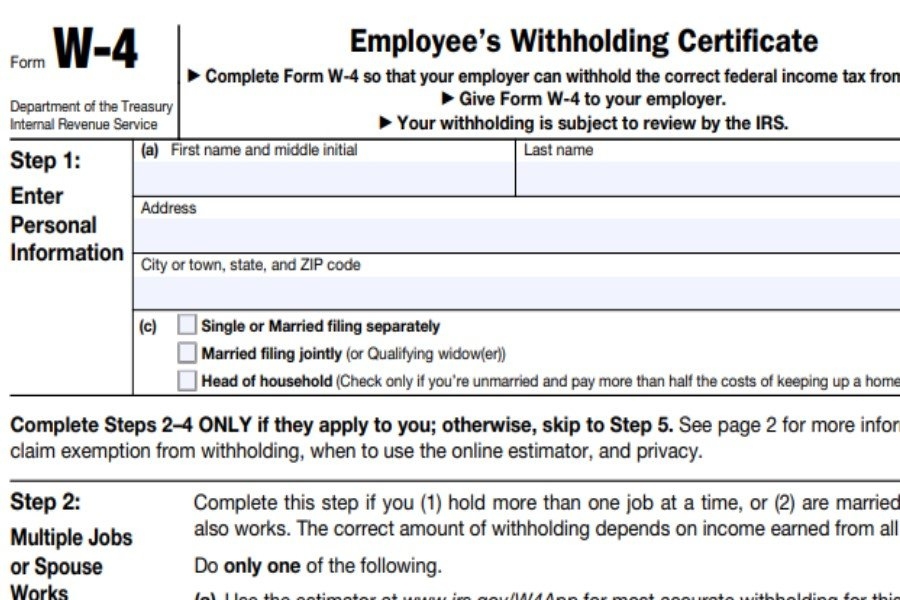

When starting a new job, one of the first things you’ll need to do is fill out a W4 form. This form is used by your employer to determine how much federal income tax to withhold from your paycheck. It’s important to fill out this form accurately to ensure that the right amount of tax is being withheld. Fortunately, there are printable W4 forms available online that make the process quick and easy.

Printable W4 forms are readily available on the IRS website and various other online resources. These forms can be easily downloaded, filled out, and submitted to your employer. They typically include sections for your personal information, filing status, and any additional income or deductions you want to take into account. By using a printable W4 form, you can ensure that all the necessary information is captured correctly.

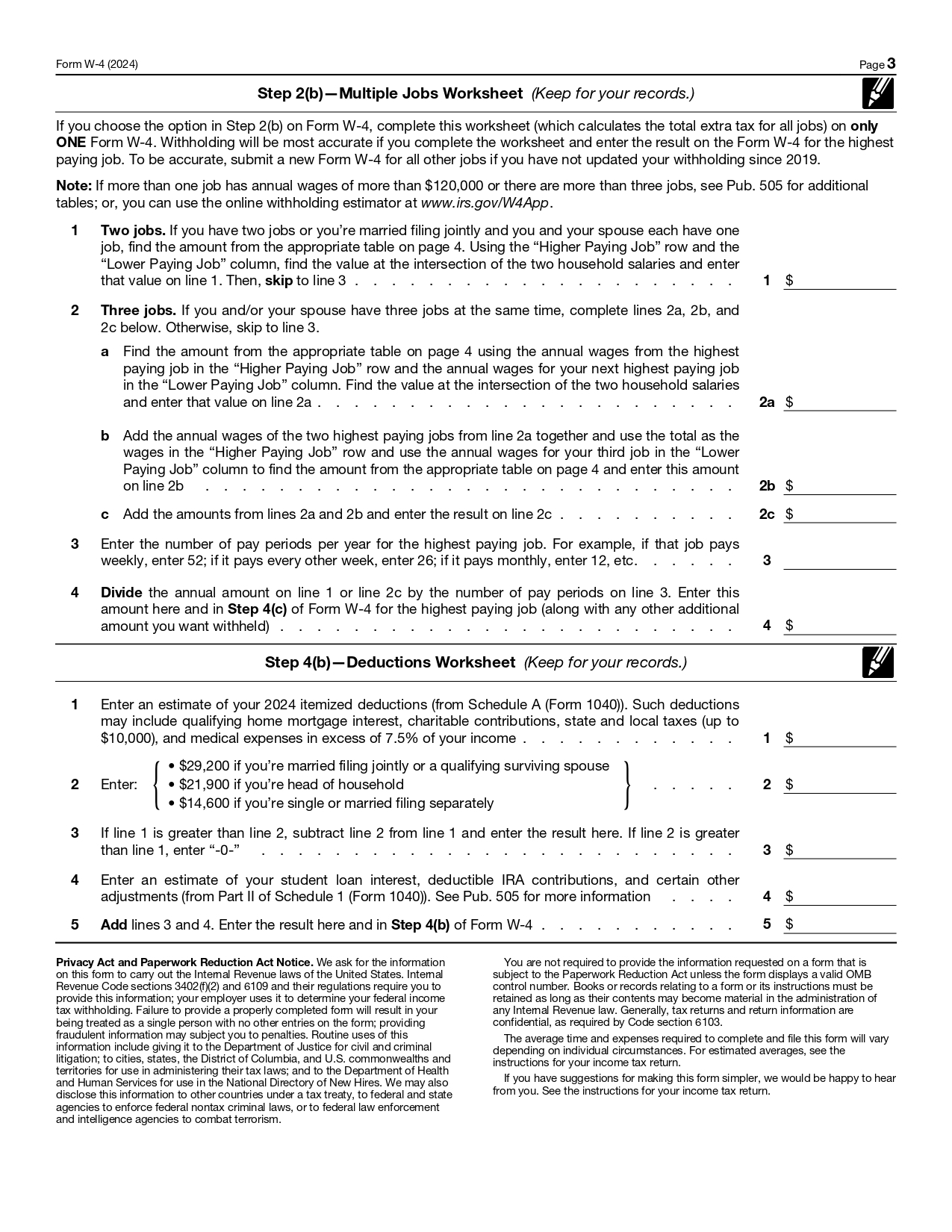

When filling out a W4 form, it’s important to consider your tax situation carefully. Depending on your filing status, number of dependents, and other factors, you may need to adjust your withholding allowances. The goal is to have the right amount of tax withheld throughout the year so you don’t owe a large sum at tax time or receive a hefty refund.

Using a printable W4 form can also be helpful if you experience any major life changes, such as getting married, having a child, or buying a home. These events can impact your tax situation and may require you to update your withholding information. By regularly reviewing and updating your W4 form, you can ensure that you’re paying the correct amount of tax based on your current circumstances.

In conclusion, printable W4 forms are a convenient tool for managing your tax withholding. By using these forms, you can easily provide your employer with the necessary information to calculate the right amount of tax to withhold from your paycheck. Remember to review and update your W4 form as needed to reflect any changes in your tax situation. With a little effort and attention to detail, you can ensure that you’re on the right track for tax season.