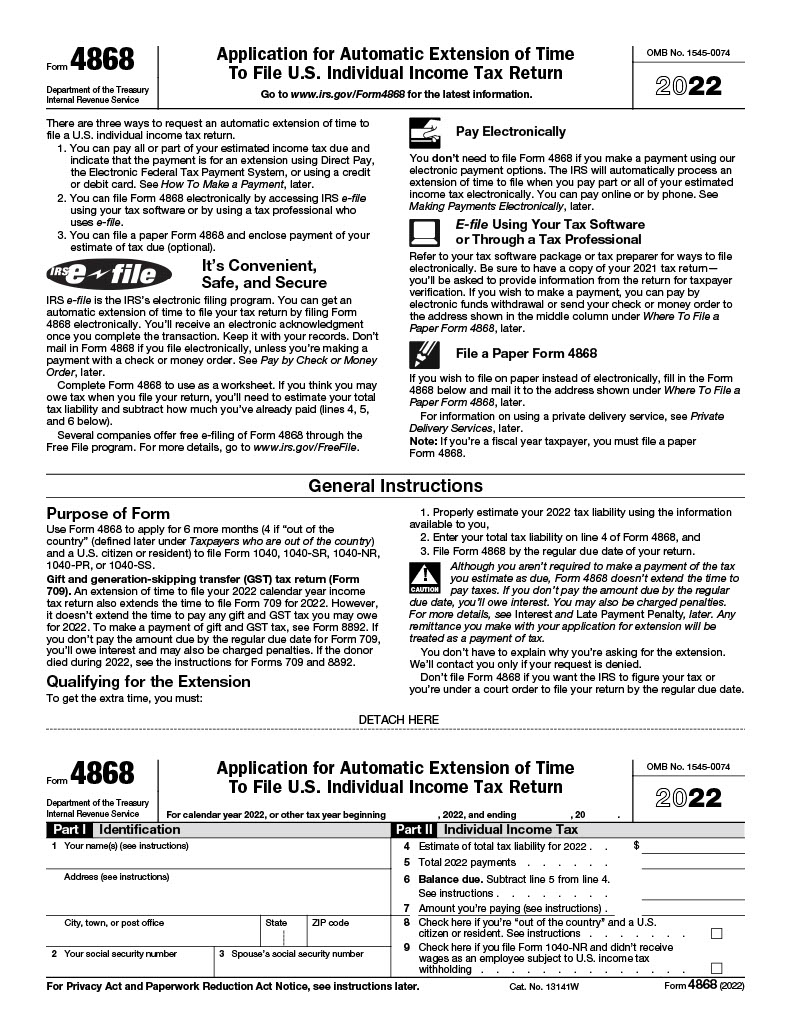

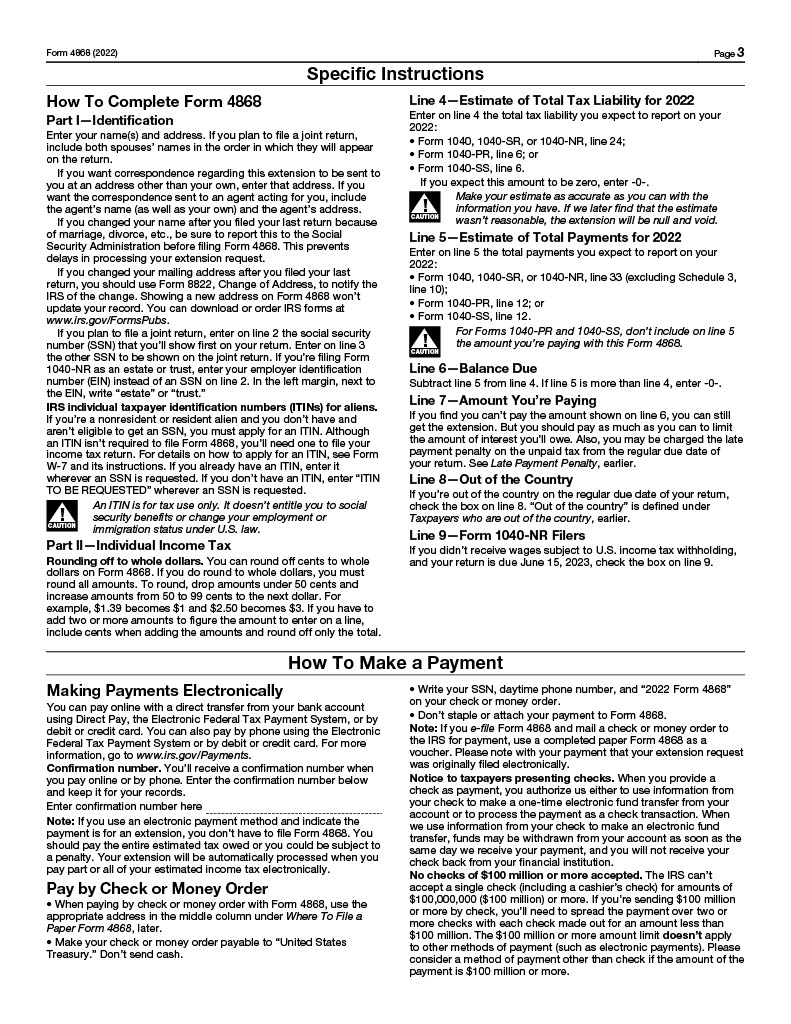

IRS Form 4868 is a simple one-page document that can be easily filled out and submitted online or by mail. It requires basic information such as your name, address, social security number, and estimated tax liability. By submitting this form, you can avoid late filing penalties and interest charges that may accrue if you miss the original deadline.

One of the benefits of using Form 4868 is that it provides peace of mind for taxpayers who may be facing unexpected circumstances or delays in gathering their financial information. By requesting an extension, you can avoid the stress of rushing to meet the original deadline and ensure that your tax return is accurate and complete.

When completing Form 4868, it’s important to remember that an extension of time to file does not mean an extension of time to pay. If you owe taxes, you are still required to estimate and pay the amount due by the original deadline to avoid penalties and interest. However, by submitting Form 4868, you can avoid the failure-to-file penalty, which is significantly higher than the failure-to-pay penalty.

Overall, Printable IRS Form 4868 is a valuable tool for taxpayers who need extra time to file their tax return. By submitting this form, you can avoid penalties and interest charges while ensuring that your tax return is accurate and complete. So if you find yourself needing more time to gather your financial information, consider using Form 4868 to request an extension and give yourself until October 15th to file.

Don’t wait until the last minute to file your taxes – take advantage of IRS Form 4868 and give yourself the extra time you need to complete your tax return accurately and on time.

Quickly Access and Print Printable Irs Form 4868

IRS Form 4868 Extension Printable 4868 Form 2023

IRS Form 4868 Extension Printable 4868 Form 2023

IRS Form 4868 Extension Printable 4868 Form 2023

IRS Form 4868 Extension Printable 4868 Form 2023

IRS Form 4868 Extension Printable 4868 Form 2023

IRS Form 4868 Extension Printable 4868 Form 2023

IRS Form 4868 Extension Printable 4868 Form 2023

IRS Form 4868 Extension Printable 4868 Form 2023

IRS Form 4868 Extension Printable 4868 Form 2023

IRS Form 4868 Extension Printable 4868 Form 2023

Ultimately, Printable Irs Form 4868 are a cost-effective, efficient, and trusted solution for organizations of all sizes. They assist in streamlining payroll processing, providing prompt employee payments and precise financial records. With user-friendly templates and professional software, you can create checks without third-party services. Whether you’re a small business or expanding firm, printable payroll checks improve efficiency and reduce admin work. Start today with a quality Printable Irs Form 4868 solution to optimize your payroll process.