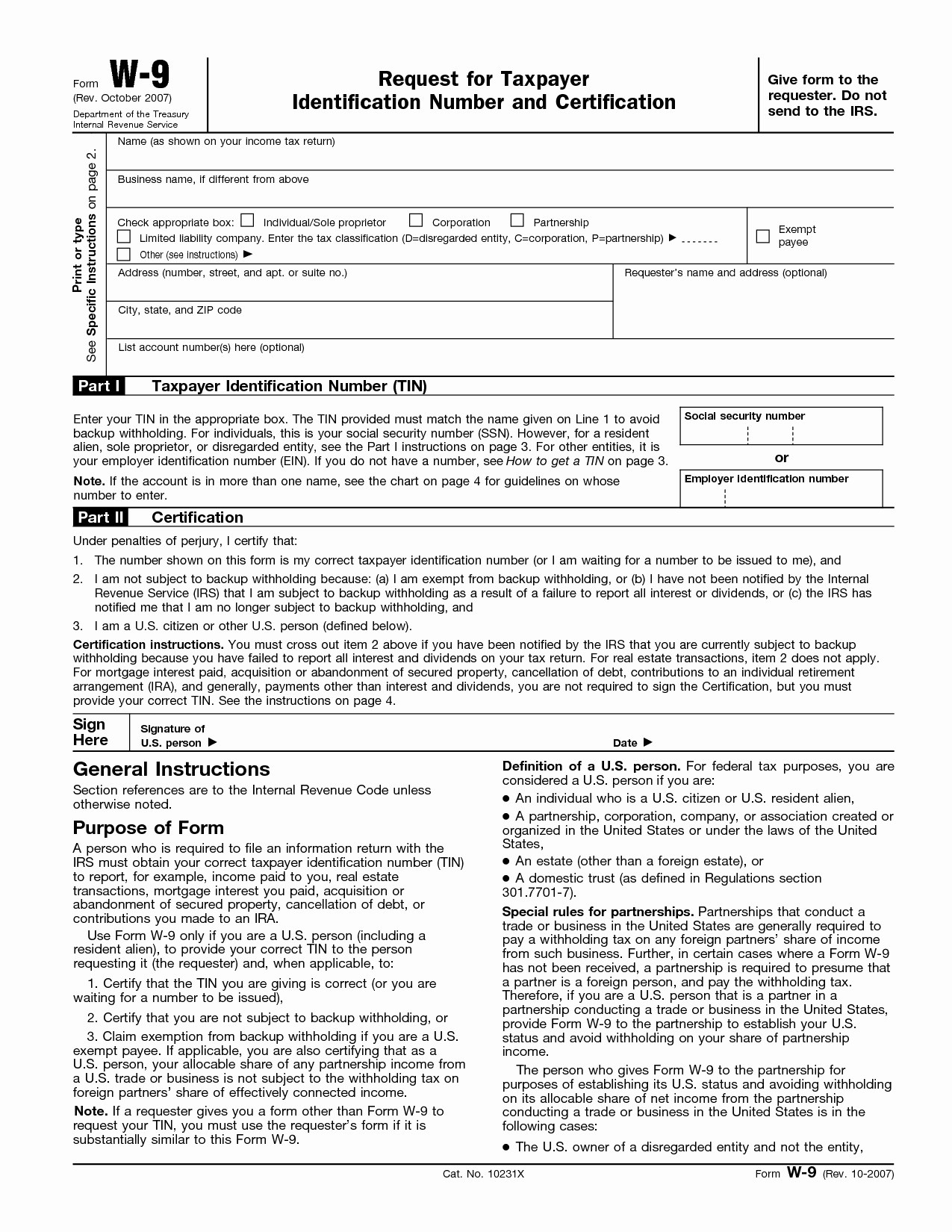

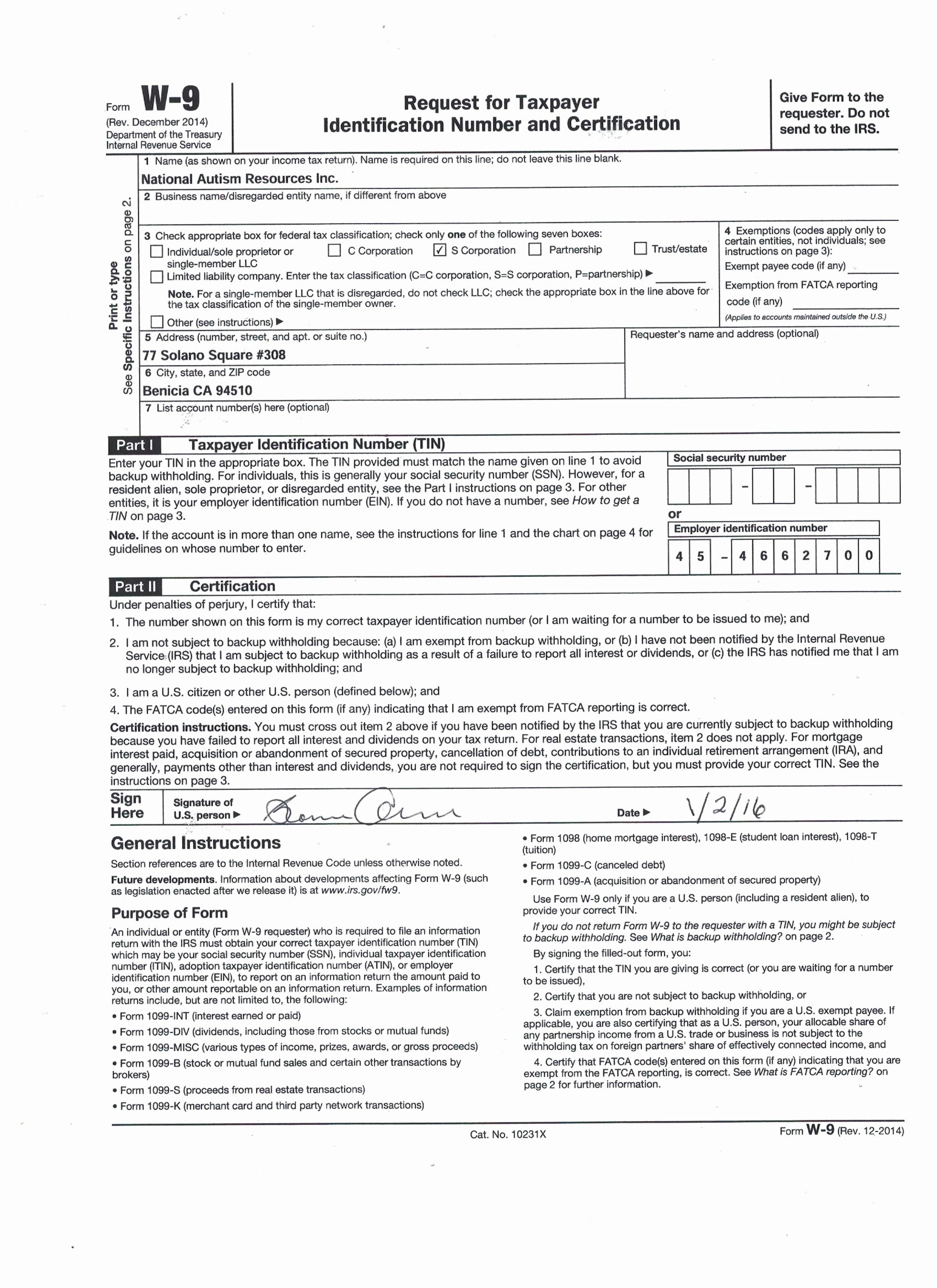

When it comes to tax season, it’s important for businesses to have all the necessary forms in order to accurately report their income and expenses. One such form that is commonly used is the W-9 form, which is used to request taxpayer identification information from independent contractors or freelancers. The W-9 form is crucial for businesses to have on file in order to accurately report payments made to these individuals.

For the year 2025, businesses can access and utilize the Printable W-9 Form 2025 to ensure they have the most up-to-date information and forms for tax reporting purposes. This form can be easily downloaded and printed for use with independent contractors and freelancers who need to provide their taxpayer information to the business.

With the Printable W-9 Form 2025, businesses can rest assured that they are using the correct form for tax reporting purposes. This form includes all the necessary fields for individuals to provide their name, address, taxpayer identification number, and certification information. By having this form on file, businesses can accurately report payments made to independent contractors and freelancers, helping to avoid any potential tax issues down the road.

It’s important for businesses to stay organized and compliant with tax regulations, and having the Printable W-9 Form 2025 on hand is a key step in this process. By utilizing this form, businesses can ensure that they have all the necessary information to accurately report income and expenses to the IRS.

Overall, the Printable W-9 Form 2025 is a valuable tool for businesses looking to stay compliant with tax regulations and accurately report payments made to independent contractors and freelancers. By having this form on hand, businesses can streamline their tax reporting processes and avoid any potential issues with the IRS.

Make sure to download and utilize the Printable W-9 Form 2025 for your business’s tax reporting needs to ensure compliance and accuracy in reporting income and expenses. By using this form, you can simplify the process of gathering taxpayer information from independent contractors and freelancers, making tax season a little bit easier for your business.