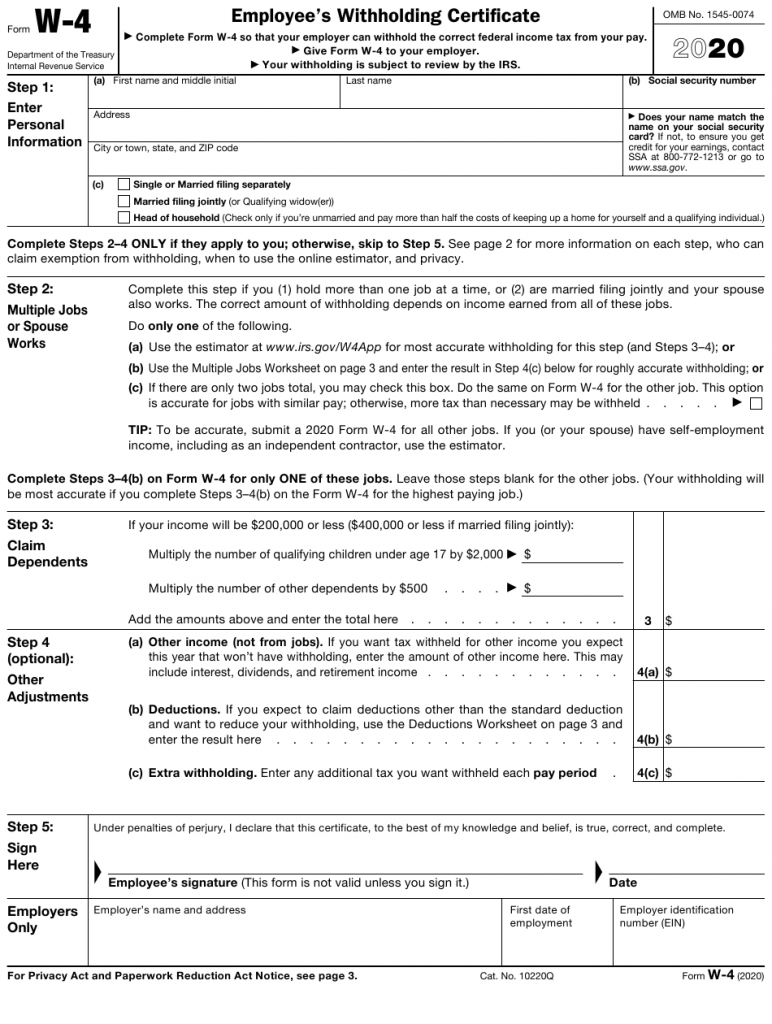

When starting a new job, one of the first forms you will need to fill out is the W-4 form. This form is used by employers to determine how much federal income tax to withhold from your paycheck. It’s important to fill out this form accurately to avoid any discrepancies in your tax withholding.

While many employers provide a paper W-4 form for you to fill out, you also have the option to download and print a W-4 form online. This printable form allows you to fill it out at your own convenience and submit it to your employer.

Printable W-4 Form

When filling out the W-4 form, you will need to provide information such as your name, address, filing status, and the number of allowances you are claiming. It’s important to accurately calculate your allowances to ensure that the correct amount of tax is withheld from your paycheck.

