When it comes to tax season, having the right forms on hand is essential. One of the most commonly used forms is the W-9 form, which is used to collect information from independent contractors, freelancers, and other non-employees. Having a printable version of the W-9 form can make the process of gathering this information much easier and more convenient.

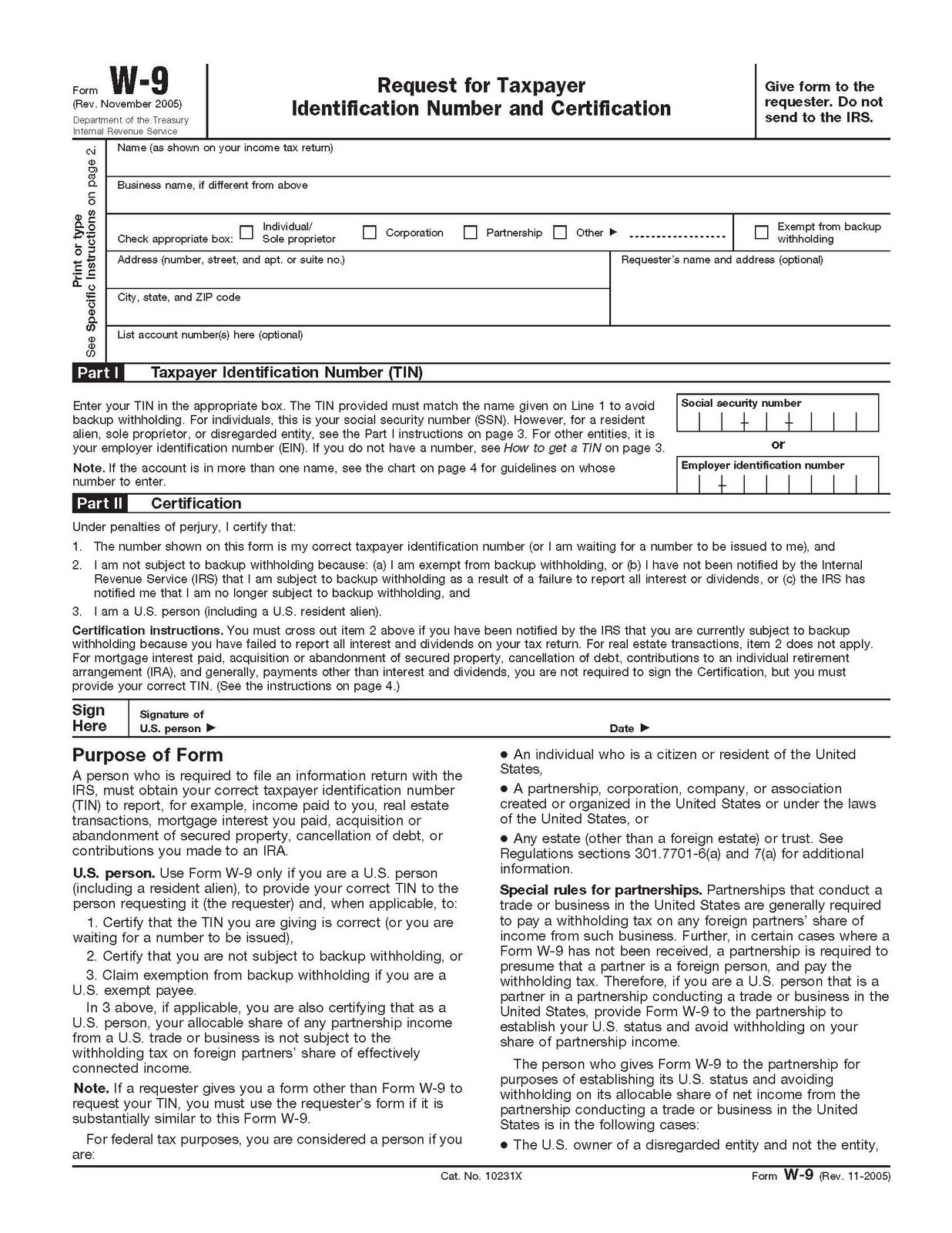

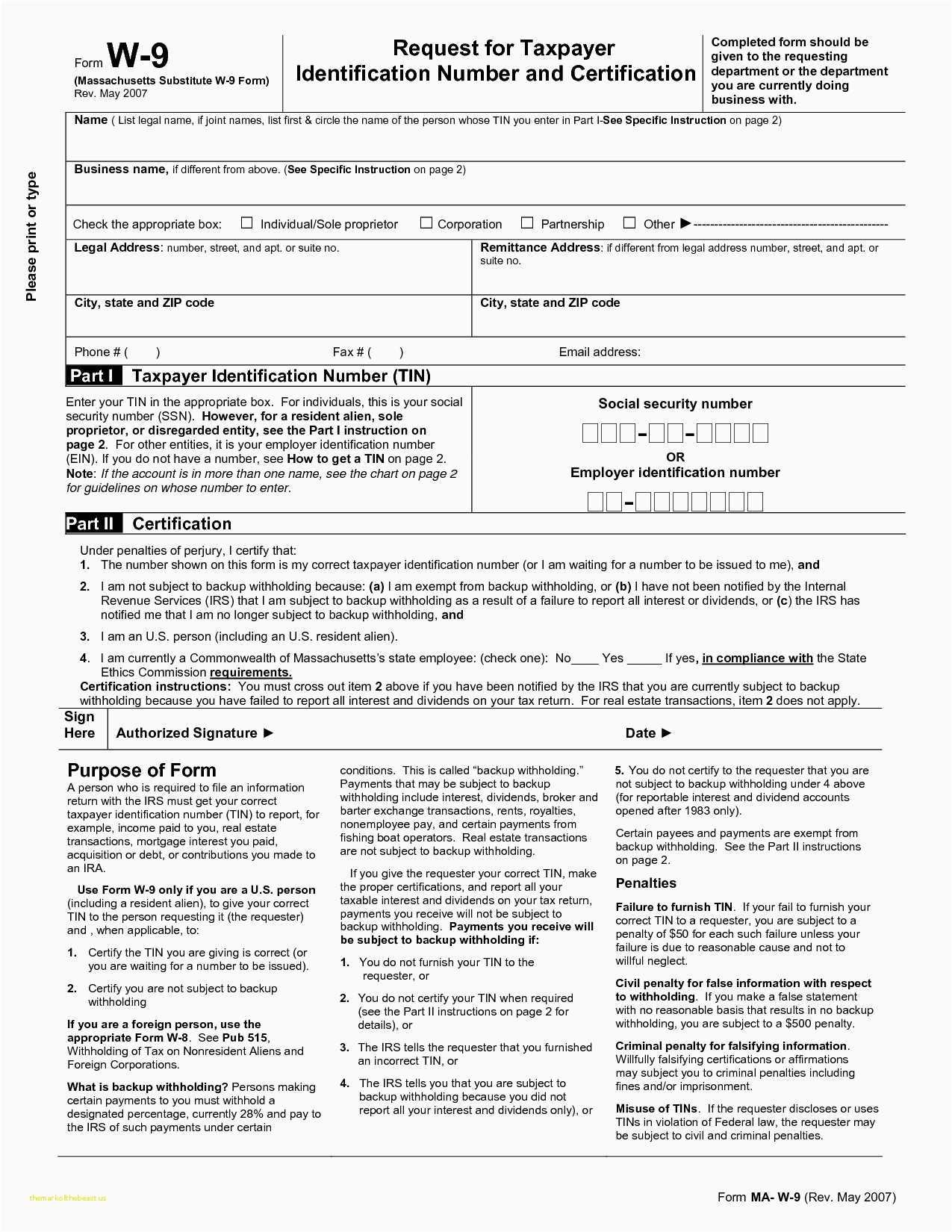

A printable W-9 form is a document that can be easily downloaded and printed from the internet. This form is used by businesses to collect the necessary information from individuals or entities that they will be paying for services rendered. The form includes fields for the individual or entity’s name, address, taxpayer identification number, and certification.

Having a printable version of the W-9 form can be beneficial for both the payer and the payee. It ensures that all the required information is accurately collected and documented. It also makes the process more efficient as the form can be easily distributed and completed electronically.

Additionally, having a printable W-9 form allows for better record-keeping and organization. Once the form is completed and submitted, it can be saved electronically or in hard copy for future reference. This can be especially helpful during tax season or in the event of an audit.

In conclusion, having a printable W-9 form is a convenient and efficient way to collect important information from individuals or entities that you will be making payments to. Whether you are a business owner or a freelancer, having this form readily available can streamline the process and ensure compliance with tax regulations.

So, make sure to have a printable W-9 form on hand for your tax and payment needs. It will make the process smoother and more organized for everyone involved.