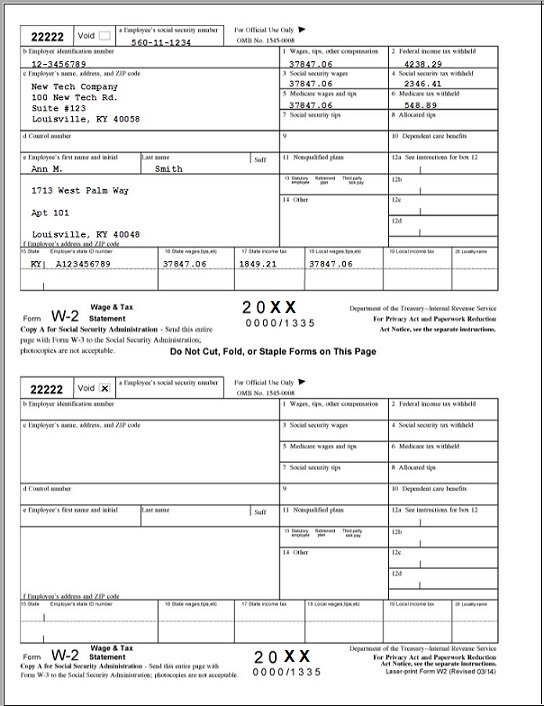

As tax season approaches, it is important for employers to provide their employees with the necessary tax forms, such as the W-2 form. This form is crucial for individuals to accurately file their taxes and report their income. While many companies provide their employees with a physical copy of the W-2 form, there are also options available for employees to access and print their W-2 form online.

Printable W-2 forms are easily accessible for employees who prefer to have a digital copy of their tax documents. With just a few clicks, employees can access their W-2 form through their employer’s online portal and print it from the comfort of their own home. This convenience eliminates the need to wait for a physical copy to arrive in the mail, allowing individuals to file their taxes in a timely manner.

Printable W 2 Form

Printing a W-2 form online is a simple process that can save time and hassle for both employers and employees. By providing employees with the option to access their W-2 form digitally, companies can streamline the tax filing process and ensure that their employees have all the necessary documents at their fingertips.

It is important for individuals to ensure that the information on their printable W-2 form is accurate before filing their taxes. Any discrepancies or errors on the form could result in delays or penalties from the IRS. By double-checking the information on the form, individuals can avoid potential issues and file their taxes with confidence.

Overall, printable W-2 forms offer a convenient and efficient way for employees to access and print their tax documents. By utilizing this option, individuals can easily stay organized during tax season and ensure that they have all the necessary forms to file their taxes accurately.

As tax season approaches, be sure to take advantage of printable W-2 forms to streamline the tax filing process and avoid any potential issues with the IRS. By accessing and printing your W-2 form online, you can save time and ensure that your taxes are filed accurately and on time.