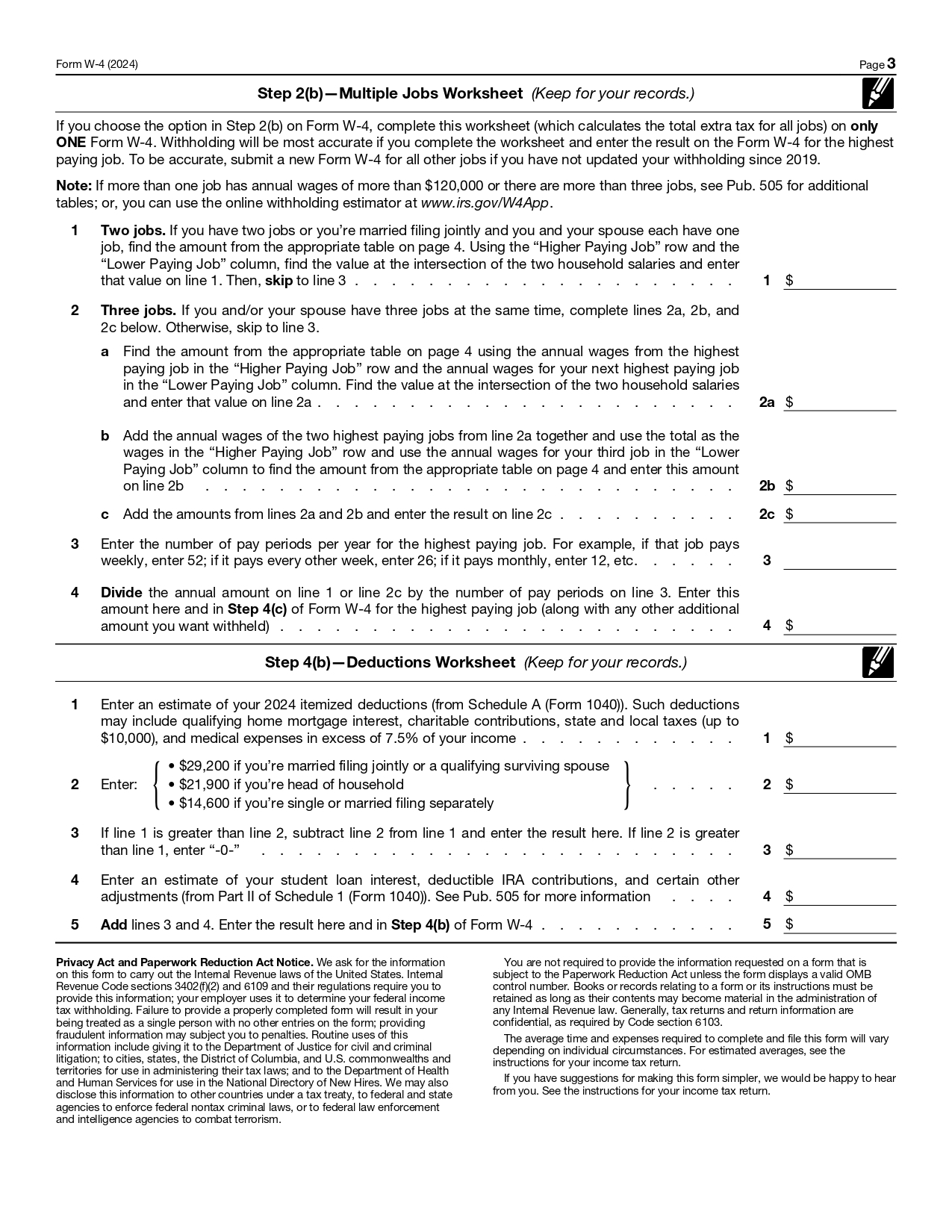

Additionally, if you have multiple jobs or are married filing jointly, you may need to use the IRS withholding calculator to determine the appropriate number of allowances to claim on your W-4 form. This will ensure that you are not underpaying or overpaying your taxes throughout the year.

Once you have completed the W-4 form, you will need to submit it to your employer for processing. Your employer will use the information provided on the form to calculate the amount of federal income tax to withhold from your paycheck. It’s important to review your pay stubs periodically to ensure that the correct amount of tax is being withheld.

Overall, the W-4 form is a crucial document that determines how much federal income tax is withheld from your paycheck. By using a printable W-4 form, you can easily fill it out and submit it to your employer for processing. Make sure to accurately calculate your allowances to avoid any issues with your tax withholding.

In conclusion, the W-4 form is an essential document that all employees must fill out when starting a new job. By using a printable W-4 form, you can easily provide the necessary information to your employer and ensure that the correct amount of federal income tax is withheld from your paycheck. Be sure to review your pay stubs regularly to confirm that your tax withholding is accurate.