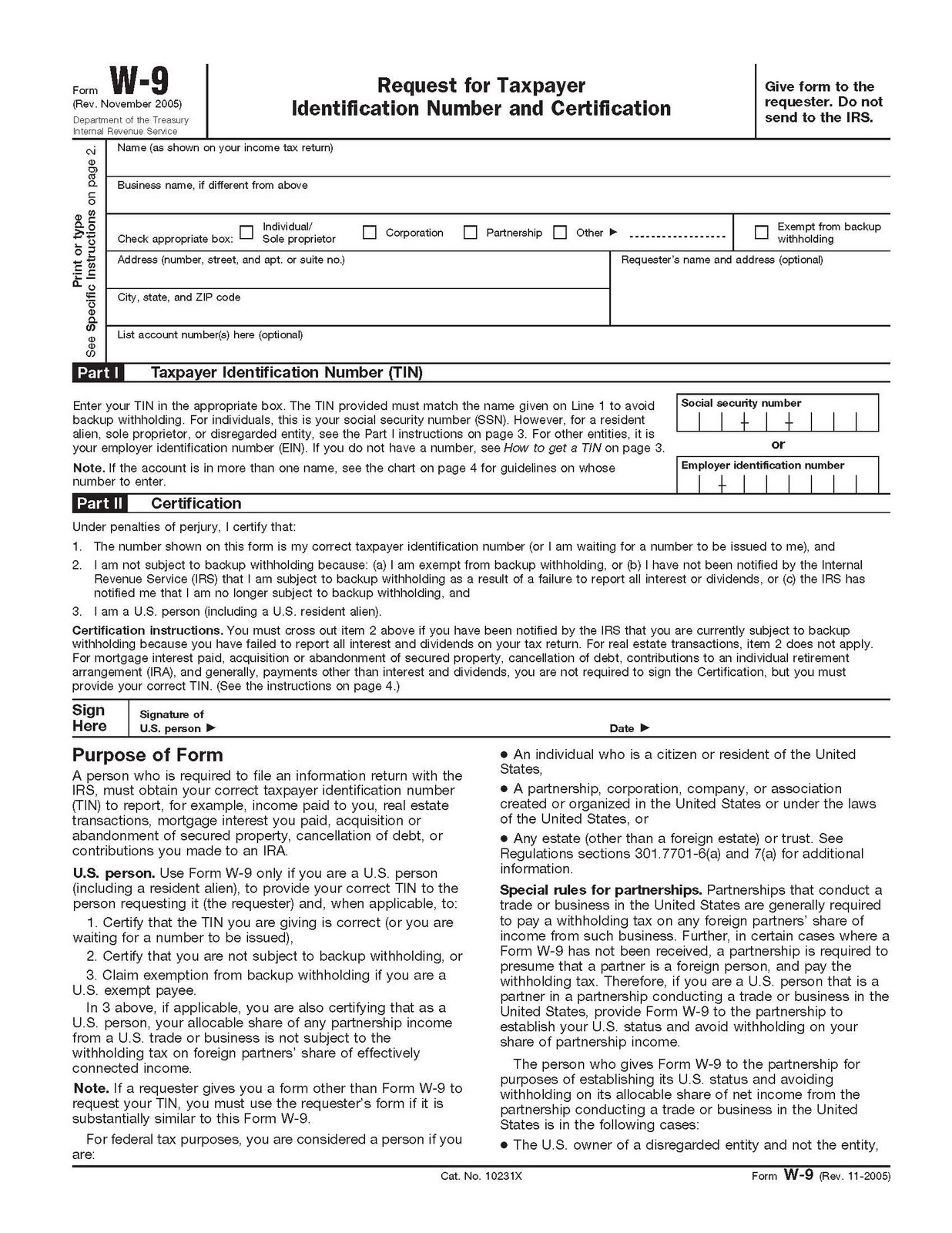

One of the most commonly used tax forms in the United States is the W-9 form. This form is used by businesses to request information from independent contractors and freelancers they hire. The information provided on the W-9 form is used to report payments made to these individuals to the IRS. It is important for both businesses and contractors to understand how to properly fill out and submit this form to avoid any potential issues with the IRS.

With the new year approaching, it’s important to be aware of any updates or changes to tax forms. The Printable W-9 Form 2024 is a crucial document for both businesses and independent contractors. It provides a clear and standardized way to collect taxpayer information for reporting purposes. By having a printable version of the W-9 form readily available, businesses can easily gather the necessary information from their contractors.

Printable W-9 Form 2024

The Printable W-9 Form 2024 is a user-friendly document that simplifies the process of collecting taxpayer information. It includes all the necessary fields for contractors to provide their name, address, taxpayer identification number, and certification. This form is essential for businesses to accurately report payments made to contractors and avoid any penalties for non-compliance.

When filling out the Printable W-9 Form 2024, contractors should ensure that all information provided is accurate and up to date. Any discrepancies or errors on the form could lead to delays in payment processing or even IRS audits. It’s important to carefully review the form before submitting it to the business requesting the information.

Businesses should also be diligent in collecting and storing W-9 forms from their contractors. Keeping accurate records of payments made and taxpayer information provided is crucial for tax reporting purposes. By using the Printable W-9 Form 2024, businesses can streamline this process and ensure compliance with IRS regulations.

In conclusion, the Printable W-9 Form 2024 is a valuable tool for both businesses and independent contractors. By understanding the importance of this form and how to properly fill it out, both parties can avoid any potential issues with the IRS. Make sure to have this form readily available for easy access and use in the upcoming tax year.